Complete Guide to Online IEC Registration in India

The Import Export Code (IEC) registration is the basic step to start any kind of international trade. This article provides clear and full information on eligibility, documents required, and step-by-step information on how to apply for IEC code registration online.

What is IEC Registration?

The Directorate General of Foreign Trade (DGFT), an agency of the Government of India, issues a unique 10-digit number called the Importer Exporter Code (IEC). Businesses or individuals, who want to import or export goods and/or services to or from India, have a mandatory requirement to obtain IEC code registration.

It is a legal permit to carry on international trade and one must have this permit to clear customs, export and import, get into foreign markets, or participate in other trade related activities. The code is part of legislation, or the law of the government, that you need before you can legally import or export anything. Hence, having an IEC code is a key requirement for any business wishing to extend its reach to a global scope and undertake global associated trade.

Eligibility Criteria for IEC Registration

To be eligible for IEC code registration, the applicant must fulfill the following requirements:

1. You must have a valid PAN card in the name of an organization or an individual.

2. An active bank account linked to the name of your company.

3. Ensure the firm is properly registered as one of the following:

Partnership

Registered society

Trust

Hindu Undivided Family (HUF)

4. Ensure you have a valid login, for the DGFT portal, maintained.

5. You should keep access either to a Digital Signature Certificate (DSC) and/or an Aadhaar card for signing the application.

Required Documents for IEC Registration

Applicants need to submit the following documents while applying for import export code registration.

1. Proof of Establishment/Registration

Such as a partnership deed, registration certificate or trust documents could be covered here.

2. Proof of Address

Accepted documents include:

Sale deed

Rent/lease agreement

Electricity bill

Telephone or mobile bill (post-paid)

Memorandum of Understanding (MoU)

In the case of proprietorships, you can submit an Aadhaar card, passport, or voter ID.

Consequently, if the firm does not own the address, it needs a No Objection Certificate (NOC) from the property owner with address proof.

3. Proof of Bank Account

Cancelled cheque or a bank certificate in the firm name is required.

All these documents need to be uploaded in PDF format, with a maximum file size of 5MB scanned copies.

