ICEGATE tracking and the process of checking AD code registration

The role of the Indian Customs Department as a facilitator and regulator of trade across borders is quite significant. Therefore, the department generates a unique identifier for businesses engaged in international trade called the Authorized Dealer (AD) code. In India, any business that imports or exports should have this code, which is necessary for promoting good trade practices.

What is ICEGATE?

ICEGATE stands for the Indian Customs EDI Gateway, and it is an online platform that helps users submit and process customs papers electronically. Operated by the Indian Customs Department, ICEGATE allows for easy sharing of information between importers, exporters and customs officials. The documentation process is simplified, thus facilitating easier access to international trade for Indian companies. By registering your AD code on ICEGATE, you ensure smooth export-import transaction processing.

ICEGATE performs some other functions that do not relate to document submission; one such function includes ICEGATE tracking. This function enables businesses to monitor the real-time status of their submitted documents and shipments. In addition, this feature promotes transparency while monitoring customs clearance progress as it fosters timely deliveries.

What Is an AD Code Registration?

AD codes are 14-digit numeric codes released by the Indian customs department to registered companies. This code is significant for any company wishing to import or export products from India. A bank where a business has its account issues it, and it has to be recorded with the Indian customs department via their ICEGATE website. This restricts importation and exportation to only authorized parties, hence minimizing the occurrence of fraudulent transactions while at the same time ensuring compliance with Indian customs law..

Significance of the AD Code Registration.

AD code Registration is not just a number, but it is an authentication tool for business enterprises that is very significant. This code is also a must if one wishes to electronically send custom-related documents via an Indian Custom EDI (Electronic Data Interchange) System called ICEGATE. The code is also compulsory in filing shipping bills, which are vital for export transactions. Not having an allotted AD code and registering it may result in delays in shipments or even penalties by customs authorities.

Key benefits of having an AD code include:

- Compliance: Makes sure that your company is conforming with rules established by the India Customs Department.

- Fraud Prevention: It prevents fraud by ensuring that only people who are allowed to import or export can do so.

- Facilitates Trade: The process of submitting electronic customs declarations becomes easy; hence, trade becomes smoother and faster.

To verify AD code registration status on ICEGATE, follow these steps:

