ICEGATE Tracking: How to Track Your Shipments Easily

In today's fast-paced global trade environment, tracking shipments accurately and efficiently is critical for businesses involved in importing and exporting goods. ICEGATE, a web-based portal developed by the Indian Customs and Central Excise Department, plays a vital role in simplifying this process. It provides real-time tracking of import and export shipments, helping businesses streamline their operations and ensure compliance with customs regulations.

In this guide, we will walk you through how ICEGATE tracking works, the key information it offers, its benefits, and tips for optimizing its use.

How ICEGATE Tracking Works

ICEGATE tracking reveals the intricate customs clearance process and current state of shipments. Here are the steps involved:

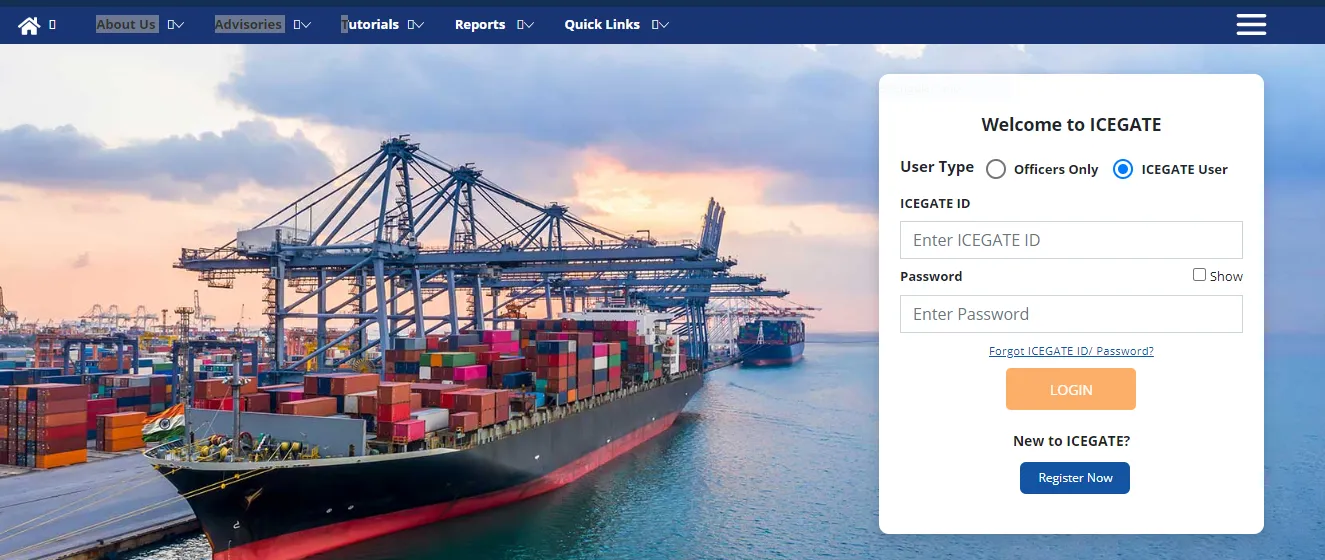

1. Register on the ICEGATE Portal : Businesses engaging in international trade must first proceed with registration on the ICEGATE portal before utilizing ICEGATE tracking. Registration entails a straightforward procedure whereby firms provide important details such as their Importer Exporter Code (IEC), which is used to create an account.

