A Complete Guide to GST Refund Claim and Process

The Goods and Services Tax (GST) system allows businesses and taxpayers to claim refunds under various circumstances, allowing them to recover excess payments or unutilized credits. Refunds can be claimed in situations such as when there is an excess balance in the electronic cash ledger or when input tax credit (ITC) remains unutilized due to specific conditions, including the export of goods or services without tax payment or the accumulation of ITC due to an inverted tax structure.

This article provides a detailed, step-by-step guide to help you navigate the GST refund process, whether you're reclaiming excess payments or unutilized Input Tax Credit (ITC). It outlines the specific forms, documentation, and procedures required for each refund type, ensuring your claims are processed efficiently and within deadlines. Suitable for manufacturers, exporters, and service providers, this guide simplifies the process of claiming your GST refund.

Steps to Submit the GST Refund Pre-Application Form

The refund pre-application form is an essential document that taxpayers must complete to provide important details about their business, Aadhaar number, income tax information, export data, and expenditure and investment details. This form is a prerequisite for all types of GST refund claims.

The process of filing the GST refund pre-application involves two simple yet important steps:

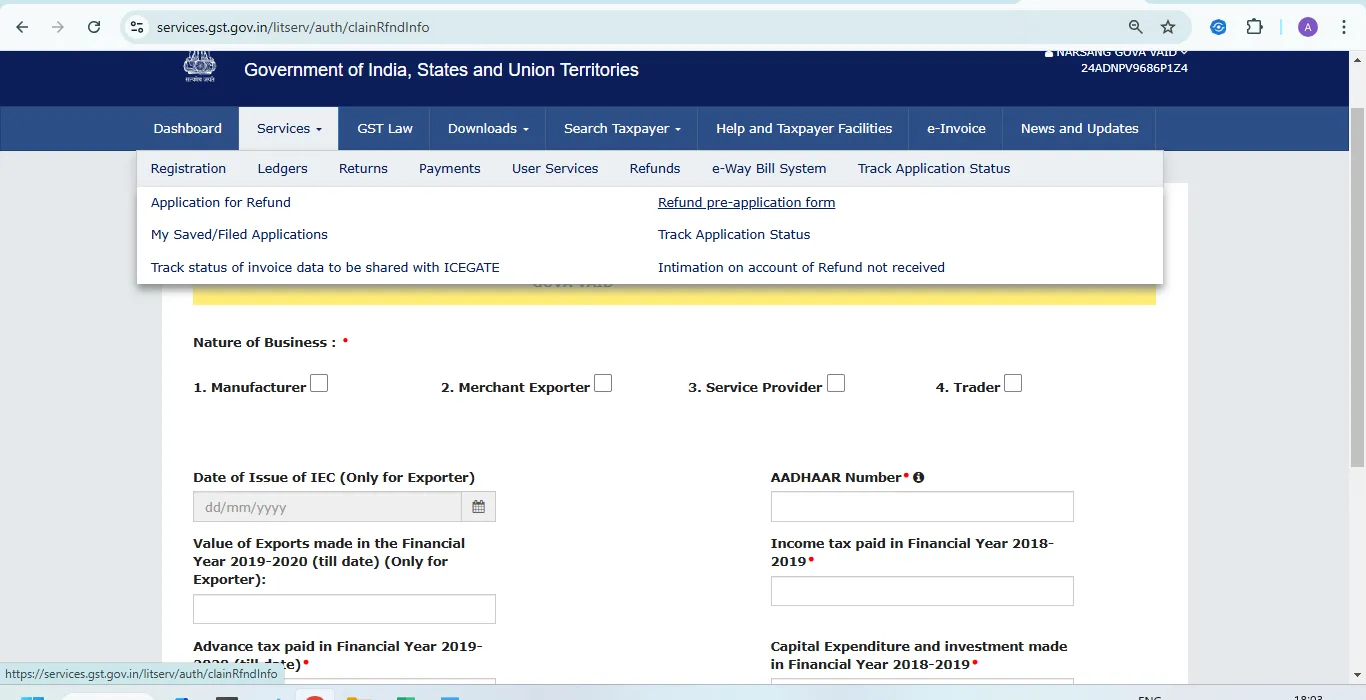

Step 1: Log in to the GST portal, navigate to the ‘Services’ tab, select ‘Refunds,’ and then choose the ‘Refund Pre-Application Form’ option.