Step-by-Step Guide for IEC Registration

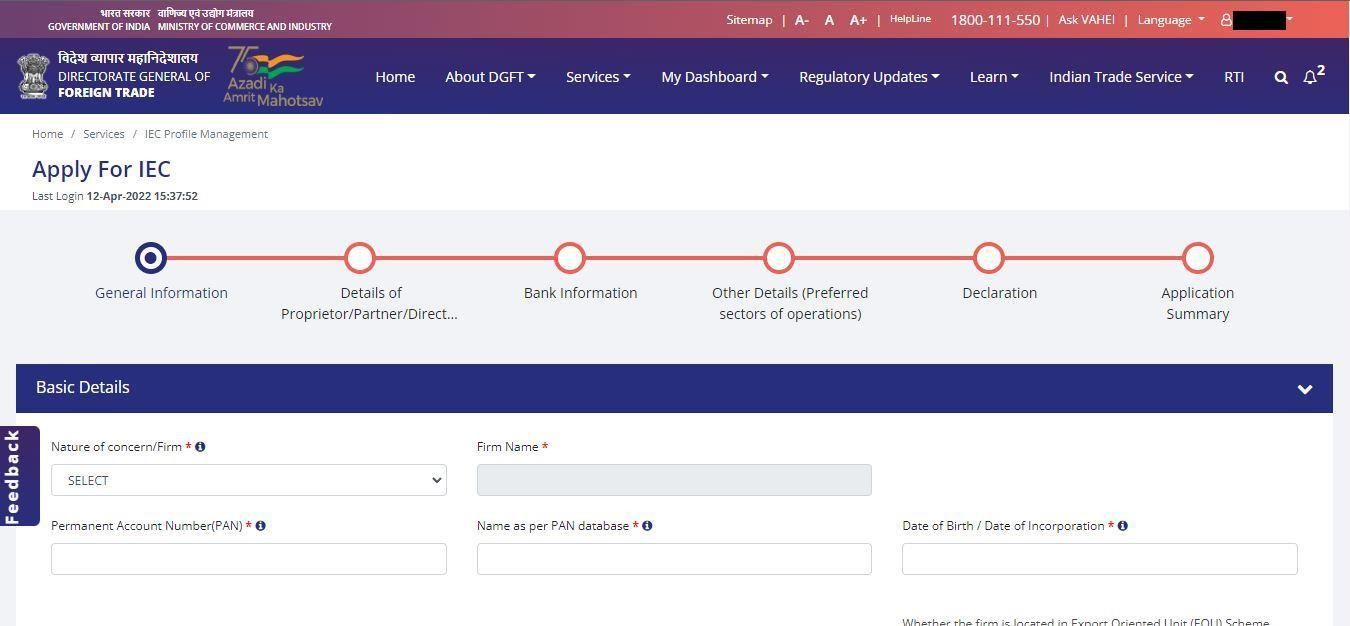

Below, we have mentioned the step-by-step process of applying for new IEC code registration online.

