GST Number Search by PAN: Step by Step Guide

Published on: Thu Dec 21 2023

Bio (Reveal/Hide)

GST Number Search by PAN: Step by Step Guide

GSTIN (Goods and Services Tax Identification Number) is a unique 15-digit number assigned to all the businesses operating in India and falls under the ambit of GST, it is a combination of State Code, PAN, Number of Entities registered in the same state, and default alphabetical series.

In the GST Portal there is a feature by which you can easily check the GST Details of anyone using their PAN, for the same you just need to enter the PAN of anyone it will automatically tell you whether GSTIN is active or not with other relevant details.

Why it is important?

This feature is really important for everyone whether you are a business customer or not, because there have been many cases of fraud happening regularly in which people are collecting GST even without paying GSTIN, with this feature anyone can check whether the GSTIN mentioned in the Invoice or PAN details are valid or not.

GST number search can be done with the help of PAN also:

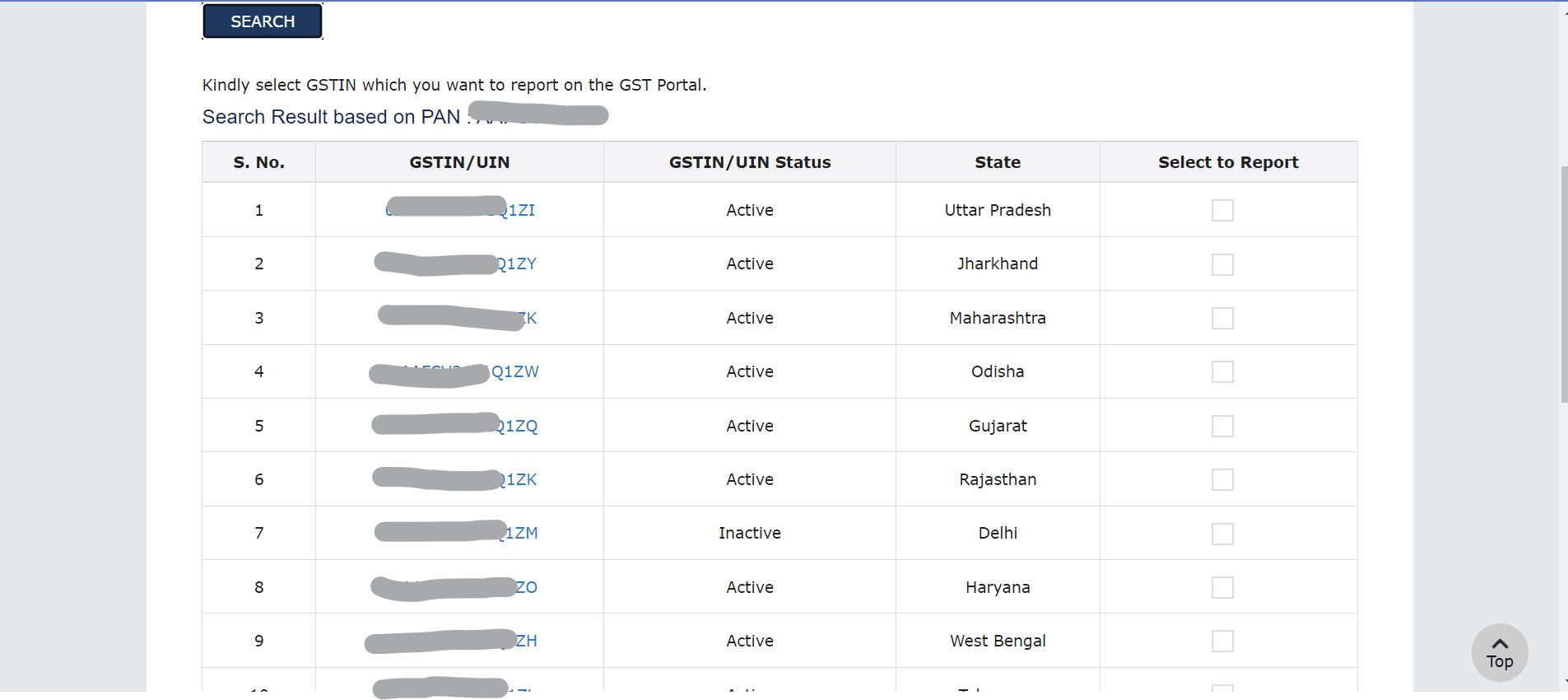

registered business persons may have various GSTINs across different states in India. To search for all the GSTIN for the same we can use the PAN of a registered Taxpayer.