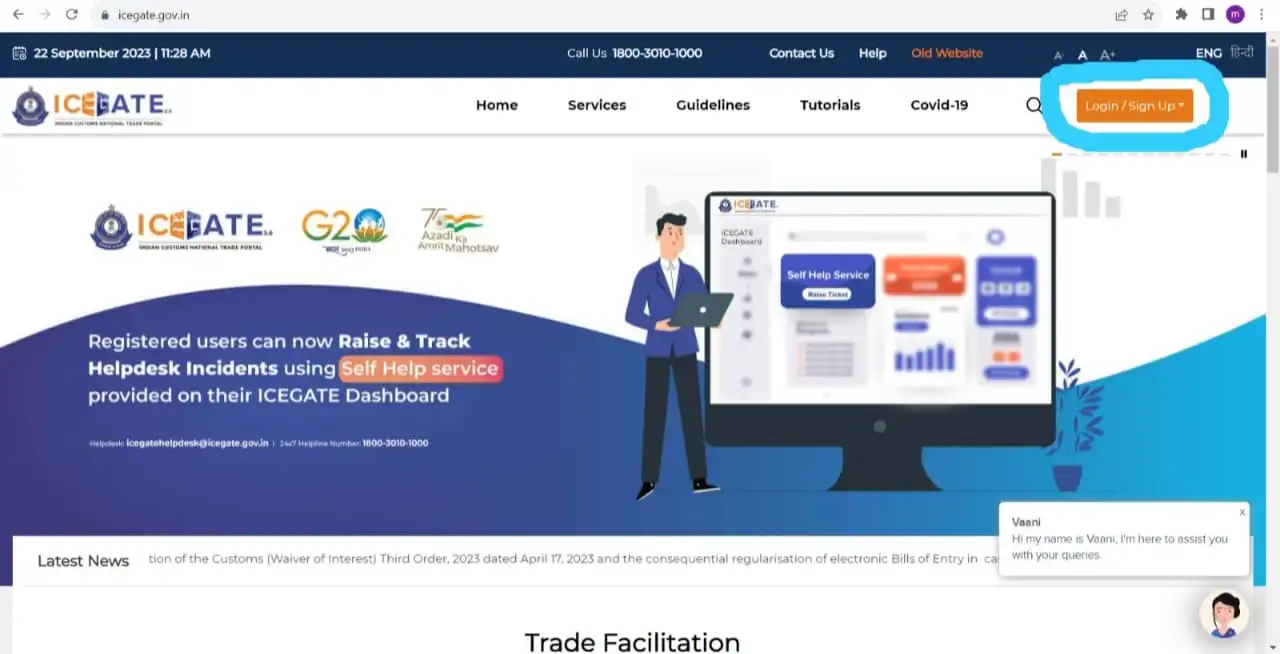

Step 1: Visit the official ICEGATE website.

Step 2: Look for the login/signup option, and you will be directed to the login page. If you don't have an existing account, proceed to sign up.

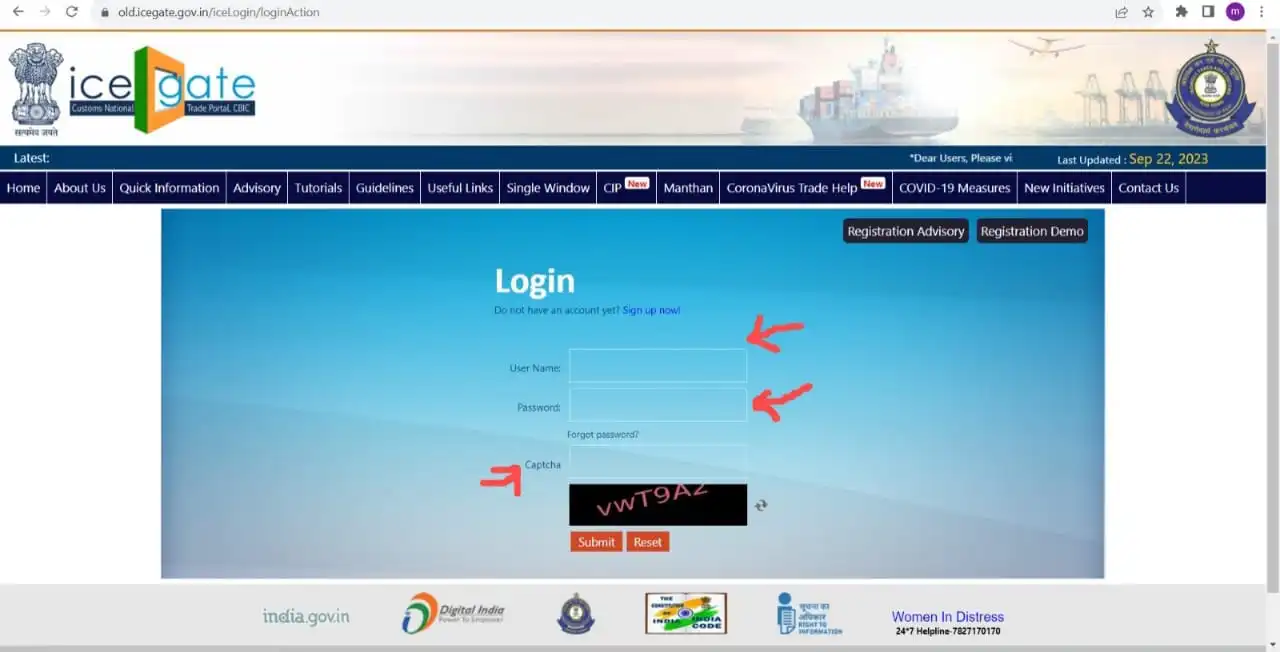

Step 3: On the login page, input your existing user ID, password, and CAPTCHA, then click "Submit." This action will redirect you to your account homepage.