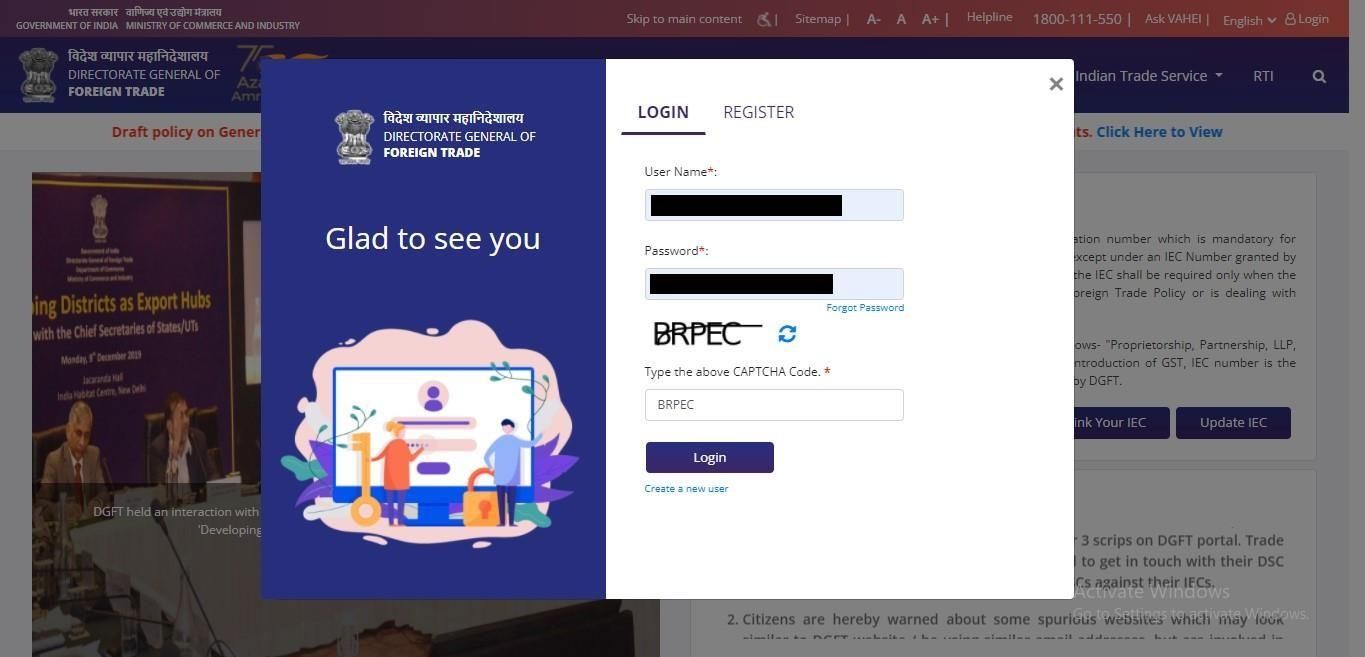

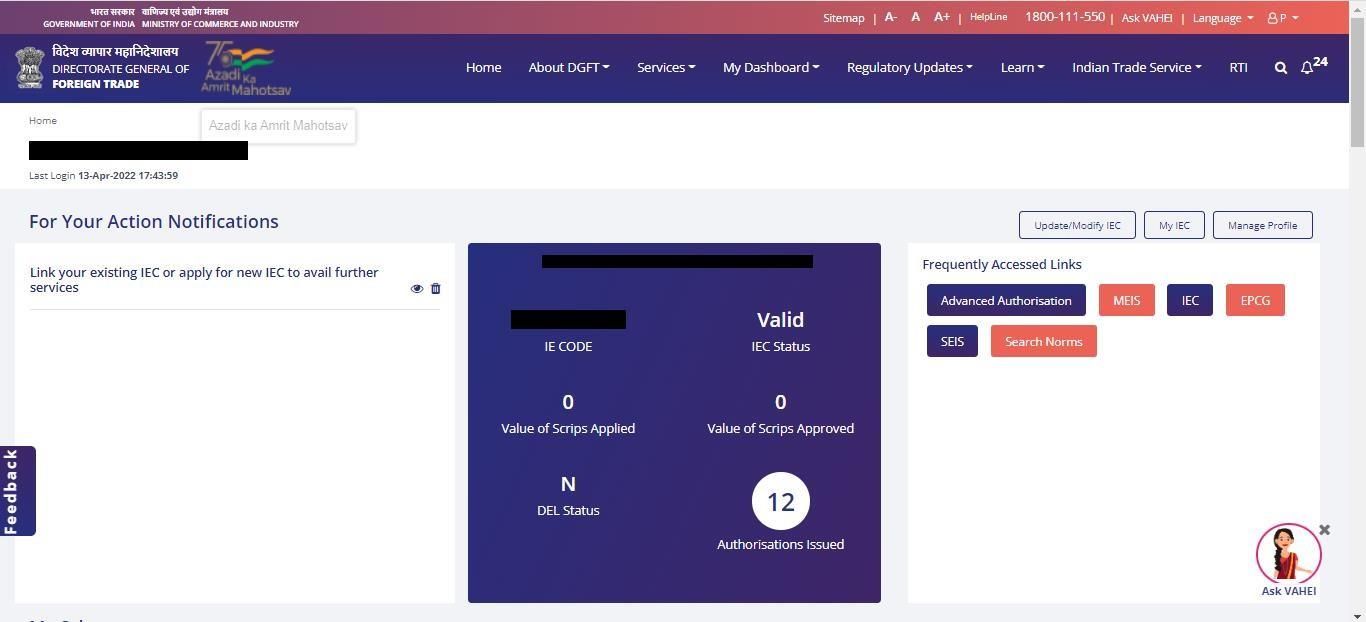

Step 1: Access the DGFT Portal

1. Visit the DGFT Website and log in with your valid credentials.

2. If you don’t have an account, register first and then log in.

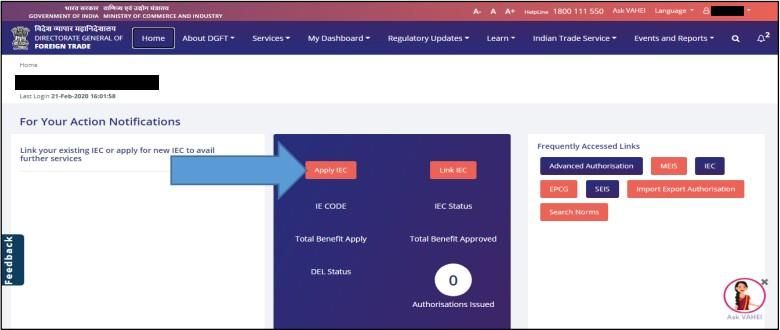

Step 2: Start the Application

1. On the dashboard, click on “Apply for IEC.”

2. You will see two options:

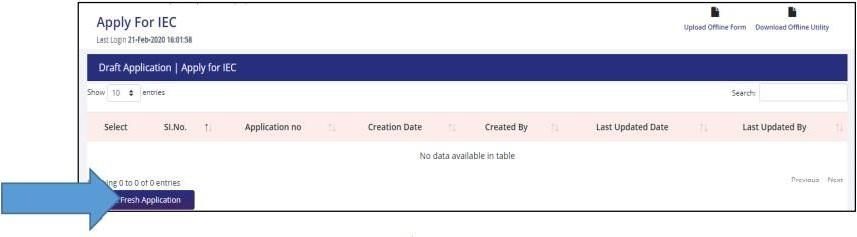

Start Fresh Application – For starting a new application.

