Customs Clearance Process: A Guide for Imports and Exports in India

The importance of customs clearance emerges as an essential aspect of international trade since it authorises legal imports and exports under local legal requirements. Knowing the import-export procedures proves essential to make these processes less complex and time-consuming. The following section provides a detailed and beneficial explanation about customs clearance processes for imports and exports in India.

1. General Tips for Customs Clearance (Import and Export)

Familiarize Yourself with Regulations

The Customs Act of 1962 controls Indian customs clearance procedures, although specific rules for industries such as textiles and electronics or food production apply in addition. The process of customs clearance requires staying informed about all updates in terms of tariffs, tax laws, and trade agreements to ensure compliance.

Choose the Right Customs Broker

To handle the intricate customs clearance agenda successfully, businesses must procure the services of accredited customs brokers or clearing agents. Made possible by their experience in documentation preparation and their ability to determine duties and regulatory obligations, these experts help you prevent delivery setbacks along with financial penalties.

Ensure Proper Documentation

The successful completion of customs clearance depends entirely on having appropriate and accurate documentation. Fines and confiscation, along with shipment delays, become possible when paperwork contains errors or omissions. Prepare and verify every document needed for the clearance process according to regulations.

Understand HS Code Classification

Products the world over use the Harmonised System (HS) Code as their standard international product classification system. Products that receive appropriate classification avoid problems with incorrect duty and tax evaluations and subsequent financial issues and shipment delays.

2. Import Clearance: Step-by-Step Process

1. Pre-Arrival Customs Clearance Procedures

Obtain an Importer Exporter Code (IEC): To start importing goods to India, all businesses need to become members of the Directorate General of Foreign Trade (DGFT) and acquire an Importer Exporter Code. Obtaining an IEC is a necessary process for conducting import-export activities in India.

Verify Import Permissions: Imports of pharmaceuticals along with hazardous materials and restricted items, require certain additional permissions and licenses from the Indian authorities. Make sure your imported products satisfy all legal requirements for obtaining import authorisation from Indian authorities.

Product Classification (HS Code): Precise HS code classifications provide necessary information for calculating import duties as well as taxes.

2. Arrival of Goods

Bill of Entry (BoE): The Customs EDI system requires the presentation of a Bill of Entry (BoE) immediately upon the goods' arrival at their destination. The Bill of Entry contains necessary information about goods descriptions together with their values and classifications. Different billing entry types, such as commercial, passenger, and courier BoEs, are available.

3. Customs Duty and Taxes

Customs Duty: The duties imposed on imported goods consist of three components, namely Basic Customs Duty (BCD) and Additional Customs Duty (ACD) together with Countervailing Duty (CVD). The duty assessment uses data from the Cost, Insurance, and Freight (CIF) value for its calculation basis.

When applying Goods and Services Tax (GST) to importation, you must also pay customs duties. Those who import merchandise can obtain an input tax credit for the GST they paid on their purchased items.

4. Examination of Goods

The goods must undergo physical verification by customs officials for correct classification assessment and detection of banned items. Agents generally conduct examinations on costly or dangerous shipments.

An automated risk management system powers the customs system, deciding how each shipment will proceed from physical examination to self-assessment clearance.

5. Payment of Duties and Clearance

After a successful inspection of your goods, you need to pay the correct customs duties in addition to relevant taxes. Most people prefer making their payments through the Customs Department's internet-based portal.

The production of a Customs Release Order (CRO) becomes possible after payment clearance allows Customs to release the goods from their control.

6. Post-Clearance Audits

Customs will execute post-clearance audits to confirm proper duty payments and classification and valuation decisions made by importers. Auditors will require your official documents in case they need to inspect your records.

