What is IEC Modification and Updation on DGFT: Step-by-Step Procedure

Every business that wants to conduct import or export operations in India requires the Importer Exporter Code (IEC) to operate lawfully. The Importer Exporter Code represents an essential requirement because businesses must possess it to carry out legal international trade operations. Businesses undergoing growth and development need to reassess their operational information since it should influence their IEC modification procedure.

The IEC modification procedure can be done through the Directorate General of Foreign Trade (DGFT) portal when businesses need changes in their Importer Exporter Code. The following blog explains IEC modification benefits as well as IEC update procedures alongside advantages of maintaining accurate IEC data.

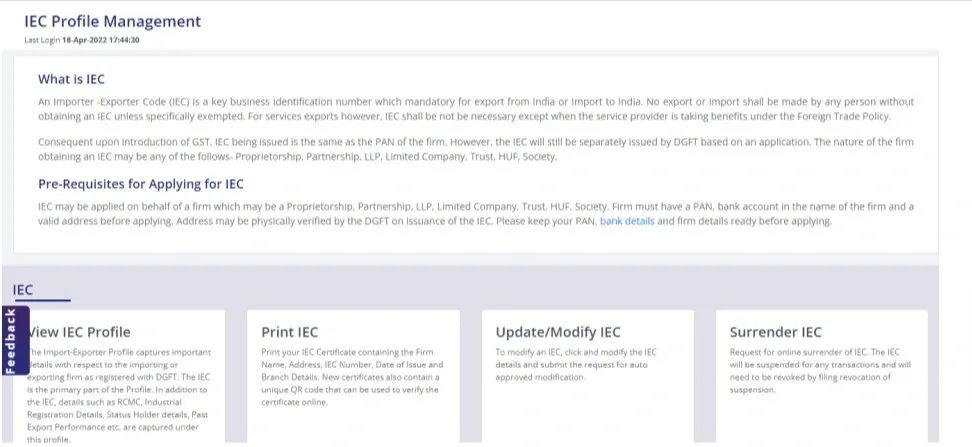

What is IEC Modification?

IEC Modification describes the procedure that changes existing information of an Importer Exporter Code. The modification process could affect either business owner information or bank details or business address or any other fundamental data. Through the DGFT portal, businesses can complete easy updates to their IEC data so the code remains comprehensive and precise. Read more to know IEC modification benefits.

Why is IEC Modification Important?

The IEC system plays an essential role for all businesses that participate in the international import-export trade. Every significant business modification requiring a change in address, director, or bank account necessitates an updated Importer Exporter Code. No updates to this data may result in difficulties with customs procedures and tax authority requirements as well as complications with international trading partners. By maintaining an updated IEC, your business will operate without operational interruptions.

Key Reasons for IEC Modification:

- A change in business location stands as the main reason why companies need to modify their IEC. Companies need to change their IEC when they shift their office to a new location because the official records must show their current address.

- Business operations are safeguarded from legal complications by updating the IEC whenever you replace a business owner or add or remove someone from the directorship.

- International Enterprise Code requires updated bank account details after business account changes including new bank activation or switching financial institutions or altering bank branches.

- The IEC system requires updates for all modifications within the export sector preferences as well as business activities and GST details. Compliance updates will maintain your IEC's accuracy because your business needs to follow any regulatory changes.

Documents Required for IEC Modification

- To modify your IEC you must submit specific IEC modification documentation including the following ones.

- Your IEC relies heavily on accurate PAN (Permanent Account Number) details that belong to your firm.

- The required proof of residence for business address verification includes recent documents such as a sale deed rent agreement electricity bill and others.

To present the new bank account one must submit either a canceled cheque or a bank certificate. - The online application requires a Digital Signature Certificate (DSC) or Aadhar from the members of the firm for its validation process.