Proceed with Existing Application – If you have already saved a draft.

3. Select the appropriate option to proceed.

Step 3: General Information Section

1. Fill in all mandatory fields marked with a red asterisk (*). The system will save the draft only if the mandatory fields in the “Basic Details” and “Firm Address Details” sections are completed.

2. Enter the following details:

Nature of Concern/Firm (e.g., Proprietorship, Partnership, Company).

Firm Name (as per PAN database).

PAN Number, Name (As per PAN database), and Date of Birth/ Incorporation. These details will be verified in real-time from the CBDT database.

Note: Ensure the name matches the full name used while registering for PAN, including First, Middle, and Last Name.

Preferred Activities (select from the options provided).

Location Details:

Indicate if the firm is located in a Special Economic Zone (SEZ) or under any specific scheme (e.g., EOU, EHTP, STP, or BTP).

Corporate Identification Number (CIN) (if applicable):

The system will fetch the firm and director details from the Ministry of Corporate Affairs (MCA).

GSTIN Number (if applicable).

Firm Contact Details:

Mobile number (OTP verification required).

Email ID (OTP verification required).

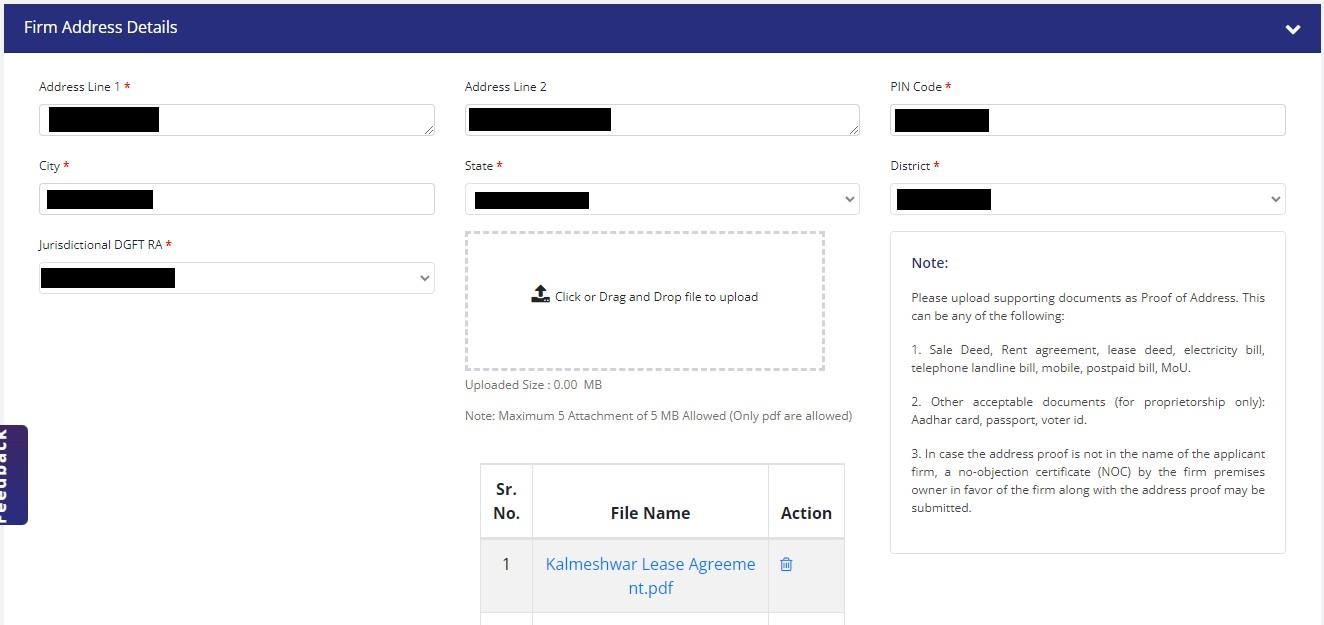

Firm Address, City, and PIN Code:

The system will auto-select the state, district, and jurisdictional DGFT RA based on the entered PIN code.

Address Proof: One of the following documents must be attached:

1. Sale deed, rent agreement, lease deed, electricity bill, telephone bill (both landline and mobile), MoU, partnership deed, etc.