To do so we can take the following steps :

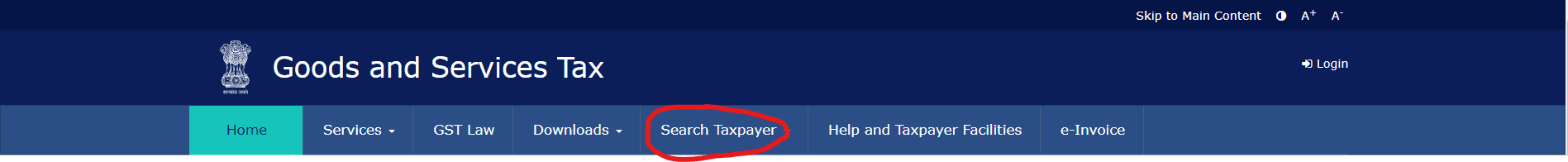

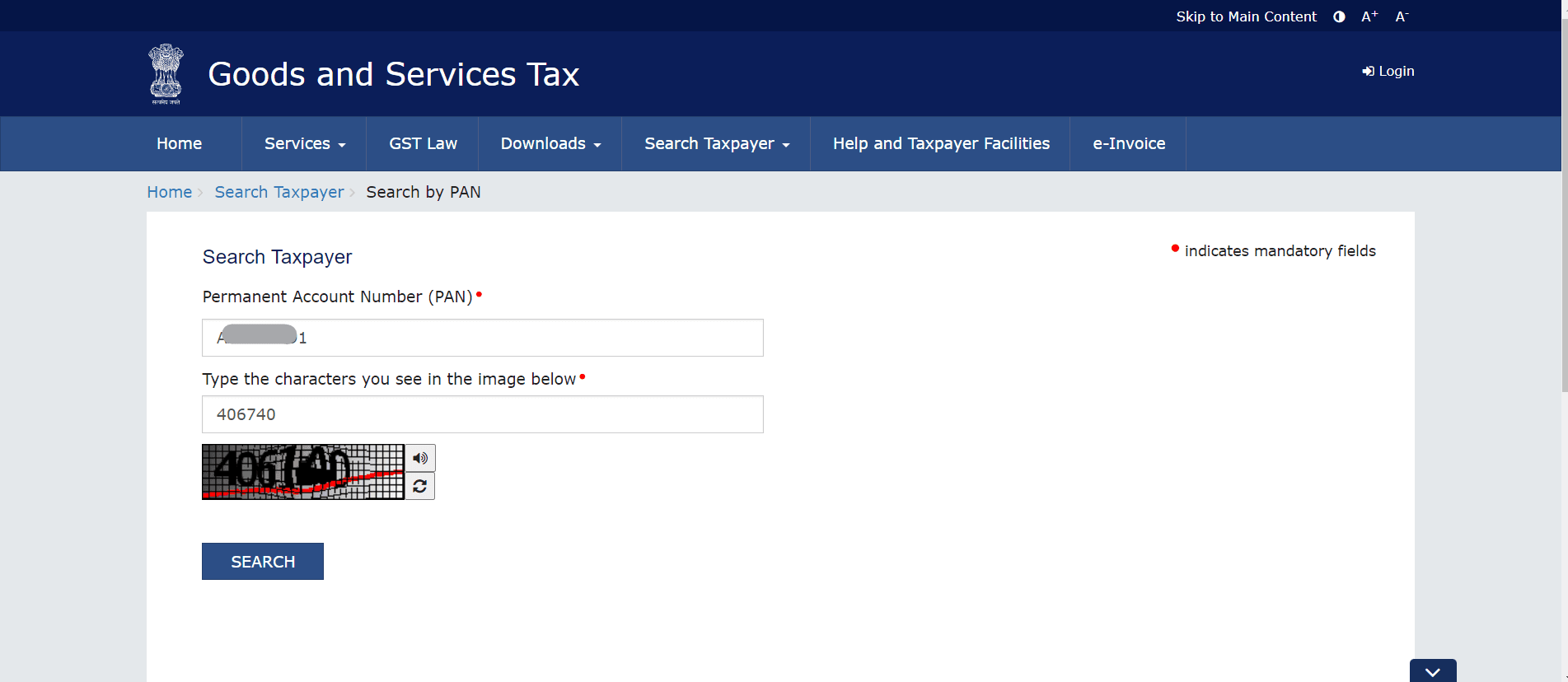

Step 1: - Go to GST Portal

Step 2: - Click on the Search Taxpayer tab

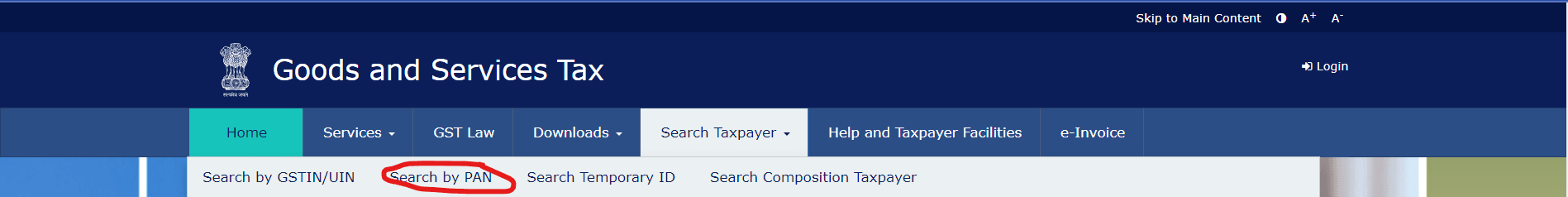

Step 3: Click on Search by PAN

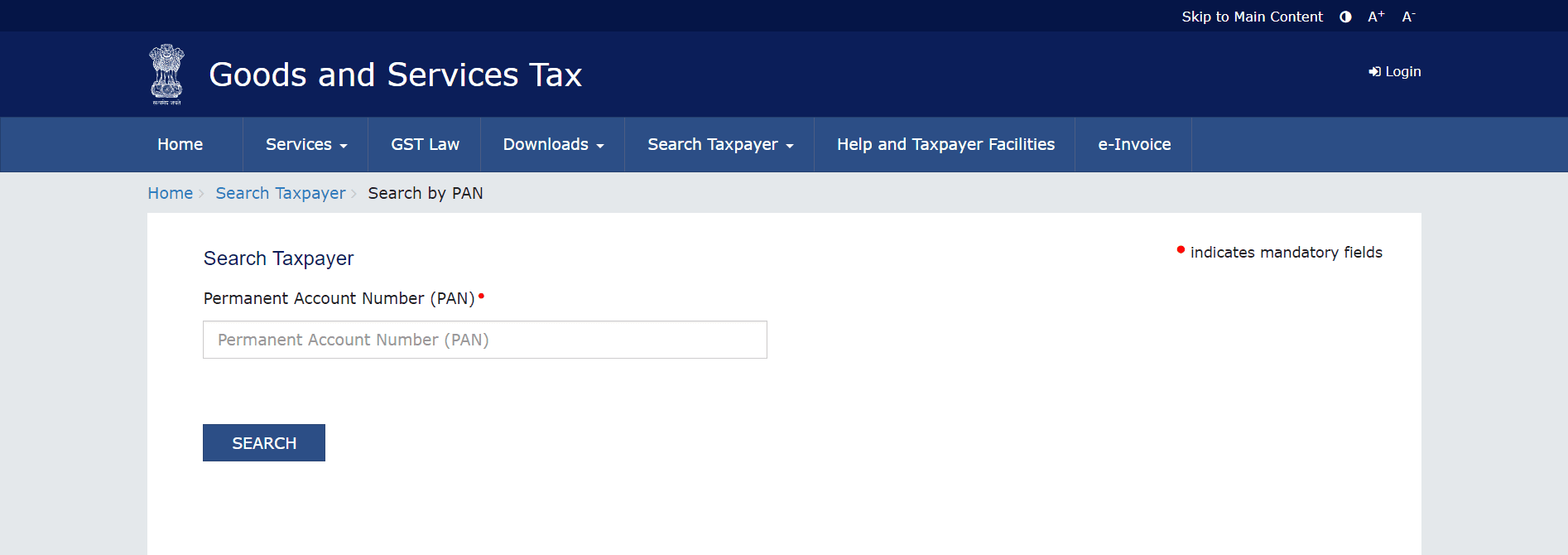

Step 4: In the tab enter PAN of the Taxpayer