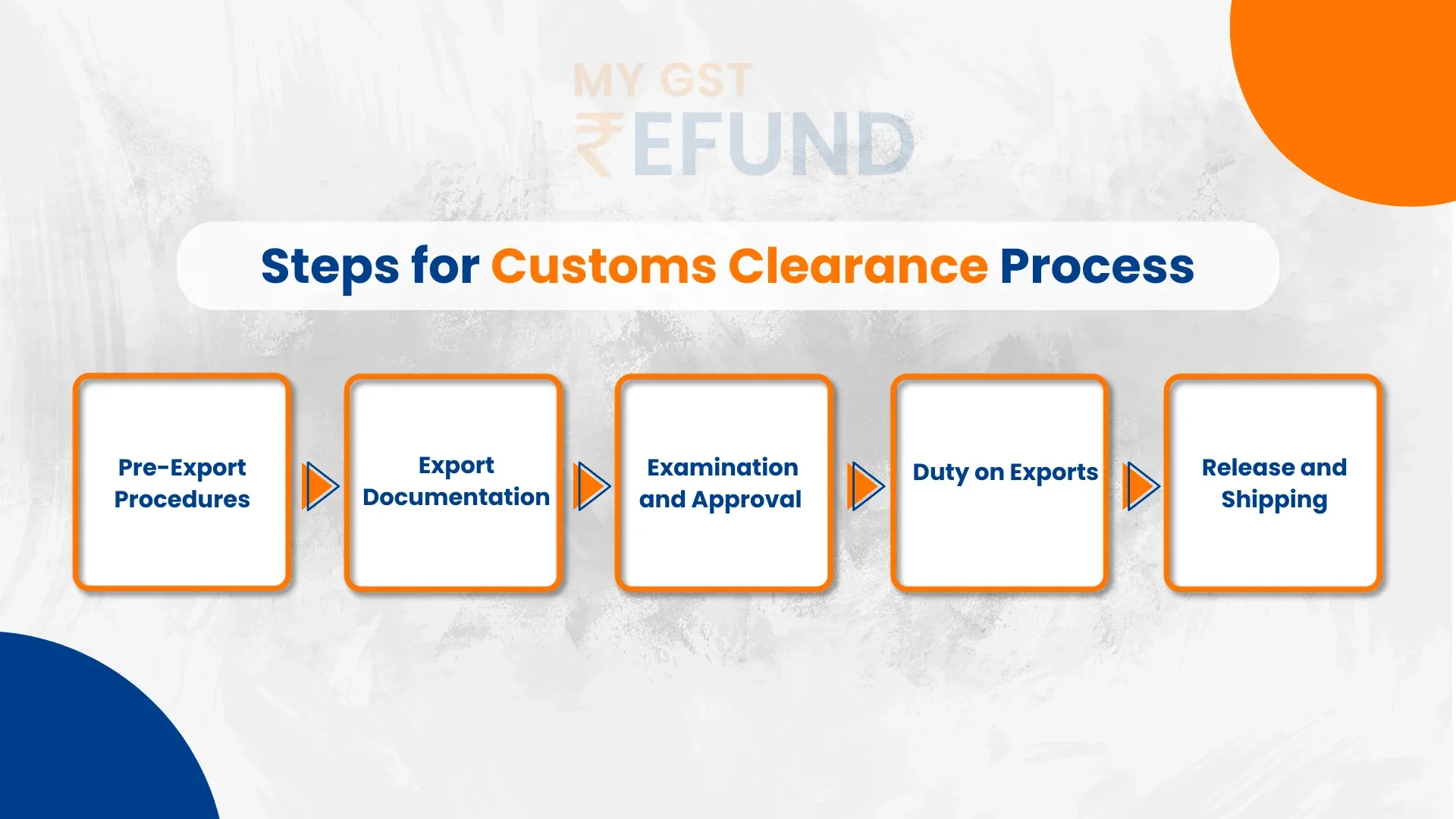

3. Export Clearance: Step-by-Step Process

1. Pre-Export Procedures

Obtain an IEC: An exporter needs to acquire the same Importer Exporter Code (IEC), which is mandatory for importers as well.

Verify Export Licenses and Permissions: Products requiring export licenses together with special permissions for export, need special attention because they fall under restricted categories (such as precious metals or military equipment).

Product Classification (HS Code): A smooth export clearance happens when you use the correct HS code system to classify your products.

2. Preparation of Export Documentation

Export Declaration: You should start the export process by filing an Export Declaration on the Indian Customs EDI system.

Commercial Invoice: You must create a commercial invoice that contains essential transaction information about the worth and specifications of the sent goods.

Packing List: Detailed packing descriptions together with shipping procedures should be incorporated into the documentation.

Bill of Lading (B/L): Under this contract, the shipper collaborates with the carrier to establish shipping conditions through an official document.