2. For instance, an Aadhaar, passport, or voter ID are proprietorship-specific documents.

3. Only submit the proof in a single PDF if the proof is not the name of the firm, and then, submit a No Objection Certificate (NOC) from the owner and proof.

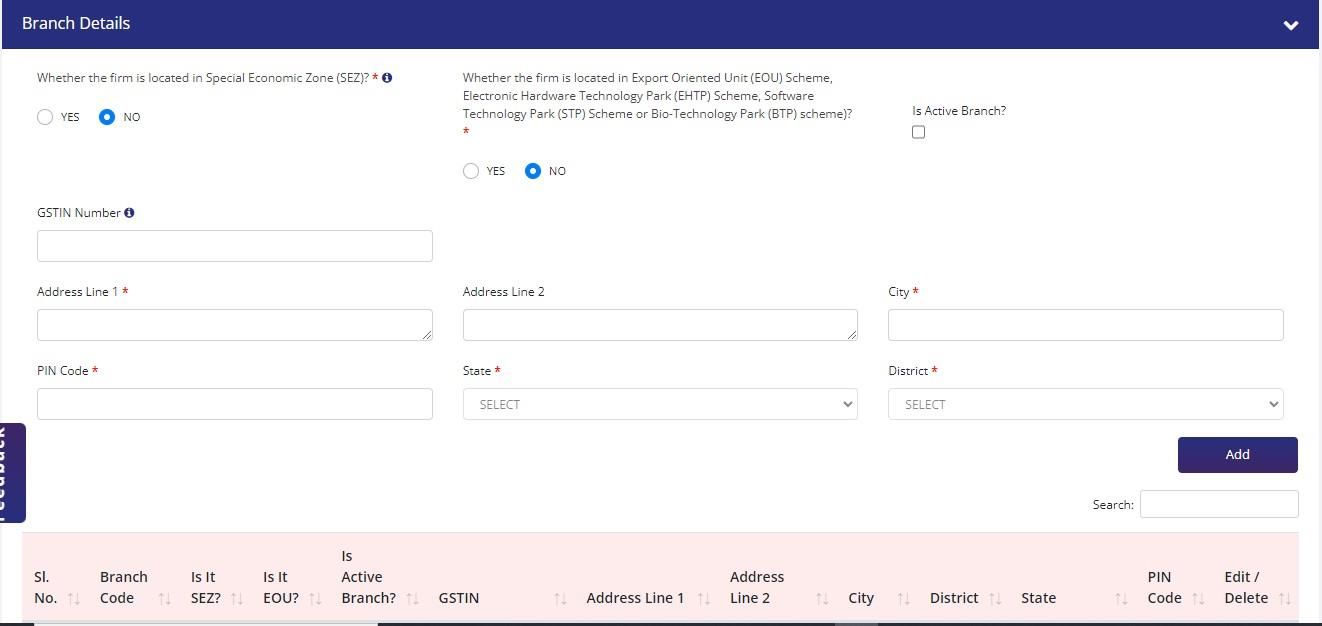

3. Branch Details (if applicable):

Enter GSTIN, address, city, and PIN code of the branch(es).