Step-by-Step Procedure for IEC Modification on DGFT Portal

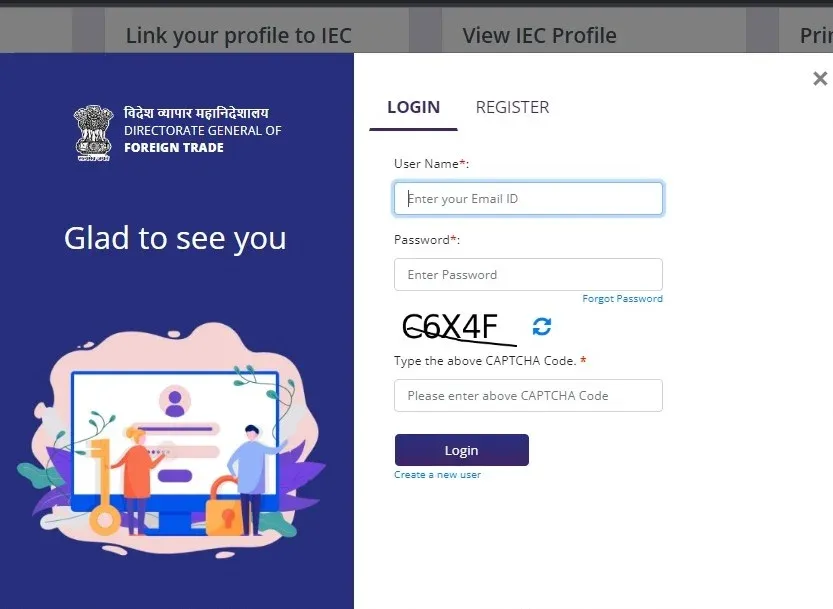

1. Login to DGFT Portal

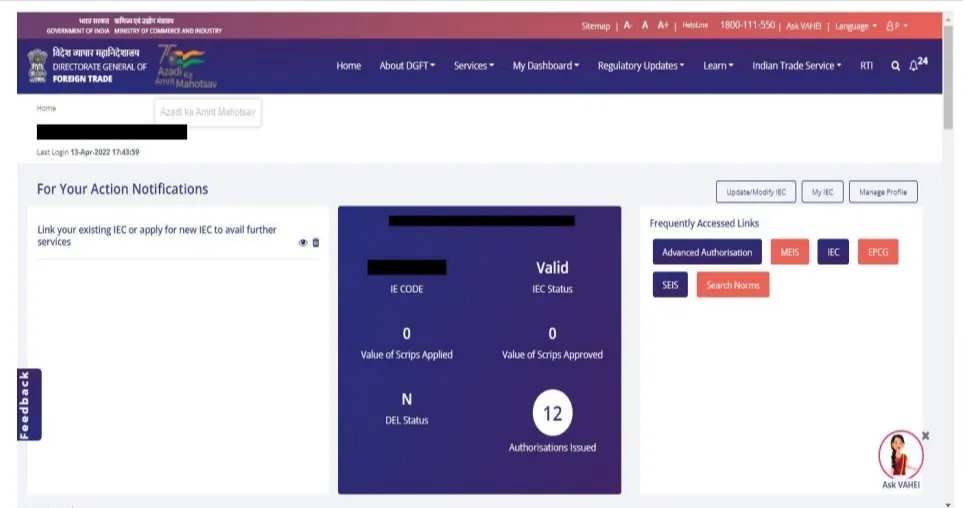

Users should access the DGFT website using their credentials according to the information shown on the below screen. You need to register as a user before proceeding because you are not yet registered with the system.