Step 2: Here’s a step-by-step breakdown of the process for filling in the ‘Refund pre-application form’:

1. Nature of Business: Select the appropriate option based on your business type. The options to choose from are:

- Manufacturer

- Merchant Exporter

- Trader

- Service Provider

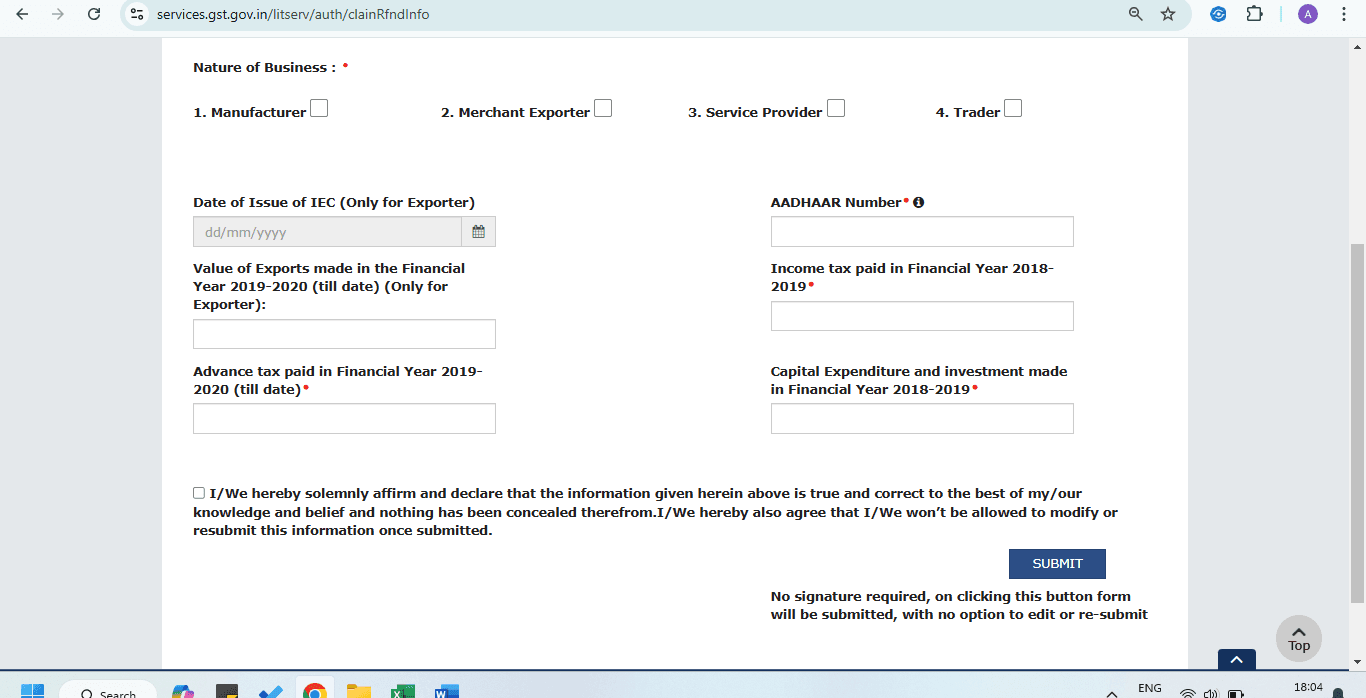

2. Date of Issue of IEC (for Exporters): If you are an exporter, provide the date on which the Import Export Certificate (IEC) was issued. This is required for exporters applying for a refund based on exports without payment of tax.

3. Aadhaar Number of the Primary Authorized Signatory: Enter the Aadhaar number of the primary authorized signatory for your business. This is mandatory for verification.

4. Value of Exports in FY 2019-2020 (for Exporters): Only exporters need to provide this. Calculate the value of exports made in the financial year 2019-2020 at the GSTIN level (not PAN level).

5. Income Tax Paid in FY 2018-2019: Provide the total income tax paid during the financial year 2018-2019.

6. Advance Tax Paid in FY 2019-2020: Indicate the amount of advance tax paid during the financial year 2019-2020.

7. Capital Expenditure and Investment in FY 2018-2019: Provide the details of capital expenditure and investment made by your business in the financial year 2018-2019.

After filling in all these details, click on ‘Submit’. A confirmation message will appear to acknowledge that your submission was successful.