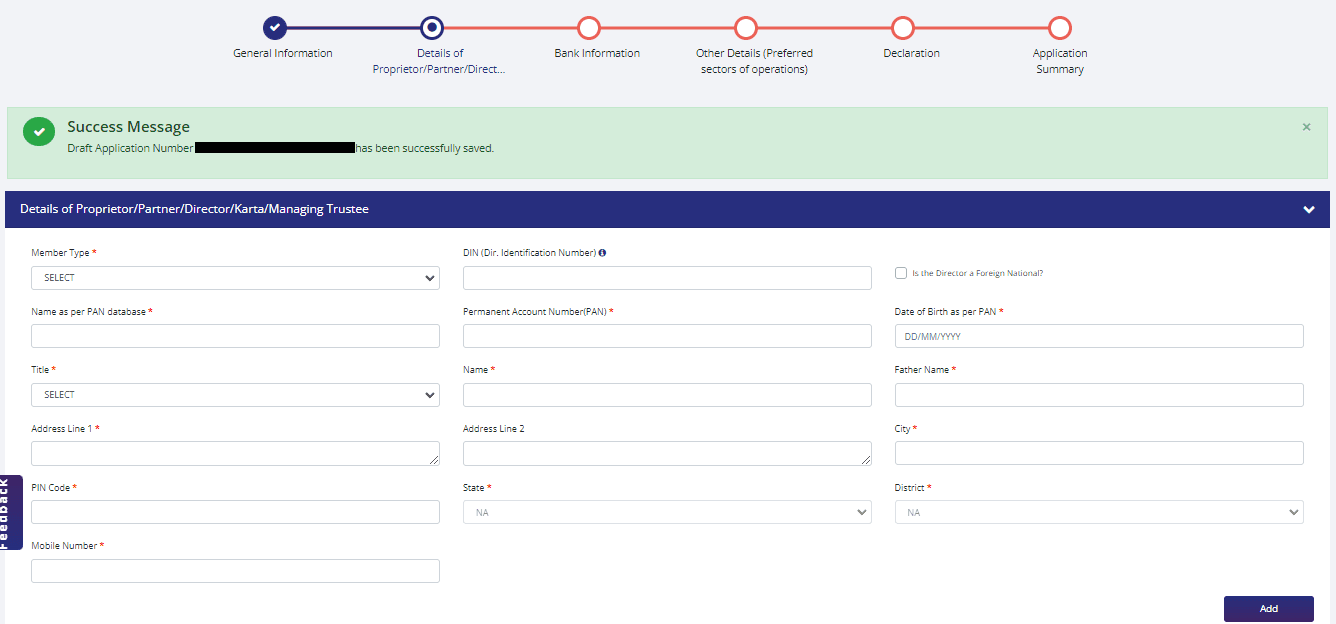

Step 4: Proprietor/Director Details

1. If the firm has a Corporate Identification Number (CIN), the Director Identification Number (DIN) will be auto-fetched from the MCA database.

Note: Fetched details cannot be deleted.

2. Enter or verify the following details:

1. Verified Name (PAN database), Date of Birth/Incorporation (real-time verified), PAN Number.

2. Personal details of the Proprietor/Partner/Director/Karta/Managing Trustee:

(Father’s Name, Name, Address, City, PIN, State, District, Mobile Number.)