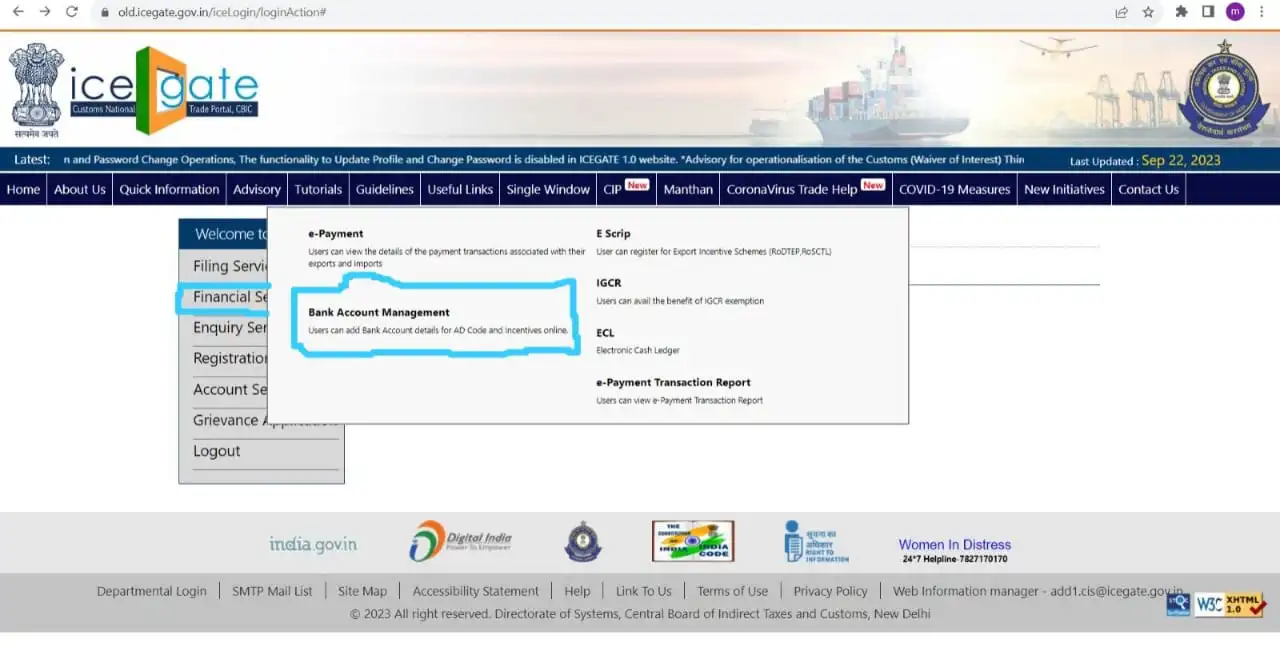

Step 4: Navigate to the 'Financial Services' menu on the left and select 'Bank Account Management.'