Steps to Apply for GST Refund Using Form RFD-01

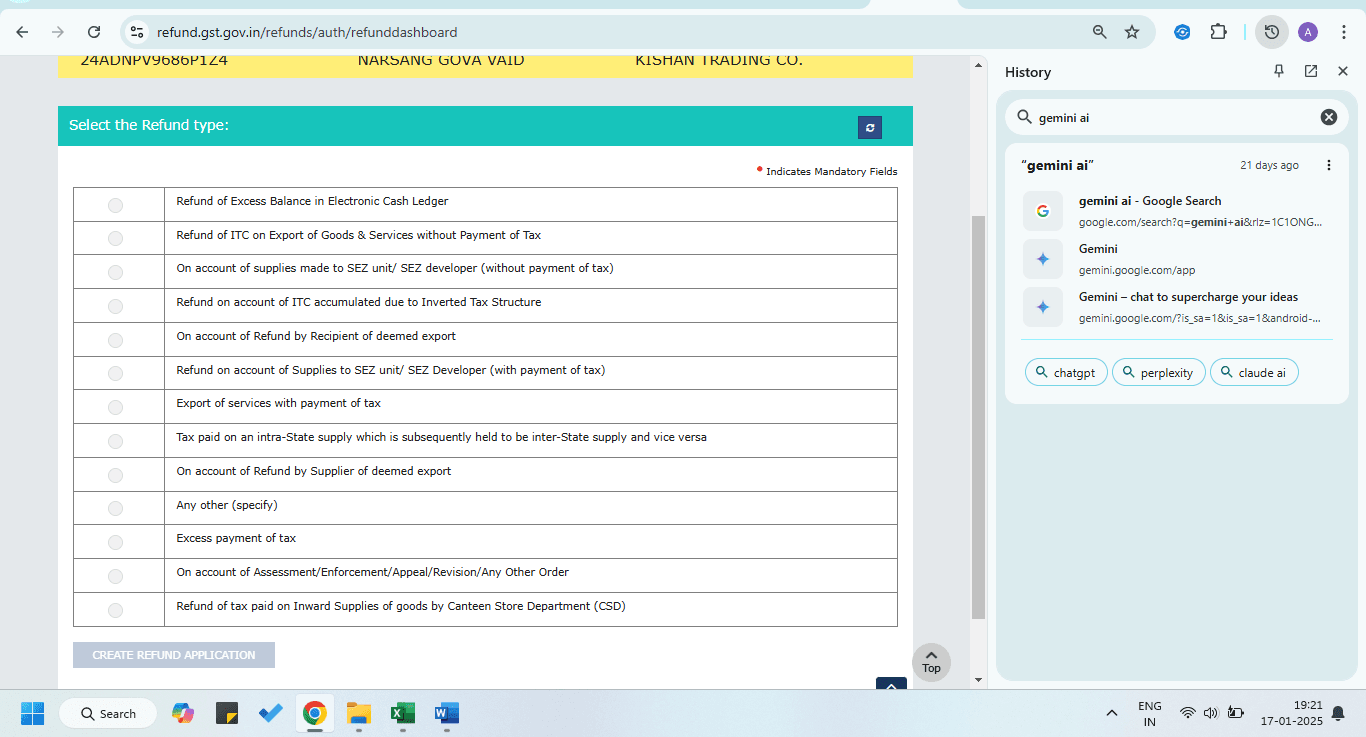

Step 1: Log in to the GST portal, navigate to the ‘Services’ tab, select ‘Refunds,’ and then choose the Application for refund tab:

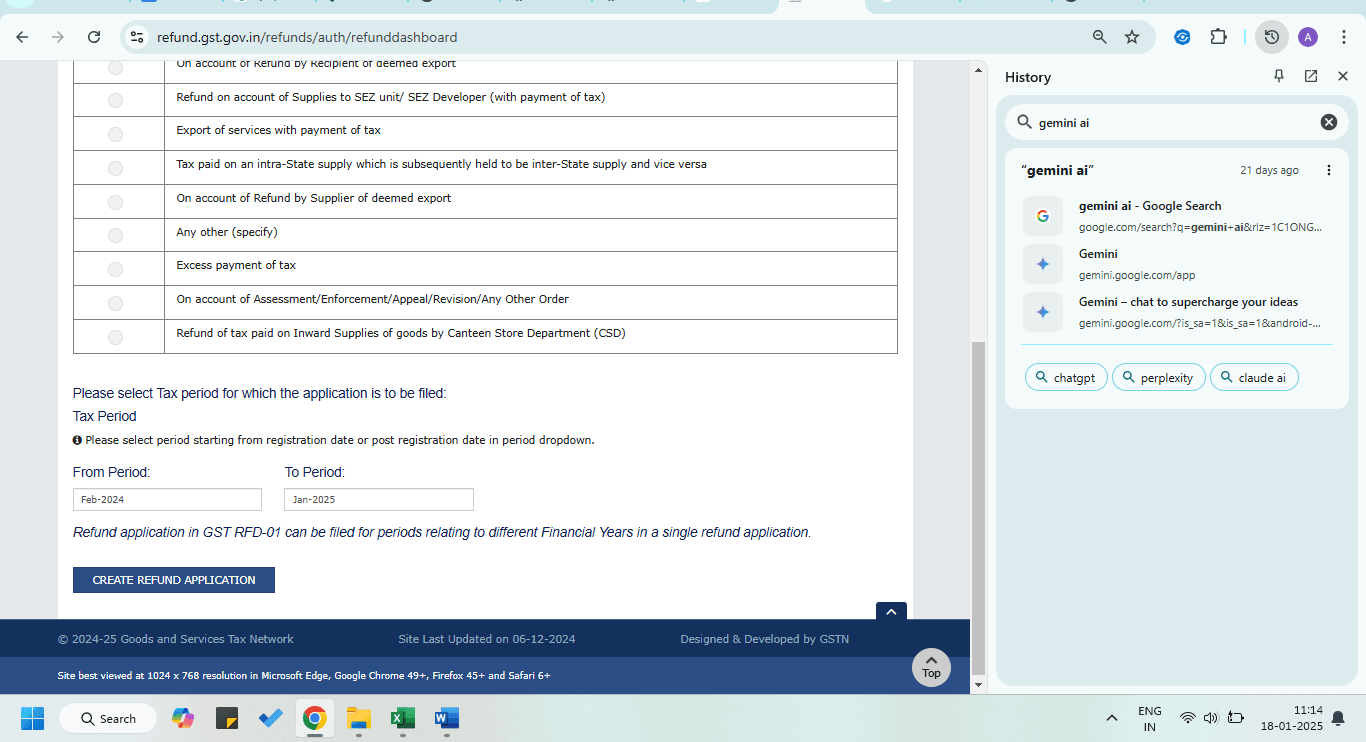

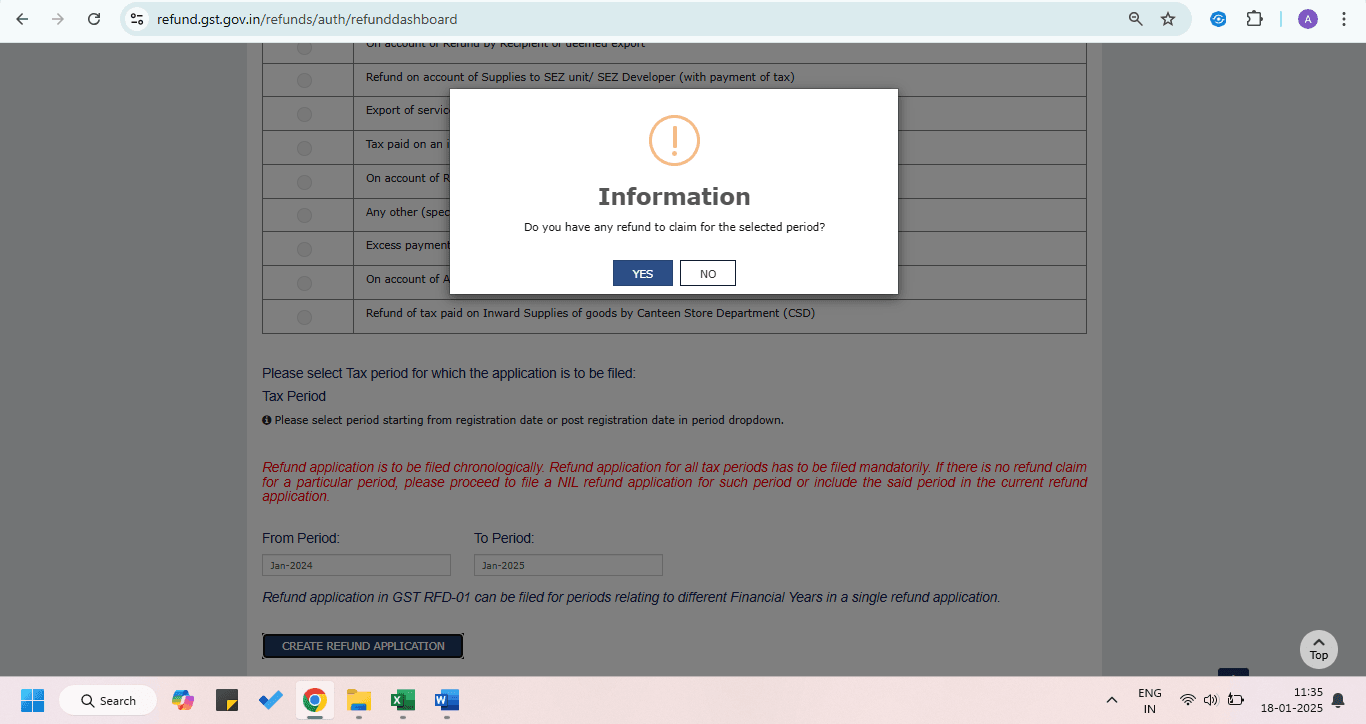

Step 2: On the displayed page, choose the reason or type of GST refund you are seeking and then click on the "Create refund application" button

Step 3: Specify the timeframe for which you are requesting the GST refund. Then, a dialogue box will appear asking "If you want to file a nil refund." Select "Yes" or "No" accordingly.

Taxpayers must acknowledge a declaration and then file using either a Digital Signature Certificate (DSC) or Electronic Verification Code (EVC).

This step is not applicable for refund types such as:

- Excess cash balance in the ledger

- Intrastate supplies later deemed interstate or vice versa

- Refunds based on provisional assessments, appeals, or other orders.

Step 4: If you intend to file a standard refund application (not a nil refund), please proceed with the application process as usual.

Refund Process of IGST Paid on Export of Goods (With Tax Payment)

Zero-Rated Supply refers to goods or services that are taxable under the Goods and Services Tax (GST) regime at a rate of 0%. This means that while the supply is subject to GST, the tax rate is set to zero, so no tax is effectively levied on the supply.

Exports are treated as Zero-Rated Supplies under the Goods and Services Tax (GST) regime, meaning no tax is charged on exports. However, exporters who have paid IGST and cess on export goods are eligible for a refund. To streamline the refund process, the GST portal offers a simplified procedure, with no need for a separate application in Form RFD-01.

At MyGSTRefund, we understand the complexities of the GST refund process, so we have developed several intuitive tools to simplify your refund journey. Our Know Your Refund tool provides valuable insights into your eligibility and helps you track your refund status efficiently. Additionally, our