3. If the director is a foreign national, mark the box “Is the Director a Foreign National?”

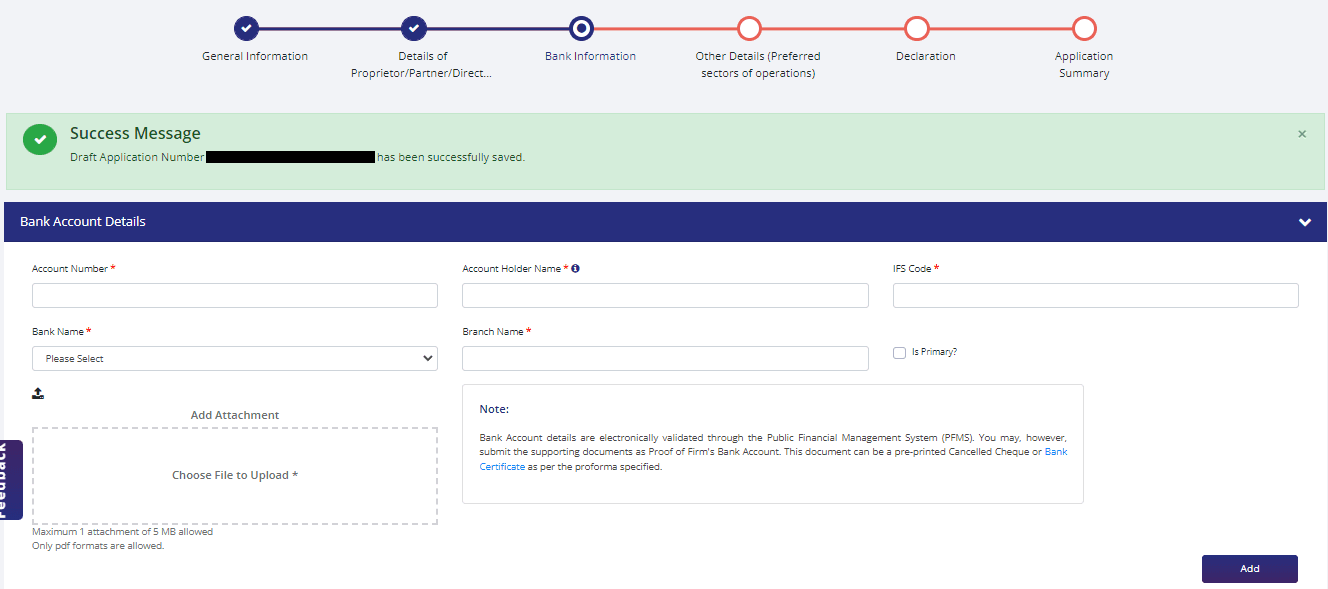

Step 5: Bank Account Details

1. Provide the following details:

Account Number

Account Holder Name (should match the firm name).

IFSC Code

Bank Name and Branch Name

2. Attach proof, such as a Cancelled Cheque or a Bank Certificate.

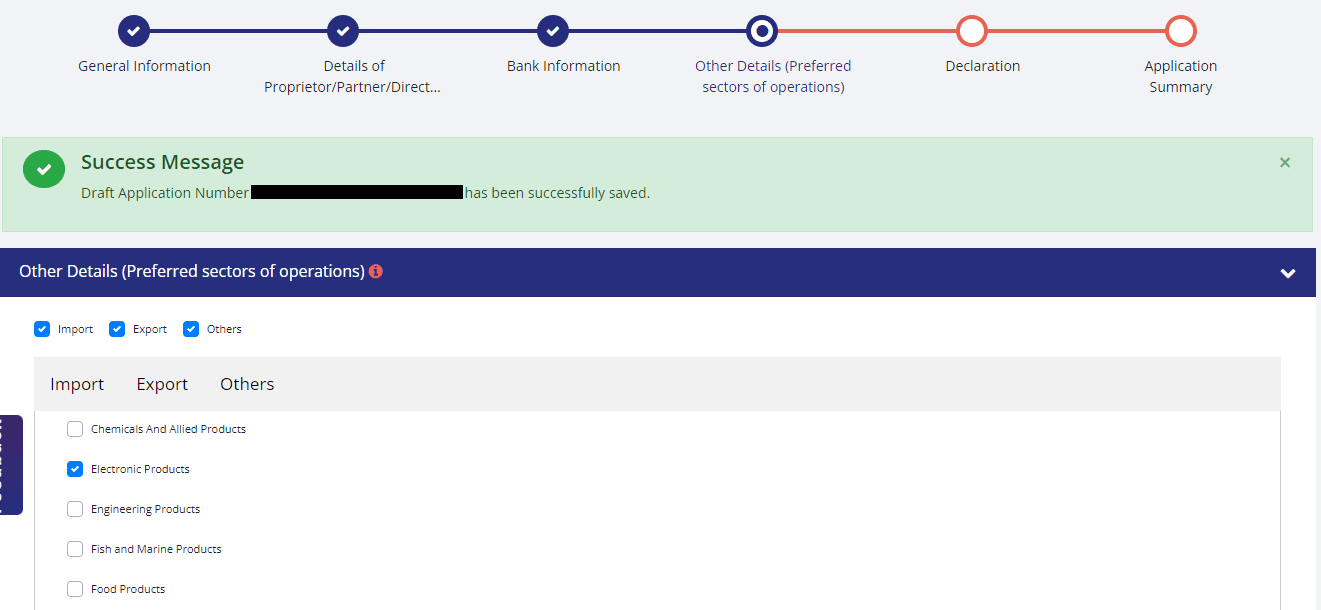

Step 6: Other Details

1. Specify the reason for applying for IEC:

Answer the question, “Why are you applying for IEC or where will this IEC be utilized?”