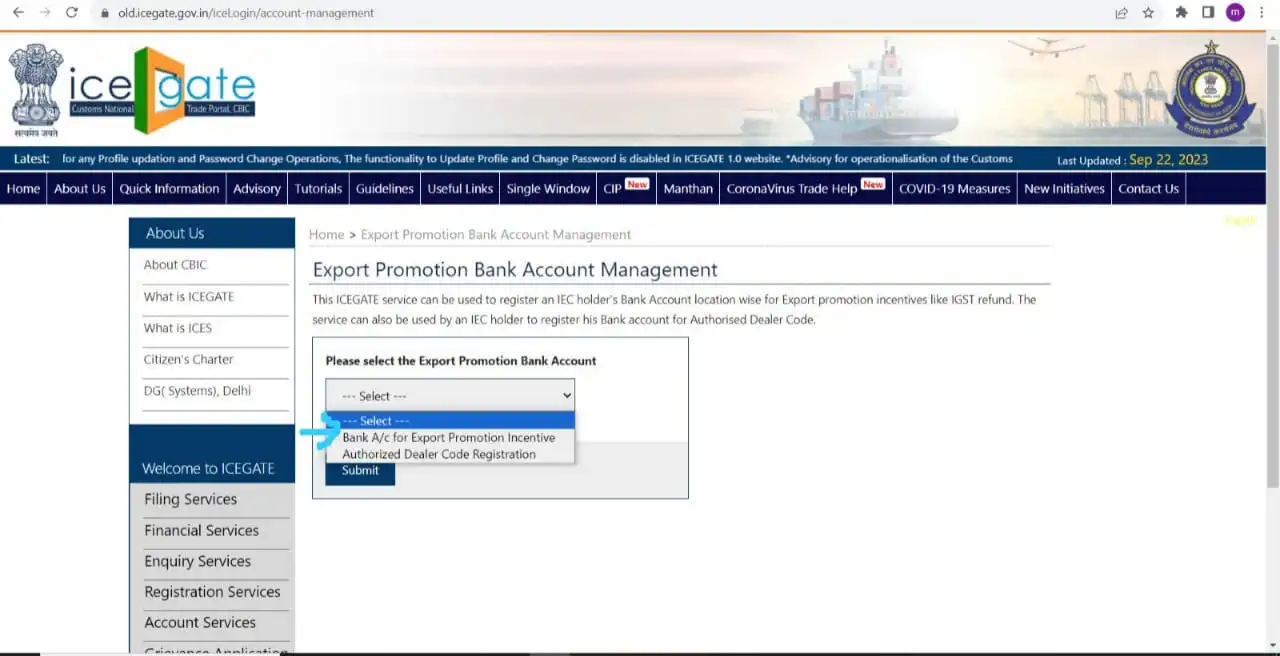

Step 5: Within the Export Promotion Bank Account Management section, use the drop-down menu to choose your export promotion bank account. Click on 'Authorized Dealer Code Registration' and then click 'Submit.'

