Understanding Form GST DRC-03A: The Essential Guide for Taxpayers

Under the Goods and Services Tax (GST) framework, one crucial compliance tool the government introduced is Form DRC-03A, a tool to deal with challenges faced by taxpayers in paying out first contextualization outstanding tax demands. In this form, taxpayers can reconcile tax demand orders with payments made under Form DRC-03. This article will explain a complete overview of Form GST DRC-03A, DRC-03A-Filing and its importance in reducing tax payment adjustments.

What is Form GST DRC-03A?

GST Notification No. 12/2024 dated 10.07.2024 introduced Form GST DRC-03A for dealing with any specific issues in the Electronic Liability Register (ELR). Before introduction, the taxpayers faced difficulties while making payment by Form DRC 03 but without linking it to the GST demand order without linking it to the GST demand order. Therefore, though payment was made, the tax demand became open in the GST system.

To address this problem, form GST DRC-03A provides a means to increase payments made through DRC-03 against a specific demand order number. This ensures that the ELR is holding accurate taxpayer liability thereby being easier to track and settle tax liability. Read Further to know how to fill form DRC-03A.

Key Features and Benefits of Form GST DRC-03A

Precise Adjustment of Payments:

The primary purpose of Form GST DRC-03A is to correctly allocate the payments made under Form DRC-03 against the requisite demand orders. This is important, because payments made voluntarily, or for other reasons, are not subsequently linked to the correct demand orders.

With DRC-03A, taxpayers can relate these payments to the proper demand orders, keeping their tax records current.

Simplification of the Compliance Process:

Form DRC-03A helps you reconcile tax liabilities. Previously the taxpayers had to record their payments and update the ELR, which resulted in errors and delays. Form GST DRC-03A automates a lot of this process.

Once you enter the Application Reference Number (ARN) and demand order number, the system auto fills with appropriate payment information. The reduced chance of human error and fast process make tax compliance more efficient.

Transparency and Accuracy in Record Keeping:

Another significant standout of Form GST DRC 03A is it can update the ELR automatically. Once the payment is linked to demand order, the status of the tax demand is updated and all current demands are closed into the liability register.

This is especially useful for people who have paid partially or under the 'Voluntary' or 'Others', but this was not adequately reflected in the GST system.

Helps with GST Appeals:

Form GST DRC-03A has primacy for taxpayers filing an appeal against GST demand. During the appeal process, taxpayers often have had to pre deposit an amount. Taxpayers can satisfy the condition of filing an appeal by using Form GST DRC 03A for showing that the pre-deposit for that specific demand order has been made.

Who Can Use Form GST DRC-03A?

GST DRC 03a is used by Taxpayers who have already made payments in response to GST DRC 03 and want to associate them with order of GST demand. Here are the key situations where taxpayers may need to use Form DRC-03A:

Voluntary Payments:

Taxpayers, who have voluntarily paid towards their GST liabilities using Form GST DRC - 03, but the payment has not been rightly linked to the corresponding demand order, can file Form DRC - 03A.

Payments Made Under the "Others" Category:

Payment under the "Others" category is not automatically linked to a demand order. Form DRC 03A helps taxpayers adjust these payments concerning the applicable demand order in such situations.

Partial Payments:

Such a taxpayer uses Form GST DRC 03A to reconcile the payment made by him in part against a specific demand and thereby reduce the outstanding amount of the demand accordingly.

Payments Made Through Incorrect Channels:

Some taxpayers may have paid their demands through Form DRC 03 instead of using the Payment towards Demand feature on the GST portal. Form DRC-03A is primarily designed to help tie such payments to the proper demand order.

How to Fill Form GST DRC-03A: A Step-by-Step Guide

It is a straightforward process if you know how to file the GST DRC 03A. Here’s a step-by-step guide on how to fill form DRC-03A.

