How to Check Your GST Refund Status and Know Common Reasons for Delays

Getting a refund for GST can significantly improve cash flow for businesses. However, delays in refunds can impact operations. In this guide, we will explain how to check your GST refund status and outline common reasons for refund delays. This ensures you're equipped with the knowledge to expedite the process.

1. What is a GST refund?

A GST refund is the refund of excess tax paid by businesses or individuals under the Goods and Services Tax (GST) system. Refund claims are made in cases of-

- Export of goods or services (zero-rated supplies).

- Accrued input tax credit due to an inverted duty structure.

- Refunds on account of GST paid on deemed exports.

- Refunds on account of provisional assessments, judgments on appeal, or excess payments.

- Refund on account of deduction/collection of TDS/TCS.

- Supply to SEZ.

2. How to Check GST Refund Status?

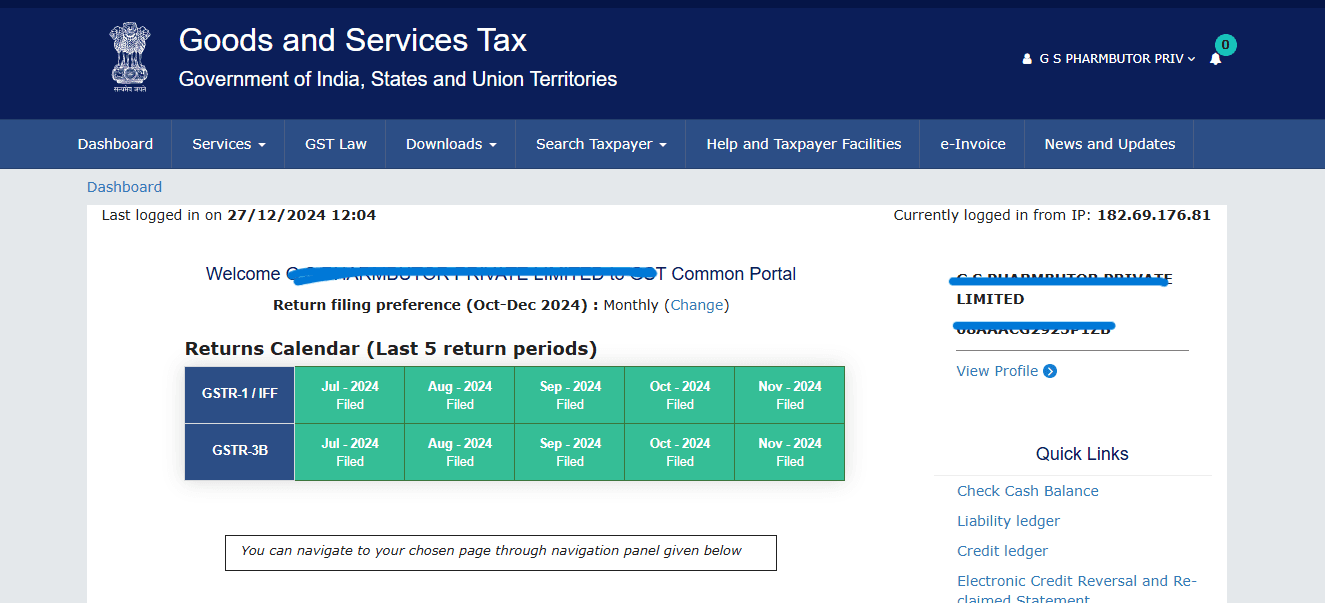

To check the GST Refund status, you have to visit the official GST website

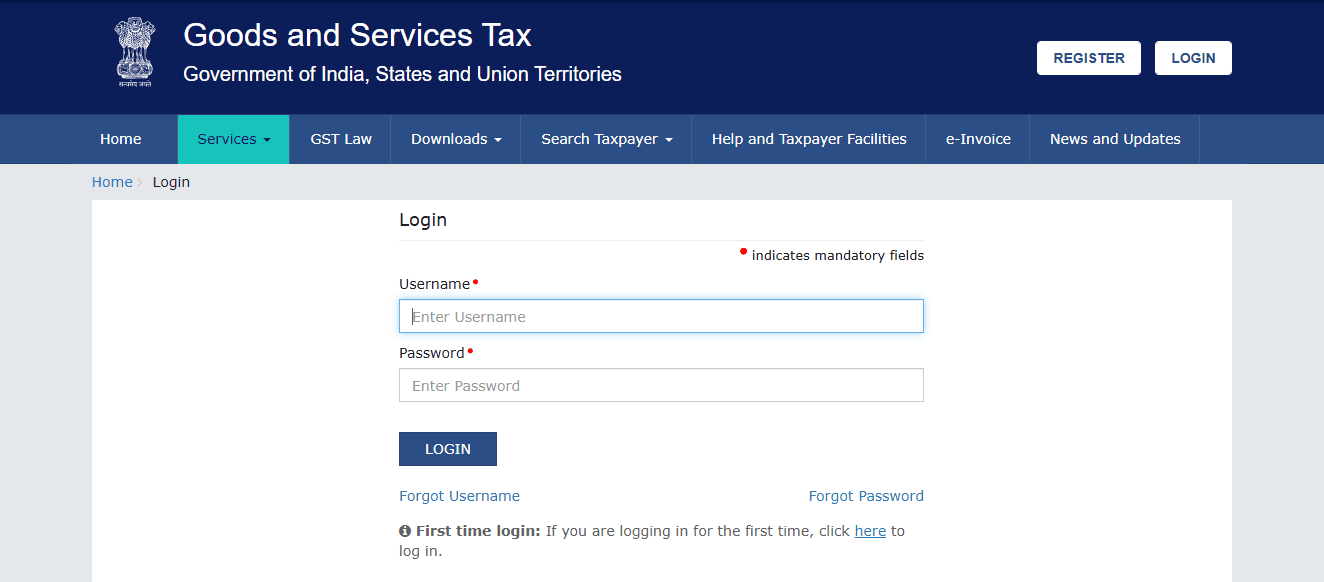

Step 1: Log in to the GST Portal

- Visit : www.gst.gov.in

- Use your credentials to log in (username and password).

