Difference Between IEC Code Registration and GST Registration in India

Every business must obtain legal permission to operate legally in the market. Businesses must have an IEC Code Registration and GST number to participate in worldwide trade or sell products within India. The Importer Exporter Code lets companies do business around the world but GST helps them follow Indian tax requirements. Businesses can grow faster and stay safe from legal issues when they register this way. We need to understand why companies need these registrations and what benefits they offer.

What is IEC Registration?

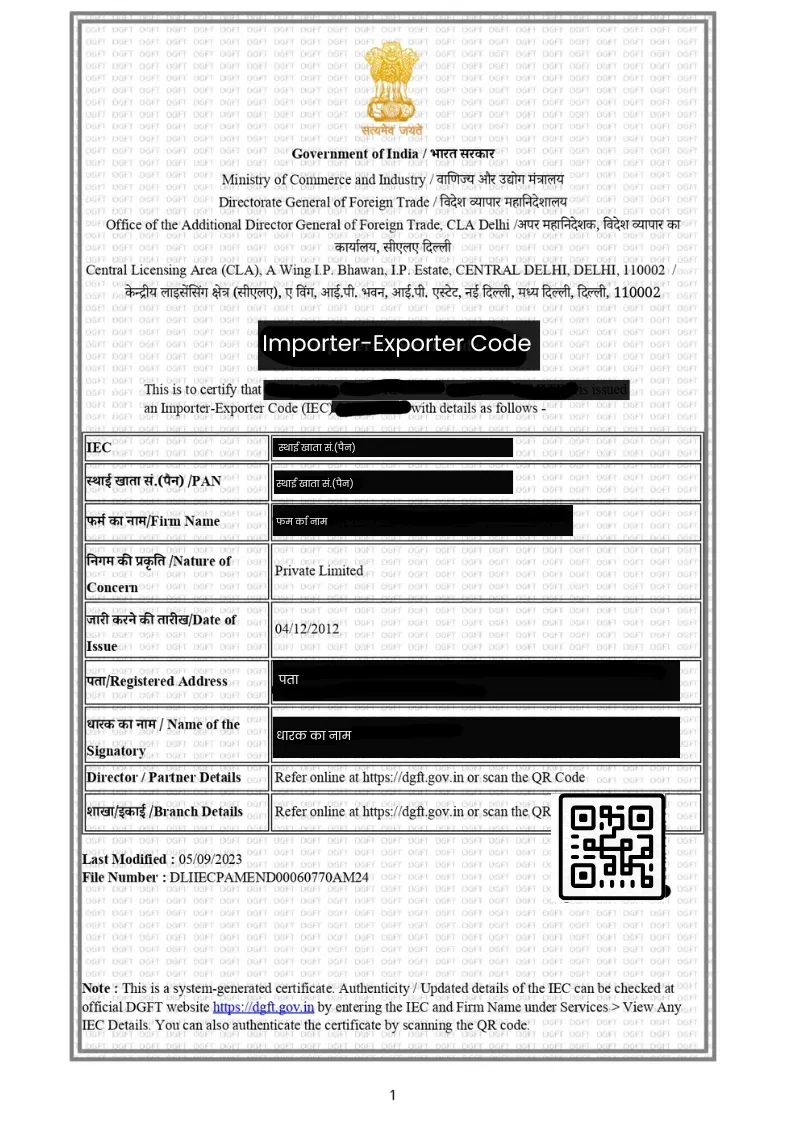

The Directorate General of Foreign Trade uses their authority to distribute a 10-digit Importer Exporter Code (IEC) to eligible business entities. Companies must obtain this license before they start their international trade operations. A business must have it to conduct valid international trade operations. The IEC Code Registration ensures smooth trade across borders.

Key Features of IEC Registration:

Simple Process: The application process is straightforward. It usually takes 10-15 working days for approval.

Access to Benefits: Any company that holds an IEC can apply for export tax breaks.

Global Transactions: Through an IEC businesses can reach customers across the world while avoiding complex international trade rules.

Lifetime Validity: Once issued, the IEC Code Registration does not require renewal, but you must submit annual updates to confirm whether the details remain the same or if any changes are necessary.

Government Schemes: Officially registered organisations can take advantage of government export enhancement schemes.