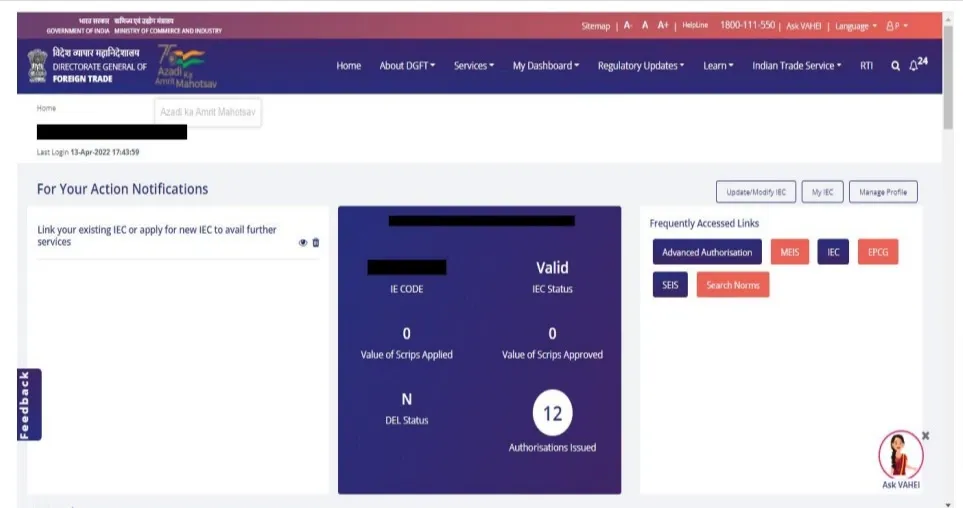

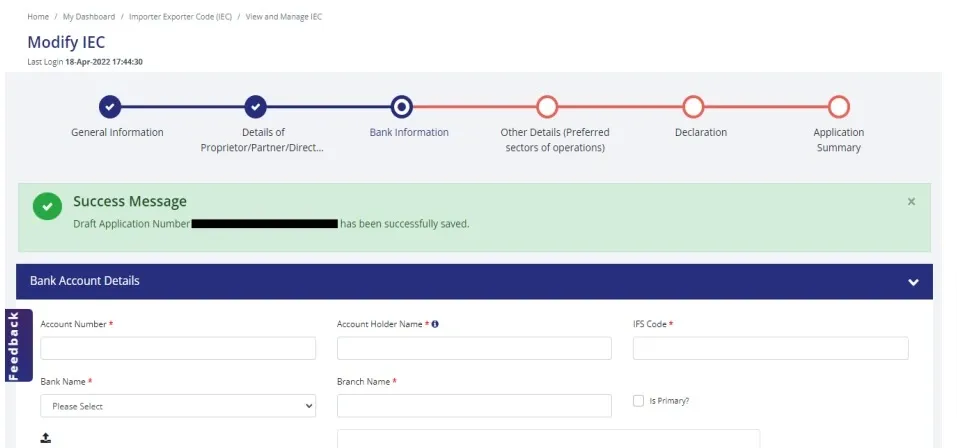

2. Navigate to IEC Modification

Press "Update/Modify IEC" from the dashboard after logging into the system. From this point following the link will lead you to the page where you can modify your IEC.

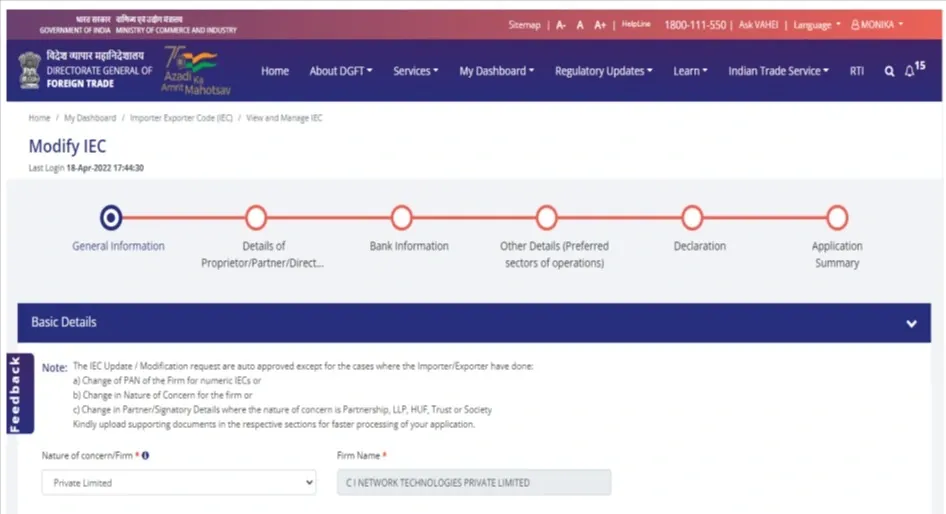

3. Start Fresh Application

The button to start a fresh IEC modification application will appear for initial users. To keep working on your saved draft modification request you should choose the "Proceed with Existing Application" option.

4. Modify Details

All modifications need to be applied to the "General Information Section." Firm details requirement includes business name and contact information and proper address information. Changes in ownership or management need to be reflected in both "Details of Proprietor/Partner/Director/Karta/Managing Trustee" sections which appear on the below screens.

5. Attach Supporting IEC Modification Documentation

Proceed to upload every required file including proof of address bank account paperwork and digital signature certificate. The PDF of IEC modification documentation needs to have clear imaging to validate properly.