GST Refund Calculator helps you accurately calculate your refund amount, minimizing the chances of errors and increasing the likelihood of a successful refund sanction. These tools are designed to make the refund filing process easier, ensuring you get your rightful refund without unnecessary delays.

Key Steps for Exporters to Claim Refund:

1.The exporter must fill in Table 6A of GSTR-1, providing shipping bill details for export transactions (with payment of tax)

2.The exporter must report the summary of export transactions in Item

3.1(b) of GSTR-3B and ensure that the return is filed by the due date.

3. In Table 6A of GSTR-1, exporters must provide the following details for export invoice data: Shipping Bill Number, Shipping Bill Date, Port Code Details.

4.Export transactions carried out during a particular tax period must be filed in GSTR-1 and GSTR-3B of the same tax period & tax reported in GSTR3B must be equal or higher than the tax reported in GSTR-1.

The GST authority considers the shipping bill as the refund application, and the export details provided in GSTR-1 are sent to the ICEGATE system for validation. This system cross-checks the information on the shipping bill and the Export General Manifest (EGM) to ensure accuracy. Once the data is validated, the refund process is initiated. After the refund is credited to the exporter's account, the ICEGATE system communicates the payment information to the GST portal, which then sends a confirmation of the refund payment to the exporter via SMS and email.

Refund of Excess Balance in Electronic Cash Ledger

Step 1: Log in to the GST portal, navigate to the ‘Services’ tab, select ‘Refunds,’ and then choose the Application for refund tab:

Step 2: On the displayed page, choose the reason or type of GST refund you are seeking and then click on the "Create refund application" button