Read More: What is the IEC Import Export Code? Definition and Benefits

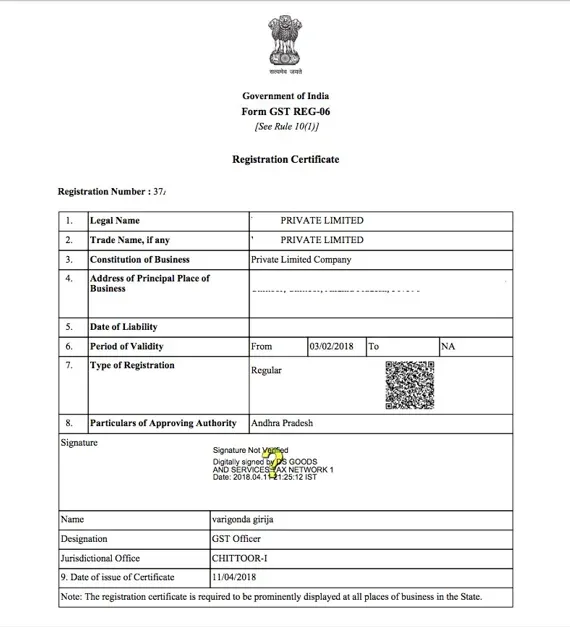

What is GST Registration?

Businesses need to go through GST Registration to enter the Goods and Services Tax network. Under this system, businesses now pay a single tax both when buying and selling goods and services. All businesses must register for GST when their annual revenue hits the required limit.

Key Features of GST Registration:

Legal Recognition: After getting GST registered businesses have the legal power to collect tax payments from their customers.

Tax Credit: Business owners get GST refund benefits when they submit proof of tax payments they made for their business purchases.

Interstate Trade: Business entities registered for GST have no trade limitations when operating between Indian states.

Improved Credibility: It helps build trust relationships between businesses and their customers along with suppliers.

Compliance: A company needs GST registration to follow tax requirements so they can avoid tax penalties.

A company needs a combination of IEC and GST registrations to maintain legal standing and expand its business activities in India and worldwide. Through these registrations, businesses gain official acceptance while receiving tax benefits plus financial help from government programs that improve their reputation and help them develop.

Key Differences Between IEC Registration and GST Registration

Pro Tip: Use our GSTIN Validator to quickly verify GST numbers and ensure accuracy in your business transactions!

Impact of IEC Registration and GST Registration on Businesses

Companies conducting international trade activities will receive helpful advantages from IEC Registration. The license permits companies to conduct commercial activity locally and worldwide through their trading transactions. A business gains new customers worldwide through its expanded market access. An IEC Code Registration lets businesses take advantage of special export benefits and duty exemptions that make operations more affordable and help them expand. Businesses with registered status face shorter and smoother customs procedures which reduces shipment wait times. This improves international operations.

Every business must obtain GST Registration to conduct legal domestic business activities. Indian tax compliance and legal protection become possible when businesses obtain this registration. Through GST registration businesses can use purchased taxes as credits to minimize their tax obligations. This directly improves financial health. By registering as a business you build better relationships with customers and suppliers through increased trustworthiness. It lets companies handle their multi-state business transactions efficiently.

Penalties for Non-Compliance

Breaking IEC and GST registration rules will lead to serious problems. A company can receive fines and trade restrictions in the IEC system by not registering. Customs will reject your shipment which leads to delayed deliveries and money loss. Businesses miss valuable government trade assistance programs when they do not comply with registration requirements.

If you fail to register for GST you must pay penalties. Companies without GST registration should expect to pay either 10% of their tax liability or ₹10,000 as a punishment. Late tax payments attract interest charges. When businesses act in a very serious manner they risk being prosecuted and could serve prison time from six months up to five years. Failure to comply with GST rules can lead to blocked registration status and stop both legal deals and business processes.

Read More: How to Start an Import and Export Business in India

Conclusion

Businesses in India and across the world need to obtain IEC and GST registrations to grow successfully. They protect businesses through legal requirements while saving money on taxes and making them more reliable to customers. Registering for both IEC and GST straightforwardly boosts business growth and prevents fines which leads to sustainable business development.

Pro Tip: Use our GST Refund Calculator to easily calculate your refund and simplify the GST process. Whether you want to know your refund amount or check its status, our tool makes it simple to know your GST refund quickly and accurately.

Frequently Asked Questions

Is GST Registration Mandatory for IEC Code?

The IEC code application process does not require a GST registration first. Businesses properly registered for GST can use their GSTIN instead of obtaining a new IEC number to handle export-import transactions. Each registration type operates independently yet both help businesses move forward.

What is IEC Code Registration?

To engage in global trade businesses must get a 10-digit IEC code through the DGFT. An IEC is mandatory for international business because it enables legal operations of import and export activities.

Who Needs No GST Registration?

Businesses operating under the specified income limit are free from mandatory Goods and Services Tax registration requirements. Businesses engaged in service exportation plus government entities and charity groups should get IEC registration to use certain incentive programs.

What Are the Benefits of IEC Code Registration?

A business can use IEC registration to conduct cross-border trade and receive export incentives plus government programs. The certificate helps expedite customs processes and continues working forever while aiding companies wanting to grow internationally.

Who Issues IEC Certificate in India?

The Ministry of Commerce and Industry's Directorate General of Foreign Trade agency issues the necessary IEC certificate for businesses seeking international trade. The DGFT regulates and controls all IEC Code Registration of businesses throughout India.

Related Posts