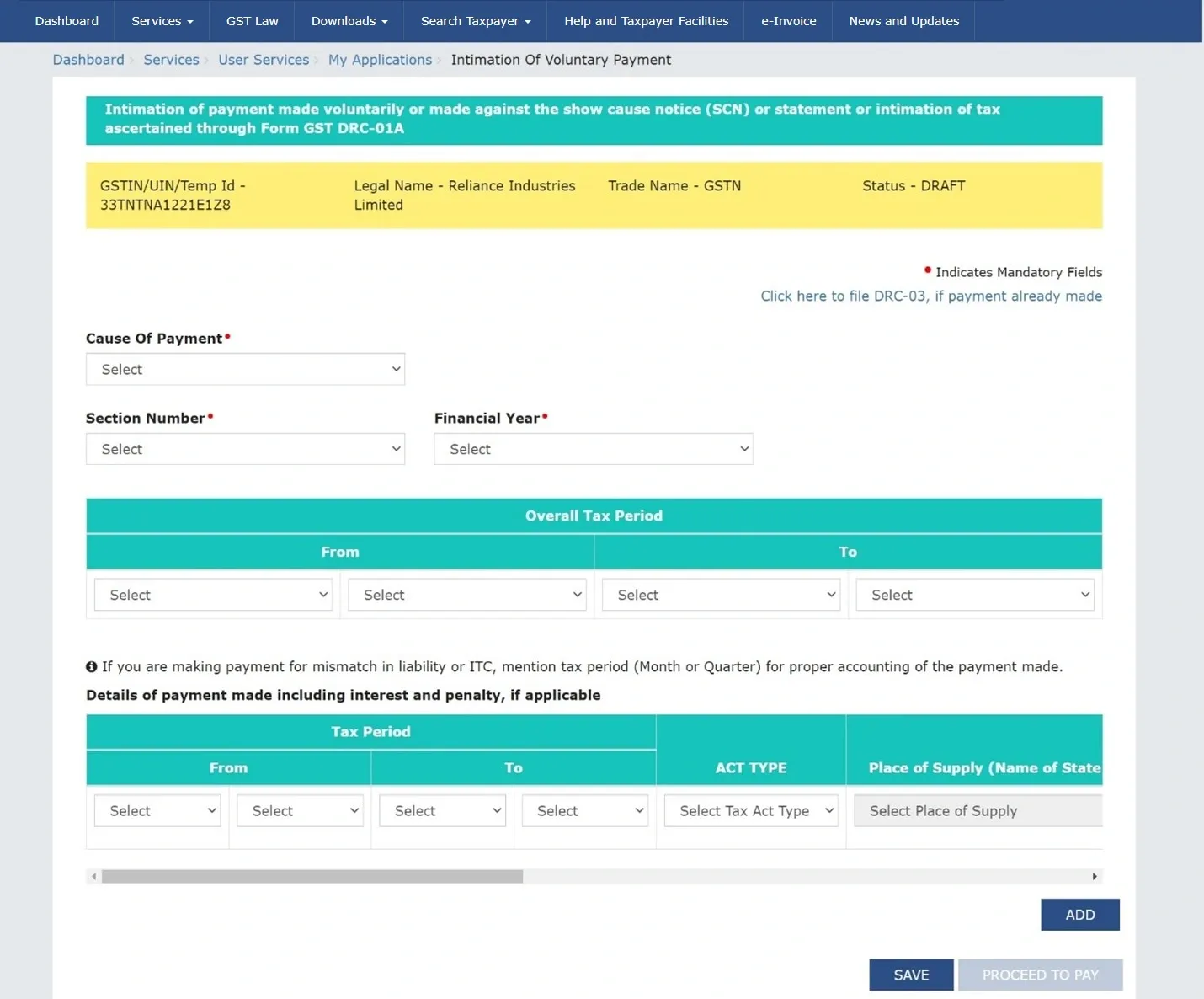

1 . Log in to the GST Portal:

Fill up GST credentials on the GST portal and log in.

2. Access Form GST DRC-03A:

Once logged in, click on Services > User Services > My Applications. GST DRC-03A (Form) under this section is available.

3. Enter DRC-03 Number:

The ARN also enters the Form GST DRC-03 number. This directly connects your payment details to Form DRC 03A.

4. Select the Relevant Demand Order:

Select the demand order number for which payment was made from the drop down menu. Automatically, information like the demand order date, period, and outstanding amount will be populated.

5. Adjust the Demand:

Output the outstanding demand details in Table A. Both Table B (Cash Adjustments) and Table C (Credit Adjustments) have the amounts paid and to be adjusted. In calculating the balance following the adjustment, the system will do so automatically.

6. Verify and Submit:

Check all the details in the form and click the Validate button. If necessary you will be able to upload any supporting documents. After verification, you can file the form with your Digital Signature Certificate (DSC) or Electronic Verification Code (EVC).

7. Acknowledge Submission:

Your submission will be acknowledged once it’s done successfully. Your Electronic Liability Register is updated with the latest demand status.

Conclusion

GST DRC-03A is a necessary tool for taxpayers to manage their GST liabilities efficiently. With precise payment of payments made to Form DRC-03 to some type of demand orders, it guarantees to keep taxpayers' records straight without any inconsistencies in the Electronic Liability Register. Not only does the DRC-03A reduce administrative nuisance, simplifies the compliance process, and eases tax reconciliation.

Being understanding of Form GST DRC-03A helps prevent future issues that could arise from things going wrong during the taxing process. If you are adjusting voluntary payments, managing partial payments or making an appeal then Form GST DRC 03A is a must to ensure reconciliation of tax demands and liabilities precisely.

Common FAQs on Form GST DRC-03A

1. Can multiple payments be adjusted against a single demand order using Form GST DRC-03A?

Taxpayers can offset multiple payments made using Form DRC 03 against one demand order. Likewise, a single payment variable can be utilized for numerous demand products.

2. What happens if a taxpayer does not file Form GST DRC-03A?

Non filing of Form DRC-03A by taxpayers can lead to a recovery case initiated against the outstanding demand as per section 78 and 79 of CGST Act.

3. Is Form GST DRC-03A mandatory?

Tax payers who have not joined the payments made under Form DRC – 03 with the pertaining demand orders and wish to adjust such payments have to file Form GST DRC mandatorily – 03A.

Also Read : Transition Provisions Under GST

Related Posts