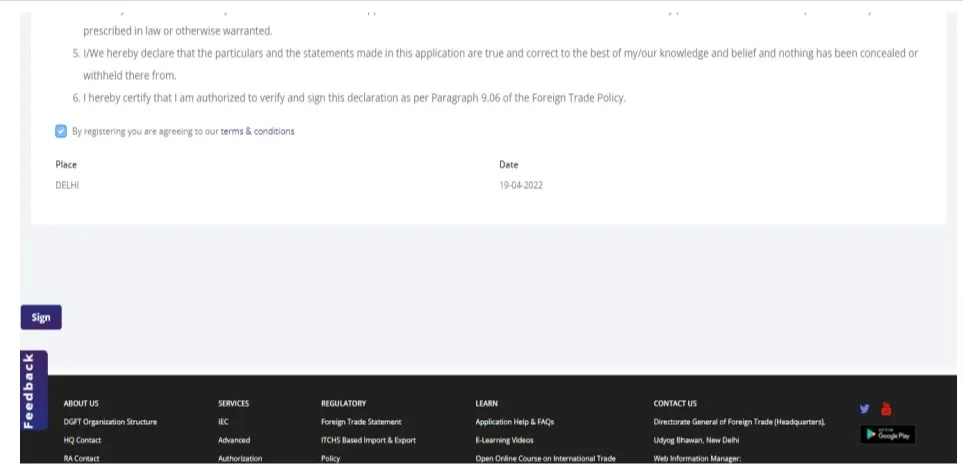

6. Submit the Application

Check all provided details before you read and accept the declaration statement. Click "Sign" before submitting your application through the provided interface.

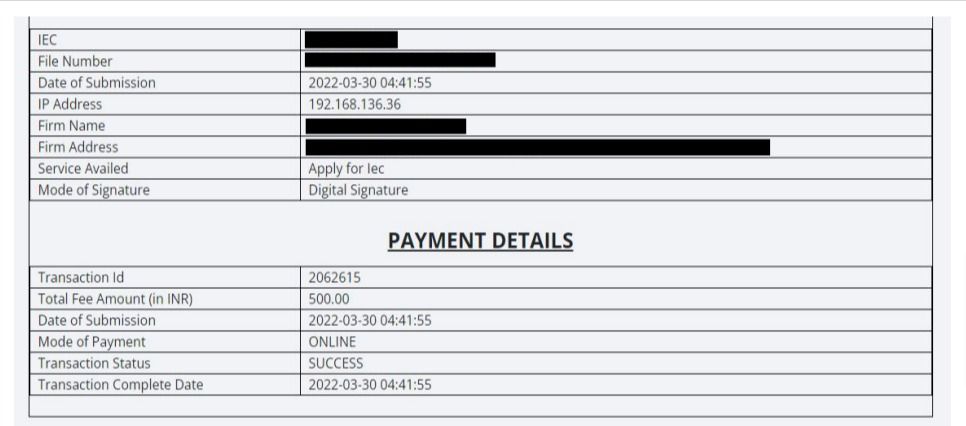

7. Pay the Modification Fee

The needed fee for IEC modification is ₹200. You will obtain payment confirmation through the Bharatkosh payment gateway before receiving the payment receipt.

8. Download the Updated IEC

The DGFT portal processes your modification request after payment authentication and then sends the updated IEC certificate through email to your account. You will find the option to retrieve your updated IEC through the DGFT portal by visiting the "Manage IEC "section.

What You Can Update in IEC on DGFT

Through the DGFT portal users can modify the following information in their IEC.

The address of your corporation should always display its precise location.

- Updating your bank account details allows you to achieve seamless financial transactions through the system.

- Recipients of proprietorship-directional-role authority must provide altered updates once their management or ownership undergoes structural adjustments.

- You should change export sector preferences whenever your business enters new export markets or switches its main export business areas.

Pro Tip: Use our GST Refund Calculator to easily calculate your refund and simplify the GST process. Whether you want to know your refund amount or check its status, our tool makes it simple to know your GST refund quickly and accurately.

Recommended: Guide to Online IEC Registration in India

Conclusion

An IEC modification procedure stands as an essential measure to keep correct records through the Directorate General of Foreign Trade. Organisations must maintain an updated IEC to ensure smooth operations in their international trade because it helps prevent any trading complications. Businesses can perform straightforward IEC modifications on the DGFT portal by implementing the provided procedural steps to update their information according to recent changes.

Frequently Asked Questions

1. Is the IEC updation mandatory?

Yes, it is mandatory to update your IEC whenever there are changes to your business information such as address, ownership, or bank details. This ensures compliance with DGFT’s regulations.

2. Can I modify my IEC more than once?

Yes, you can modify your IEC multiple times, provided that the changes are valid and that your IEC is not in a suspended or canceled state.

3. What documents are needed for modifying the IEC?

You will need address proof, bank account proof, and digital signature for submitting the modification request as an IEC modification documentation.

4. How do I check my IEC modification status?

To check the status of your IEC modification, log in to the DGFT portal and navigate to the "View and Track Submitted Request" section (Screen 134, Page 85).

5. How do I amend my IEC certificate?

To amend your IEC certificate, follow the steps outlined above. Once submitted, the changes will be reflected in the updated IEC certificate.

Related Posts