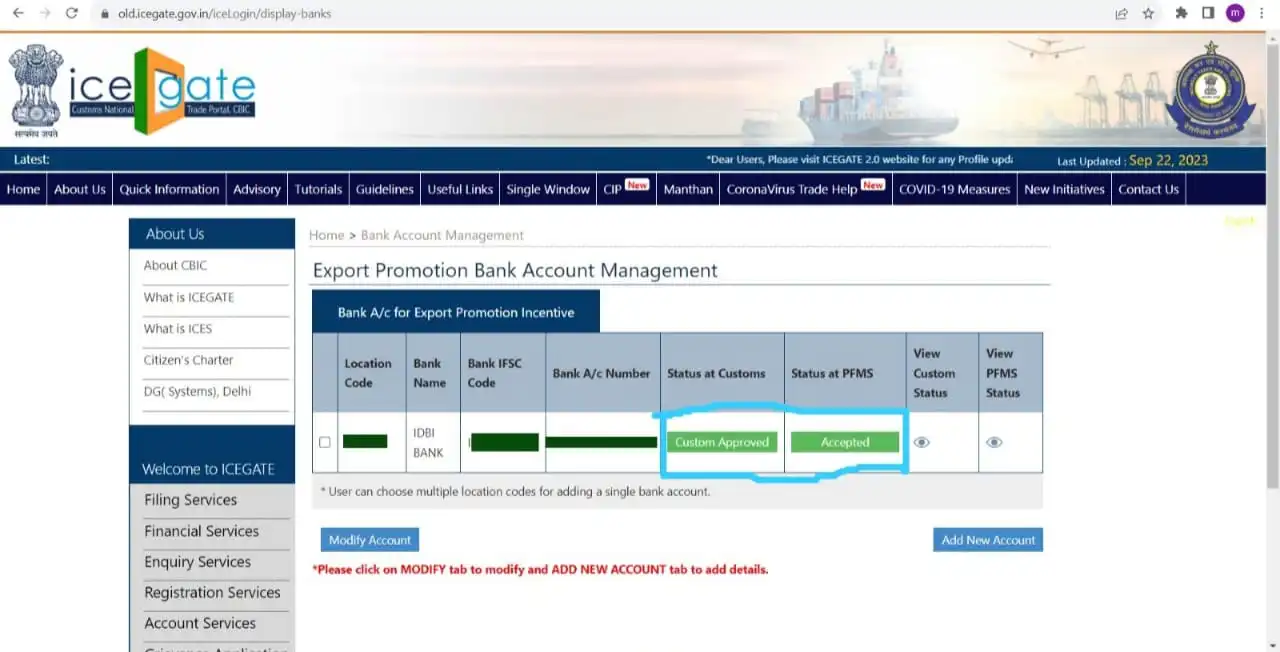

Step 6: Your registration status will be displayed on the following page. If it indicates 'Approved,' your AD code is registered and valid. If it shows 'Deactivated,' your AD code has been deactivated, and you will need to reapply for a new one.

ICEGATE Tracking: Real-Time Updates for Your Business

This tracking service provides updates on customs clearance, ensuring that businesses are aware of any delays or issues that may arise during the import or export process. One of the significant features of the ICEGATE platform is ICEGATE tracking, which allows businesses to monitor the status of their shipments and submitted documents in real-time.

By using ICEGATE tracking, businesses can:

Being able to know their shipping bills and bills of entry.

Tracking the clearance progress of their goods at various ports.

Take note about any actions needed or documents missing from them.

Make sure that an on-time delivery takes place for all consignments.

For companies engaged in international trade, ICEGATE tracking serves as an indispensable tool for transparency and efficiency. Knowledgeable firms are better placed to anticipate challenges that may arise along their supply chain.

ICEGATE Tracking: Real-Time Updates for Your Business

This tracking service provides updates on customs clearance, ensuring that businesses are aware of any delays or issues that may arise during the import or export process. One of the significant features of the ICEGATE platform is ICEGATE tracking, which allows businesses to monitor the status of their shipments and submitted documents in real-time.

Reasons Why Registration of AD Code on ICEGATE is Important

There are various reasons why registering your AD code on ICEGATE is extremely important. First, it allows for the electronic submission of shipping bills and other customs-related documents, thereby accelerating the export-import process. Secondly, this act ensures that your business complies with customs laws, preventing the chances of penalties or delays in transactions. Finally, with an ongoing digitalization in trade India has embarked on, registering with ICEGATE will prepare you for success in global emerging markets.

Growth of E-commerce and the Role of AD Codes

In the past few years, the Indian government has taken many steps to ease and digitalize the process for exporting documents. Hence, small and medium businesses found it easy to engage in international trade. With e-commerce booming, a number of local companies are now able to go global without having overseas offices or warehouses. Such companies must necessarily have an AD code so as to comply with customs rules, thus making international trading operations easier.

Conclusion

The Authorised Dealer (AD) Code Registration plays an indispensable role in India’s import-export processes. The system guarantees that only authorized traders can engage in international trading, thus protecting the nation from fraud and other illicit activities. If you want to speed up customs formalities and help your enterprise excel in international markets, register your AD code with ICEGATE and use ICEGATE tracking services. In India’s ongoing journey towards morphing into a more digitally oriented economy, it’s important for any business involved in cross-border trade to have an AD code, not just because it is necessary but also because it offers a competitive advantage.

Also Read:ICEGATE tracking and process of checking AD code registration

Related Posts