Step 5 : Fill the Captcha and click the search button

Step 6: Portal will show the list of GSTIN linked with the PAN

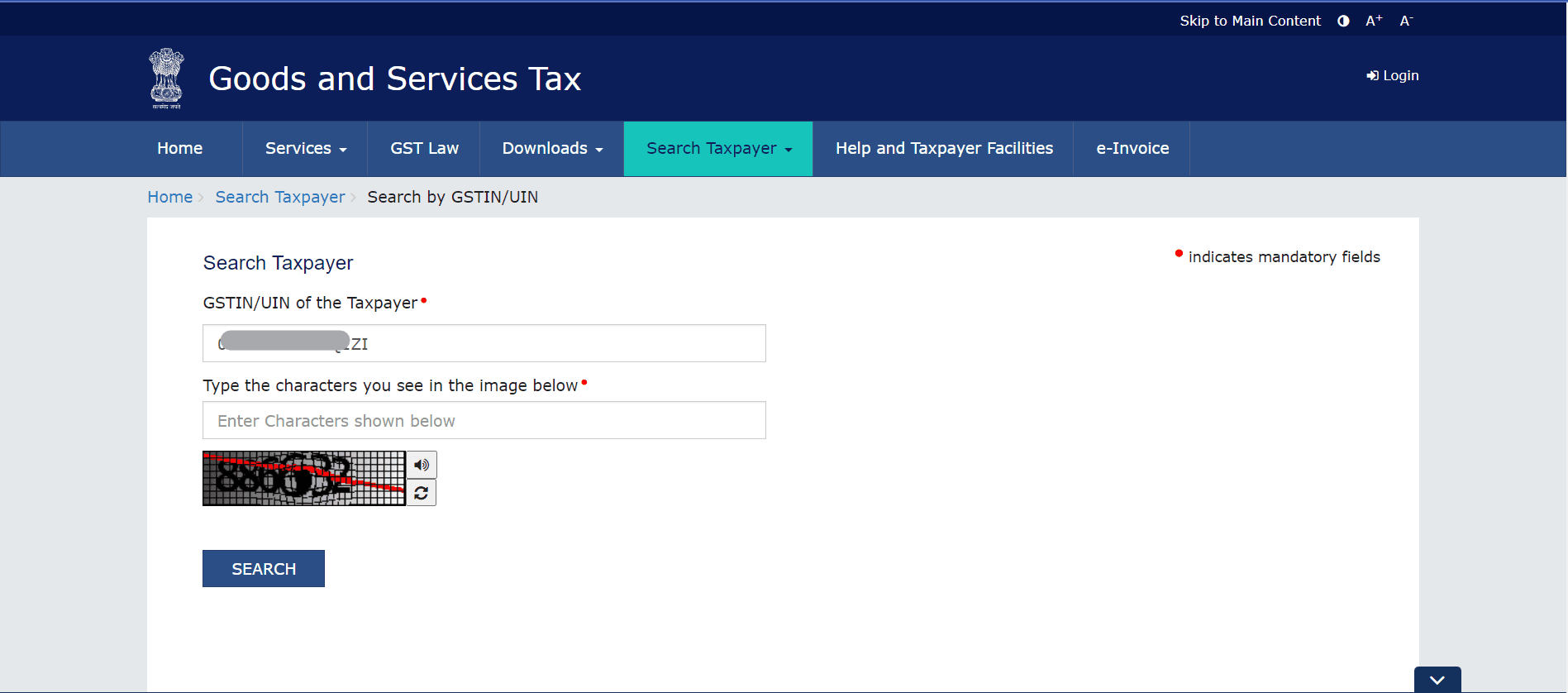

Step 7: Click on the GSTIN it wll take you to search taxpayer by GSTIN

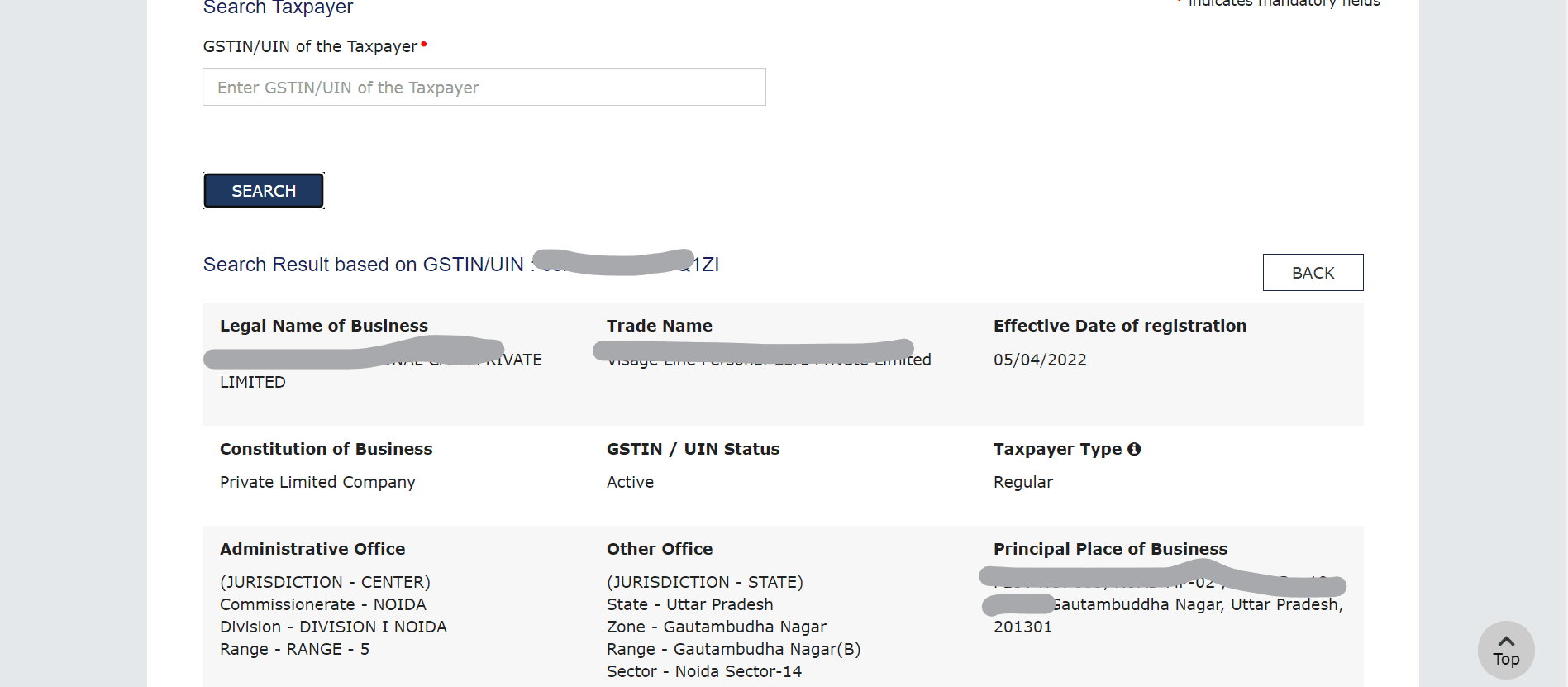

Step 8: Fill in the Captcha and hit the search button it will show all the details

This is how you can GST number search by PAN.

Conclusion

The GST number search by PAN feature is a crucial tool for ensuring the authenticity of GST registrations and preventing potential fraud. On any occasion, through a simple step by step guide on the GST portal, one is able to confirm if indeed a business has been registered under GST. Not only does this protect customers from getting involved in fraudulent cases but it also brings about openness when it comes to business transactions. It does not matter whether one is an entrepreneur, consumer or tax officer; this option makes it easy and credible for people to check if PAN related GSTINs are right hence ensuring smoother operation of businesses that adhere to rules and principles of financial ethics.

Related Posts