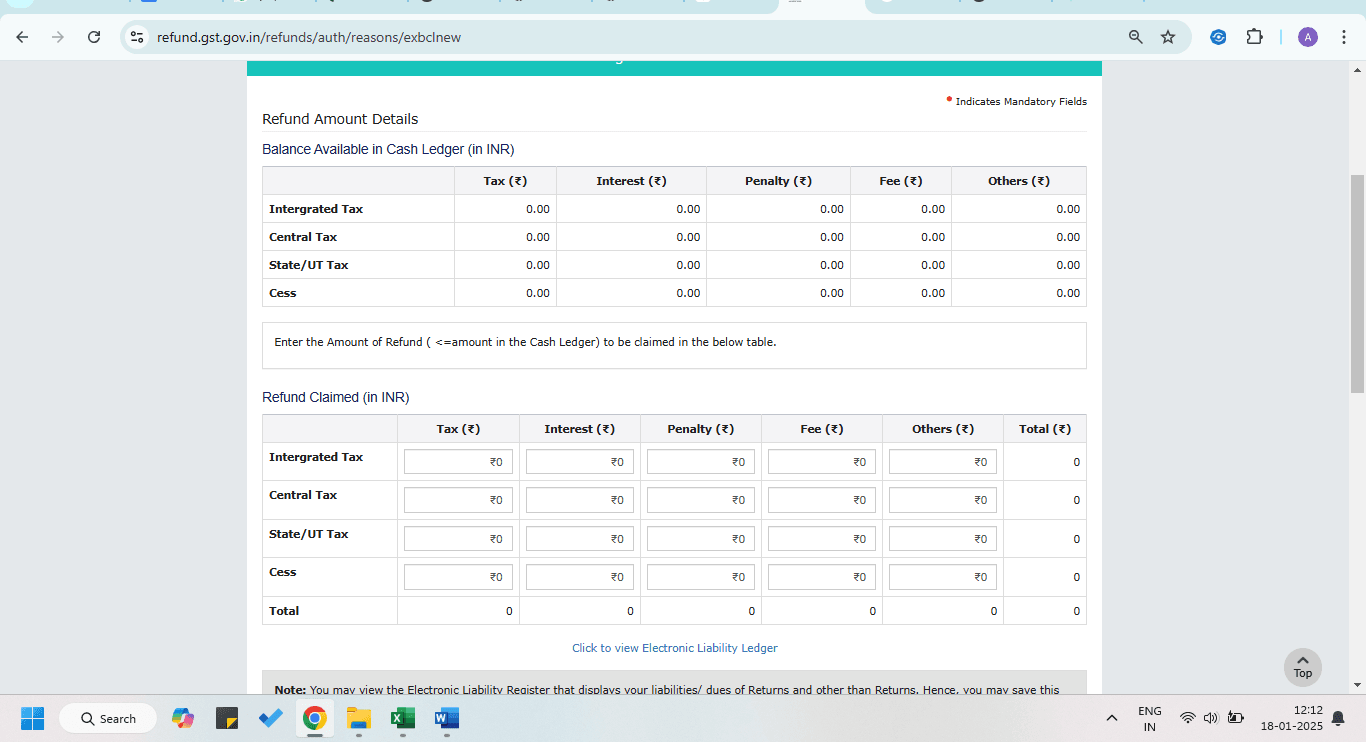

Key Note: The system automatically populates the available balance in the Electronic Cash Ledger. You can claim a refund up to this amount.