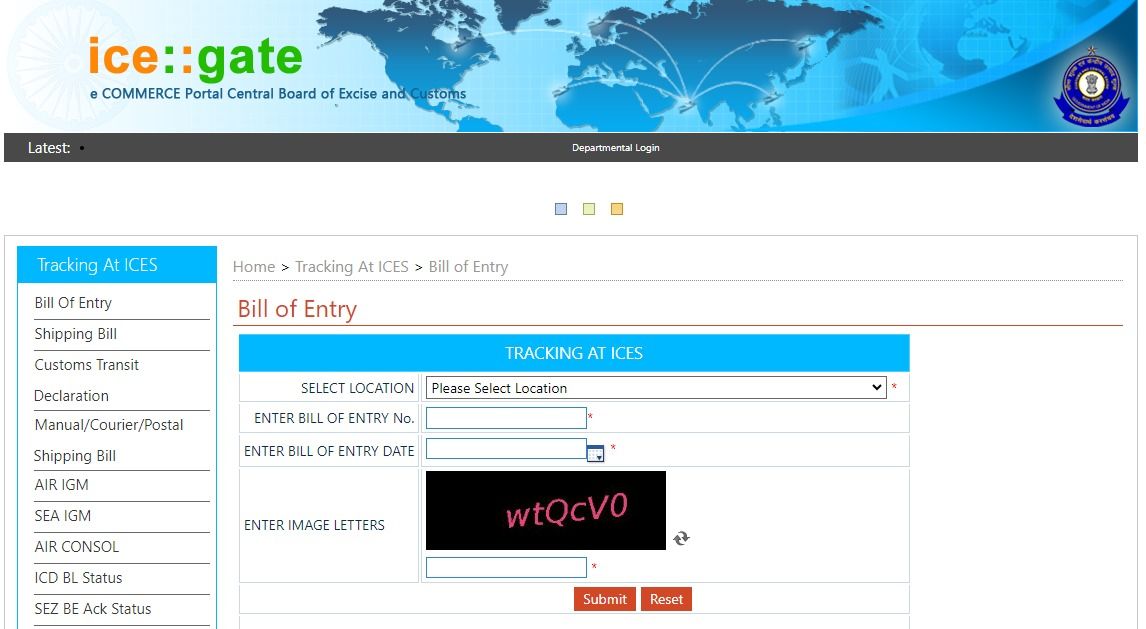

2. Filing the Bill of Entry/ Shipping Bill Etc: A Bill of Entry (BE) is filed with customs by the importer once a shipment reaches any Indian port. Bill of entry contains important details about the goods being imported, including description, value and applicable customs duties, among others. Similarly, In case of Exports, shipping bill is filed. This document is important in the customs clearance process.

3. Tracking at Icegate: After filing the Bill of Entry/Shipping Bill successfully, By entering the Port code, shipping bill/bill of entry number and date of shipping bill/bill of entry you can monitor the progress of the shipment throughout the customs clearance process.

4. Accessing Real-Time Updates: Through this tracking number, businesses can log into their accounts on the ICEGATE portal and check their shipments’ real-time status. Furthermore, the system provides regular updates from when goods arrive at port up until they are cleared by customs and finally delivered.

Advantages of ICEGATE Tracking

There are several essential advantages of ICEGATE tracking for organizations engaged in international trade:

1. Transparency: ICEGATE tracking offers an explicit and clear outline of your shipment’s path from the moment it arrives at a port until it clears customs and gets delivered. This transparency eliminates doubts on the part of businesses at every stage, which effectively improves decision-making and reduces any uncertainties that may arise.

2. Efficiency: With an online system that monitors trade information, ICEGATE tracking is a tool that supports efficiency in trade procedures. This avoids unnecessary follow-ups with customs agents as well as minimizing chances for any unforeseen delays.

3. Problem-Solving: One of the major advantages of ICEGATE tracking is its ability to notify users about impending problems. If there has been a holdup with customs clearance or some problem concerning documentation, then businesses can quickly spot them so as to avert delays and, in turn, high costs.

4. Compliance: Another essential aspect is ensuring strict adherence to customs regulations so as to avoid hitches such as fines upon defaulting. It allows organizations to be informed about the whole process of importation and also ensures they are timely in their documentation or payment of duties required by law.

Tips for Effective ICEGATE Tracking

There are some best practices for businesses to follow in order to use ICEGATE tracking efficiently:

- Correct information is necessary: The timeliness of the customs clearing process hugely relies on the information you provide in your Bill of Entry. Therefore, they have to be correct and complete; failure in this may cause delays or additional checks by customs authorities.

- Keep Your Shipment Monitored Regularly: Although ICEGATE tracking offers real-time updates, it’s best practice to check the status of your shipment regularly. This will keep you informed of any changes or issues that may arise throughout the customs process.

- Important Document Storage: Documents related to your shipment, such as the Bill of Entry and its tracking number, should always be kept. This documentation will be necessary in case of disputes or inquiries from the customs authorities.

- Engaging with Custom Authorities: In case you experience challenges or questions concerning this clearing process, do not hesitate to contact them; they could guide you on how to fix the problems and enable smooth transportation of your consignment through the system.

The Problems of ICEGATE Tracking

Technical Glitches: Any online system like ICEGATE may at times encounter technical problems which can cause delays in updates for tracking.

User Experience: The interface may serve its purpose, but it is not necessarily the easiest to use for those who do not know much about customs processes.

Data Accuracy: Since tracking information depends solely on data entered into the system, wrong entries at the source may result in wrong tracking updates.

Conclusion-

Businesses that participate in international trade cannot do so without ICEGATE tracking. Enhancing transparency, efficiency and customs regulations via real-time updates on shipment status, customs clearances and cargo deliveries is the main function of ICEGATE tracking. These are some of the ways in which companies can optimally make use of ICEGATE tracking, thereby eliminating delays and simplifying their import-export mechanisms.

Also Read:ICEGATE tracking and process of checking AD code registration

Related Posts