Breaking News! Now GST Refund available to unregistered Real Estate buyers

Published on: Mon Jan 02 2023

The government has given a big relief to unregistered Real Estate buyers who have to cancel the agreement with a builder for supply of construction service for a flat/ building due to non-completion or delay in construction activity in time or any other reasons, by opening the doors for them to file the GST Refund in cases, where the builder is not returning the money taken as a deposit from the innocent buyers or not able to return his money on account of non-issuance of Credit Note under Section 34 due to time limitation period.

GST refund for Real Estate buyers is possible in the following scenarios:

- A Flat booked by Customer and Cancelled before last date of Issuance of Credit Note under Section 34. (generally September of the succeeding Financial Year)

In this case, generally credit note will be issued by the builder within the prescribed time limit and thereby, will return the whole money to buyer including GST being charged from the buyer at the time of entering into the contract.

- A Flat booked by Customer and Cancelled after the last date of Issuance of Credit Note under Section 34:

Existing Situation:

Earlier most of the builders used to refund the whole amount to buyer without deducting GST and then he used to file a Refund Application for the GST amount under clause (e) of sub-section 8 of Section 54 considering the fact that builder has not passed the incidence of tax to buyer.

However, certain builders were denying to return the GST amount to customers to avoid the process of Refund and ultimately the buyer was forced to bear a loss of GST amount that he has paid at the time of Booking of Flat.

Present Situation:

When the above difficulty being faced by the buyers came to the notice of Council, they came up with the following solution. Now, the buyer is also given an opportunity to take the refund of GST amount from the Department by applying the following procedure:

Procedure to applying GST Refund for Real Estate buyers?

Related Topics : GST Refund Issues

Buyer is also given an opportunity to take the refund of GST amount from the Department by applying the following procedure:

Step 1: Buyer is required to take a Temporary Registration in the state in which the builder is registered using his Permanent Account Number (PAN), further he is also required to undergo Aadhar Authentication in terms of provisions of rule 10B of the CGST Rules. Further, the unregistered person would be required to enter his bank account details in which he seeks to obtain the refund of the amount claimed. The applicant shall provide the details of the bank account which is in his name and has been obtained on his PAN.

Step 2: Buyer is required to File Form RFD-01 on the common portal under the Category “Refund for Unregistered Person”.

Step 3: Buyer is required to upload Statement 8 and all the requisite documents as per the provisions of sub-rule (2) of Rule 89 of the CGST Rules.

Documents required for GST Refund:

Under Sub rule (2) of Rule 89, following are the required documents:

- a statement containing the details of invoices viz. number, date, value, tax paid and details of payment, in respect of which refund is being claimed along with copy of such invoices, proof of making such payment to the builder, the copy of agreement or registered agreement or contract, as applicable, entered with the builder for supply of service, the letter issued by the builder for cancellation or termination of agreement or contract for supply of service, details of payment received from the builder against cancellation or termination of such agreement along with proof thereof, in a case where the refund is claimed by an unregistered person where the agreement or contract for supply of service has been cancelled or terminated.

- a certificate issued by the builder to the effect that he has paid tax in respect of the invoices on which refund is being claimed by the applicant; that he has not adjusted the tax amount involved in these invoices against his tax liability by issuing credit note; and also, that he has not claimed and will not claim refund of the amount of tax involved in respect of these invoices, in a case where the refund is claimed by an unregistered person where the agreement or contract for supply of service has been cancelled or terminated.

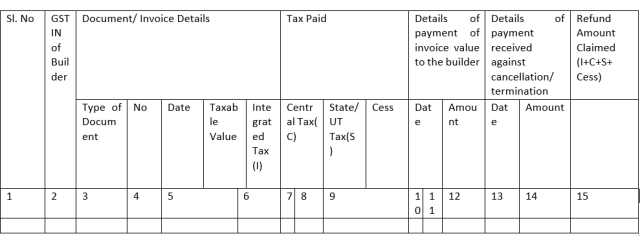

Further applicant is required to Upload Statement 8 (in pdf format) containing the following particulars:

Step 4: The proper officer shall process the refund claim filed by applicant in a manner similar to other RFD-01 claims. The proper officer shall scrutinize the application with respect to completeness and eligibility of the refund claim to his satisfaction and issue the refund sanction order in FORM GST RFD-06 accordingly. The proper officer shall also upload a detailed speaking order along with the refund sanction order in FORM GST RFD-06.

Amendment in GST Laws to give effect to the above provision:

Amendment in clause (k) of sub-rule (2) of Rule 89: The application under sub-rule (1) shall be accompanied by following documentary evidences in Annexure 1 in FORM GST RFD-01, as applicable, to establish that a refund is due to the applicant, namely :—

(k) a statement showing the details of the amount of claim on account of excess payment of tax

“(ka) a statement containing the details of invoices viz. number, date, value, tax paid and details of payment, in respect of which refund is being claimed along with copy of such invoices, proof of making such payment to the builder, the copy of agreement or registered agreement or contract, as applicable, entered with the builder for supply of service, the letter issued by the builder for cancellation or termination of agreement or contract for supply of service, details of payment received from the builder against cancellation or termination of such agreement along with proof thereof, in a case where the refund is claimed by an unregistered person where the agreement or contract for supply of service has been cancelled or terminated;

(kb) a certificate issued by the builder to the effect that he has paid tax in respect of the invoices on which refund is being claimed by the applicant; that he has not adjusted the tax amount involved in these invoices against his tax liability by issuing credit note; and also, that he has not claimed and will not claim refund of the amount of tax involved in respect of these invoices, in a case where the refund is claimed by an unregistered person where the agreement or contract for supply of service has been cancelled or terminated;”;

FAQs :

Q 1. If there are more than one builder in same state whether to file a single or multiple Application of Refund?

Ans. Separate applications for refund have to be filed in respect of invoices issued by different builders.

Q 2. IF there are multiple builders registered in Different State, whether to take single Temporary Registration or different Temporary Registration?

Ans. Builders, in respect of whose invoices refund is to be claimed, are registered in different States/UTs, the applicant shall obtain temporary registration in the each of the concerned States/UTs where the said builder are registered.

Q 3. If Builder is not refunding the full amount i.e. if there are deduction other than GST then whether to take Refund of Full GST amount or proportionate amount?

Ans Only the proportionate amount of tax involved in amount paid back by builder shall be refunded to the unregistered person.

Q 4. What is the relevant date for filing of Refund in case there is long term contract?

Ans. Relevant date in terms of clause (g) of Explanation (2) under section 54 of the CGST Act, date of issuance of letter of cancellation of the contract/ agreement for supply by the builder will be considered as the date of receipt of the services by the applicant.

Q 5. Can an Unregistered person file for refund before the Last date of Issuance of Credit Note under Section 34?

Ans. Refund claim can be filed by the unregistered persons only in those cases where at the time of cancellation/termination of agreement/contract for supply of services, the time period for issuance of credit note under section 34 of the CGST Act has already expired.

Q 6. Whether unregistered person is required to obtain Certificate in Annexure-2 of FORM GST RFD-01 issued by a Chartered Accountant or Cost Accountant to the effect that incidence of tax, interest or any other amount claimed as refund has not been passed on to any other person, in a case where the amount of refund claimed exceeds two lakh rupees?

Ans. Considering the amendment in Clause (m) of sub-rule 2 of Rule 89, no such certificate is required to be furnished in cases where refund is claimed by an unregistered person who has borne the incidence of tax.

If you are facing difficulties in claiming your GST Refund, you may always contact the GST Refund consultant at MyGST Refund. We work with a “No Success, No Fee” policy on GST Refund claims.

Related Posts