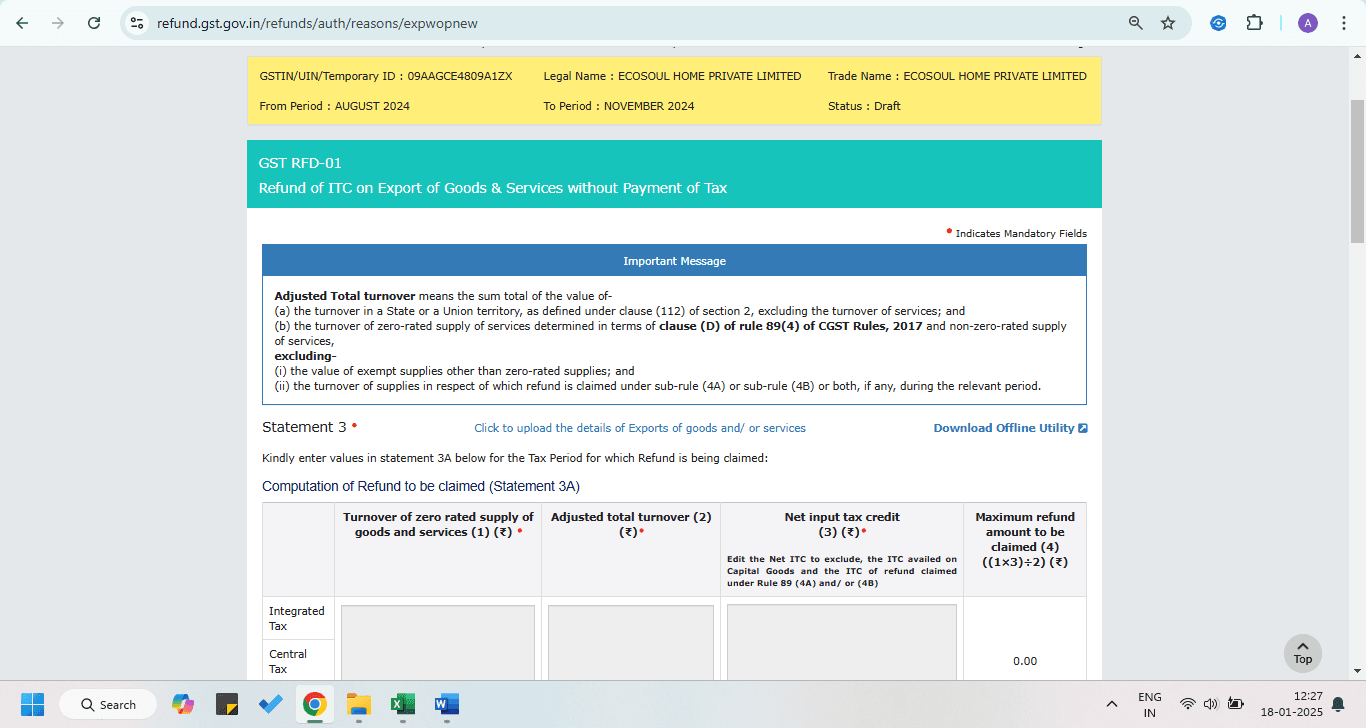

Refund of Accumulated ITC on Exports of Goods and Services Without Payment of Tax

Step 1: Create a refund application for export without payment of tax for a selected period of time.

Step 2: Download Statement 3 and fill it with details from the export invoices for which a refund is being claimed also provide all the details for shipping bills and EGM Details (in case of Goods) and FIRC (in case of Services).

Step 3: Create the JSON file and upload it on the portal from the Statement 3 tools downloaded in step 2, Then, provide the necessary information for the Computation of Refund to be Claimed (Statement 3A) on the portal, as indicated in the images above. Afterward, enter the refund amount under the respective heads, such as IGST, CGST, or SGST.