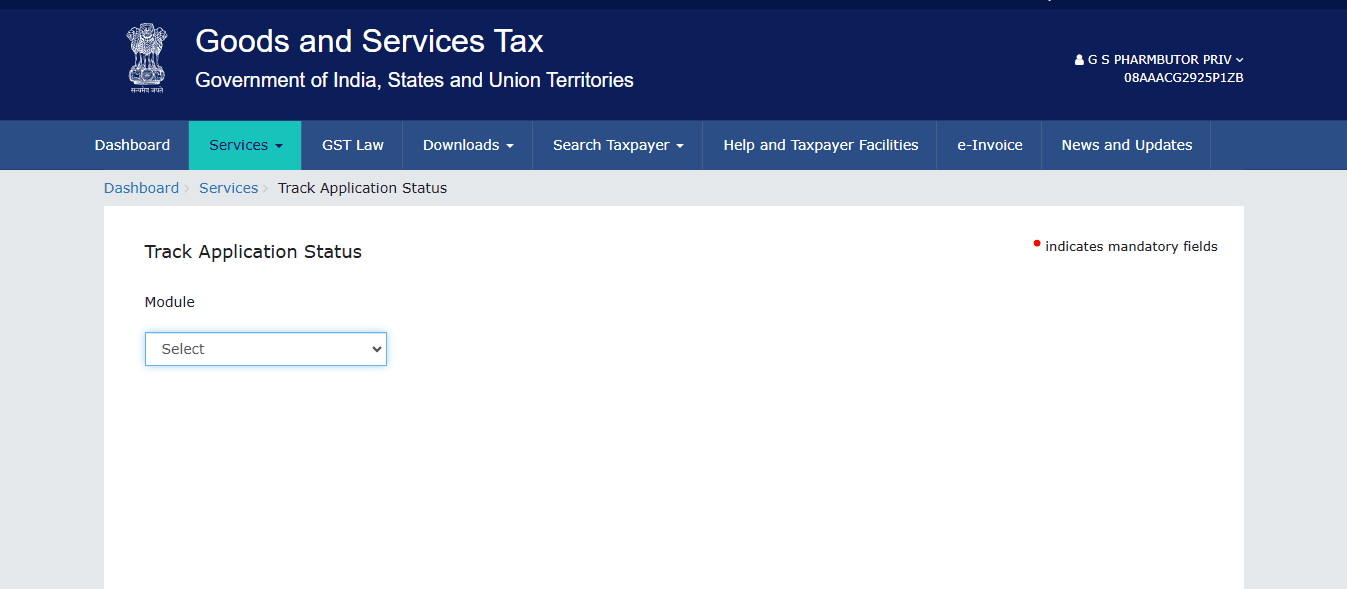

Step 2: Navigate to Refund Status

3. Go to the 'Services' tab.

4. Click on 'Refunds' and then select 'Track Application Status.

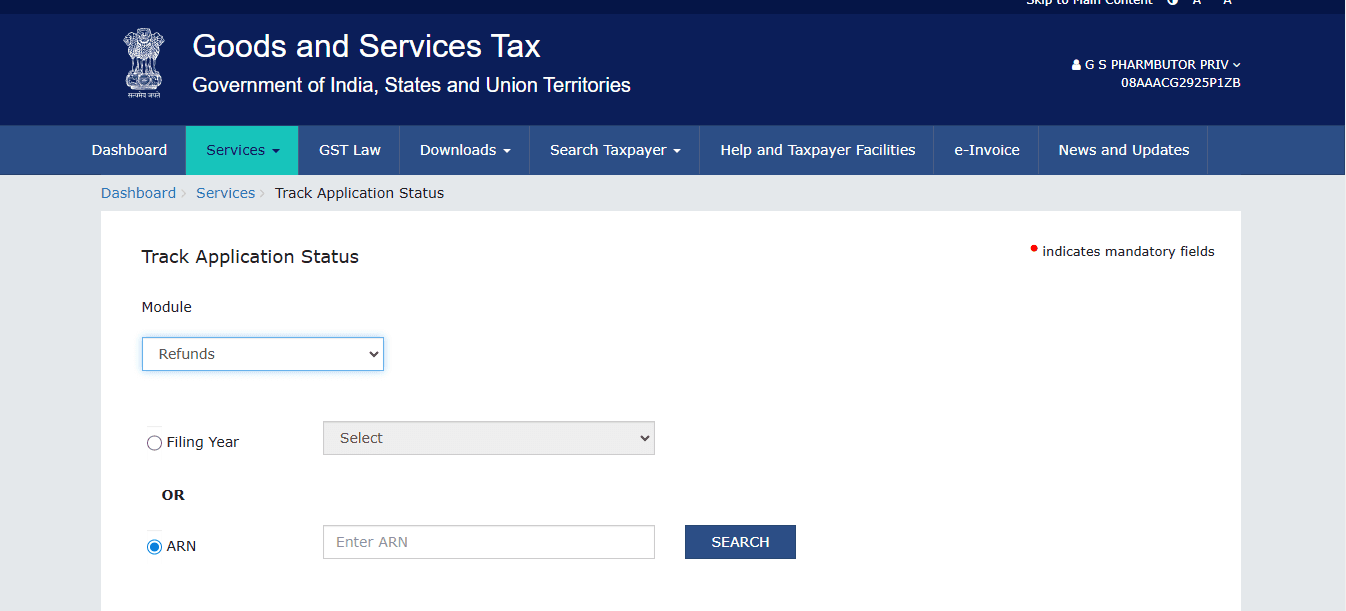

Step 3: Enter Reference Number or Date

5. Enter your ARN (Acknowledgment Reference Number) received during the refund application filing.

6. Alternatively, select the date range for the refund application.

Step 4: Review the Status

The portal displays:

Submitted: Application filed successfully.

Processed: Refund processed and sanctioned.

Deficiency Memo Issued: Application requires corrections.

Rejected: Refund denied with reasons.

Common Reasons for GST Refund Delays

1. Incomplete Documentation:

- Missing invoices, shipping bills, or declarations.

- Solution: Verify all attachments before submitting.

2. Mismatch in GSTR Filings:

- Difference between GSTR-1 and GSTR-3B returns.

- Solution: Recognize and rectify mismatches before filing for a refund.

3. Wrong Bank Account Details:

- Incorrect IFSC codes or account numbers.

- Solution: Verify and update bank details in the GST portal.

4. Incorrect Refund Application Type:

- Refund filed under the wrong category, say IGST when it is CGST/SGST.

- Solution: Be careful about the selection of the category while filing.

Pending Notices or Queries:

- Refunds withheld on account of pending GST notices or assessments.

- Solution: Answer the notices promptly with necessary clarifications.

Tips to Expedite the GST Refund Process

- Pre-file reconciliation: Reconcile input tax credit and sales details before submitting.

- Use Automated Tools: Platforms such as MyGST Refund have automated tools to know and calculate your GST refund.

- Regular Tracking: Check the status frequently to sort out queries early.

- Consult experts: Seek professional help for error-free applications and appeals.

Conclusion

The most critical step for avoiding the inconvenience of a delay is monitoring the GST refund status. Check updates frequently using the GST portal, recognise errors at the earliest, and take the required measures accordingly. Online portals such as MyGST Refund streamline the process through automated tools and professional services for proper and timely submissions.

Frequently Asked Questions

Q1. How many days does it take to process a GST Refund?

A. Refunds would normally be processed in a time span of 60 days from the date of application, if there is no discrepancy.

Q2. Can I check my GST Refund status without an ARN?

A: No, ARN is must to track the refund application

Q3. How can I get the resolution for my delayed GST Refund?

A: Contact your jurisdictional GST officer and submit your grievance on the GST portal.

Also Read : GST Refund Process, Claim and Time Limit

Related Posts