Certificate of Origin: Include a Certificate of Origin for goods to permit tariff advantages from free trade agreements according to the origin requirements.

Other Documents: Include all essential documents that the shipment requires, such as the export license, together with the insurance certificate and packing list.

3. Customs Examination and Approval

Pre-Export Inspection: Government authorities at either DGFT or Export Inspection Agency (EIA) must execute pre-export inspections for certain products.

Customs Declaration and Examination: Customs authorizes checking the accuracy of both the export declaration. The inspection process checks that goods follow all required regulations.

4. Customs Duty on Exports

Duty Drawback Scheme: By using duty drawback, exporters may retrieve duties that were paid on materials used to manufacture exportable products.

Export Incentives: Study all available export incentive programs, including RoDTEP (Remission of Duties and Taxes on Export Products) and ROSCTL (Rebate of State and Central Taxes and Duty Levies).

5. Export Release and Shipping

The Export Release Order (Let Export Order) stands as the official document that enables the shipment of exported products.

The Export Release Order becomes available after customs clearance to allow shipments abroad.

4. Key Customs Regulations and Practices

Self-Assessment: The declaration process of classification, together with value and origin for goods, falls under the responsibility of importers and exporters. The declarations undergo future audits by Customs to verify proper compliance.

Authorised Economic Operator (AEO): Being an Authorised Economic Operator (AEO) means that a company doesn't have to go through as many inspections, and the procedures for clearing customs are easier. This feature is good for exporters and importers who do a lot of business.

Risk Management System (RMS): The Risk Management System performs automatic selection of shipments for inspection through criteria including goods characteristics and trading records of exporters and importers

5. Common Mistakes to Avoid in Customs Clearance

Incorrect Valuation: The practice of wrong value declarations will result in insufficient duty payments, which might trigger fines along with shipment delays.

Wrong HS Code: Using an incorrect HS code to classify merchandise will result in an inaccurate duty assessment as well as penalty charges from authorities.

Incomplete Documentation: Timely delivery and avoidance of monetary fines depend on possession of detailed and accurate customs clearance, including invoices, packing lists, and licenses.

Not complying with Regulations: Lacking awareness about particular import/export restrictions and licenses for goods can result in penalties and product seizure.

Pro Tip: Use our GST Refund Calculator to easily calculate your refund and simplify the GST process. Whether you want to know your refund amount or check its status, our tool makes it simple to know your GST refund quickly and accurately

Conclusion

Customs clearance is a critical part of international trade, and adhering to the regulations and guidelines can significantly reduce delays and costs. Whether you're importing or exporting, following the right customs clearance procedures, ensuring compliance with laws, and keeping accurate documentation are essential for smooth clearance.

By working with a reliable customs broker, staying updated on legal changes, and understanding the detailed process, businesses can ensure timely and efficient customs clearance for their shipments.

Frequently Asked Questions

Is the customs clearance done?

Customs clearance functions involve notifying regulatory authorities about imported or exported goods, adhering to regulations, and facilitating their border crossing. The customs clearance process begins with document submission (Bill of Entry, Commercial Invoice, followed by applying HSN coding and inspections until duties and taxes payments complete the process.

How long will it take for customs clearance?

Normal customs clearance times for standard shipments range from one to five days depending on delivery, but additional factors such as congestion at ports limit clearance to 2–4 weeks in total.

How do you get a customs clearance certificate?

Customs issues Let Export Order or customs release order clearance certificates to proceed after the submission of customs clearance documents and payment of duties, along with inspections.

Who pays customs clearance duty?

The person handling import and export activities has the duty to pay all customs taxes. Incoterms determine the cost liability between seller and buyer, which usually falls on the importer according to common Incoterms terms and conditions.

Do packages get opened at customs?

Customs officials perform package inspections to examine compliance with regulations, besides conducting checks on correct declarations and detecting prohibited items.

What is the next step after customs clearance?

Goods move from clearance for their final route delivery by partnering with logistics companies. The organisation needs to schedule package delivery with both couriers and freight forwarders.

What is the customs clearance fee?

The fees for customs clearance include expenses for customs duties, along with taxes (GST and IGST), handling expenses, and agent fees. The amount of duty depends on the goods’ worth and classification, as well as their assigned HSN codes. Extra expenses, including storage as well as inspection costs, might become applicable.

Related Posts