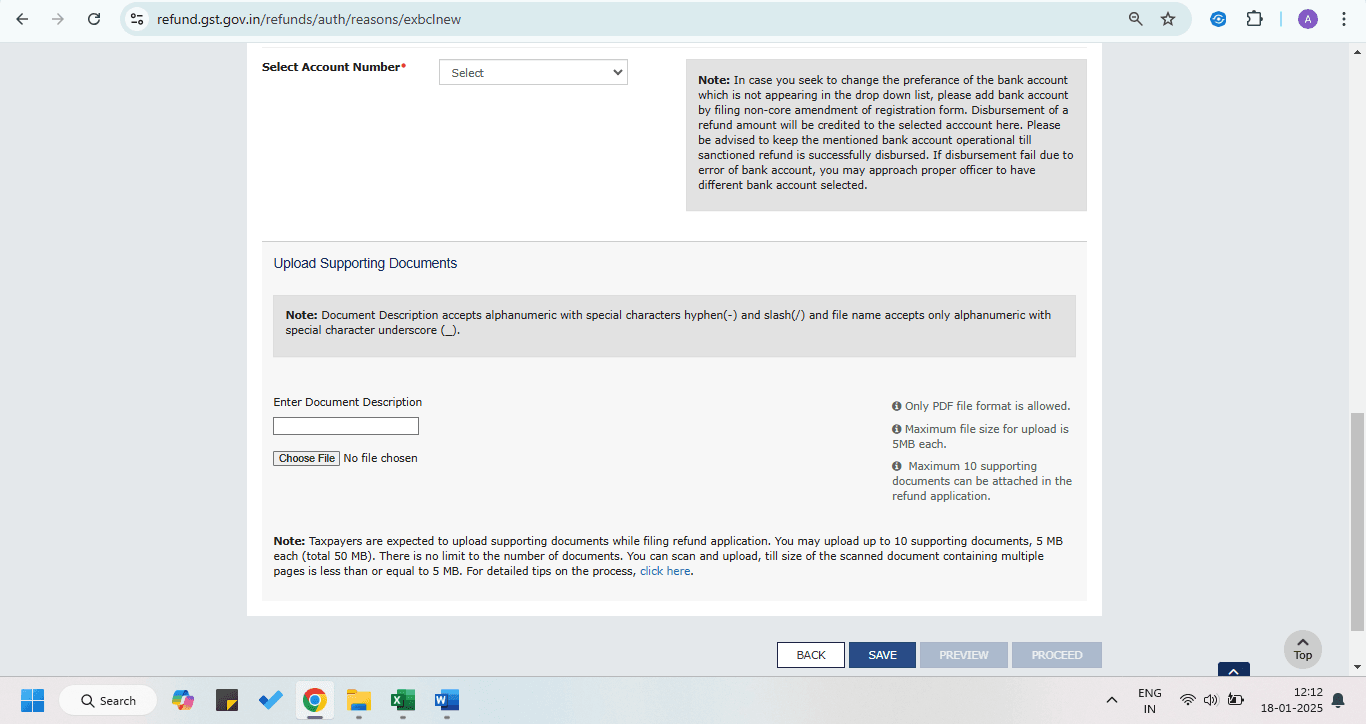

Step 4: Upload all required supporting documentation, such as.

- Shipping bills (in case of export of goods)

- Foreign Inward Remittance Certificates (FIRCs-in case of export of services)

- Purchase invoices

- Sales Invoice

- Declaration required as per circular 125

- Company Profile

- Statement 3

- Annexure B

- Bank Reconciliation Certificates (BRCs)

Step 5: File the refund application after providing accepting undertaking and declaration on GST Portal and after providing LUT Reference No with DSC/EVC code.

Refund of Accumulated ITC due to Inverted Tax Structure

In an inverted tax structure, the tax rate on the inputs used to produce a good or service is higher than the tax rate on the final output itself.

Step 1: Create a refund application for inverted tax structure in the same way as for Exports refund.

Step 2: Download Statement 1A from the GST Portal and provide details of all the input goods or services availed and also sales of inverted rated supply, tax payable, etc.

Step 3: Create the JSON file from Downloaded Statement 1A tool and upload it on the portal. Then, provide the necessary information for the Computation of Refund to be Claimed on the portal. Afterward, enter the refund amount under the respective heads, such as IGST, CGST, or SGST.

Step 4: Upload all required supporting documentation, such a

- Purchase invoices

- Sales Invoice

- Declaration required as per circular 125

- Company Profile

- Statement 1A

- Annexure B

Step 5: File the refund application after Accepting undertaking and declaration on GST Portal through DSC/EVC Code

Refund by the recipient of deemed exports

If a recipient of deemed exports has paid tax on inward supplies that qualify as deemed exports and has claimed Input Tax Credit (ITC) for the tax paid in their electronic credit ledger, they are eligible to receive a refund of the tax amount. However, the supplier of these deemed exports cannot claim the refund.

The process for claiming the refund remains the same as outlined for Exports of goods or services refunds, with the exception that the statement to be used will be Statement 5B. After that, the recipient must provide details such as the net input tax credit of deemed exports and the amount of refund to be claimed.

Refund of tax paid on supplies made to SEZ unit/SEZ developer (with payment of tax)

The steps remain the same as the ones laid down for the Export refund refund given above. However, the statement will be Statement 4. The refund amount will get auto-populated based on the statement uploaded.

After filing the refund application, the proper officer will review it along with the uploaded documents. If all the required documents are in order, the officer will issue an acknowledgment in Form GST RFD-02. However, if the officer finds any deficiencies in the submitted documents, they will issue a deficiency memo in Form GST RFD-03.

Conclusion :

Once Form GST RFD-02 has been issued, the officer may still request additional documents by issuing Form GST RFD-08. If they are satisfied with the submitted documents, they will proceed to issue a refund sanction order in Form GST RFD-06 and a payment order in Form GST RFD-05.

In the event Form GST RFD-03 has been issued, a fresh refund application can also be filed.

The GST refund process can be often lengthy and confusing, involving a series of multiple forms and detailed scrutiny by the proper officer.

This process, right from the acknowledgment in Form GST RFD-02 to issuance of a deficiency memo in Form GST RFD-03 and even additional document requests through Form GST RFD-08, can sometimes overwhelm businesses.

But with MyGST Refund, it's as smooth as it can get. Our automated platform simplifies the entire refund process and our team of experts ensures accuracy and compliance at every step. Be it filing a fresh refund application or tracking your refund status, MyGST Refund is your trusted partner in maximizing your working capital.

Goodbye, complexities of GST refunds! Visit app.mygstrefund.com and let us do the hard work for you.

Related Posts