2. Select your preferred export sectors.

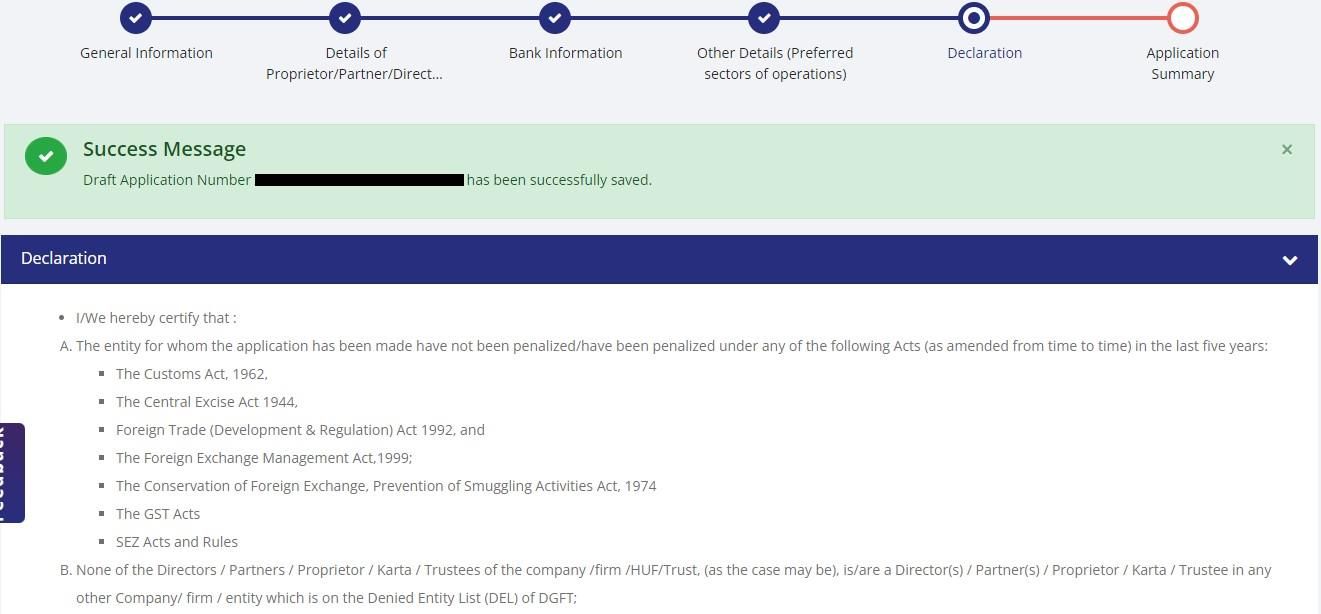

Step 7: Declaration

1. Read the terms and conditions carefully.

2. Accept them by checking the box.

3. Enter the place to confirm the declaration.

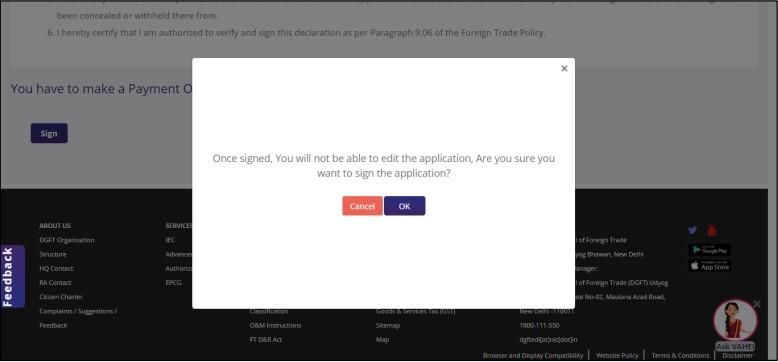

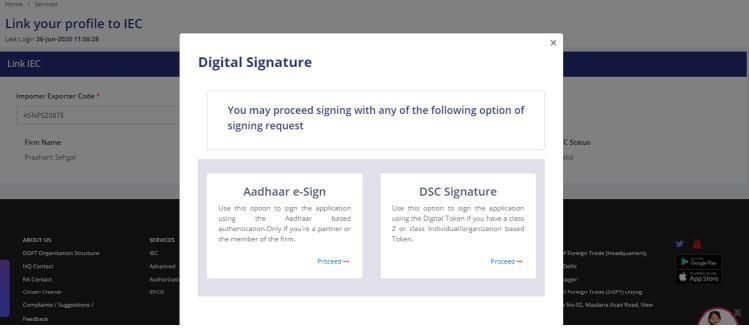

Step 8: Review and Sign

1. Verify all the details in the Application Summary.

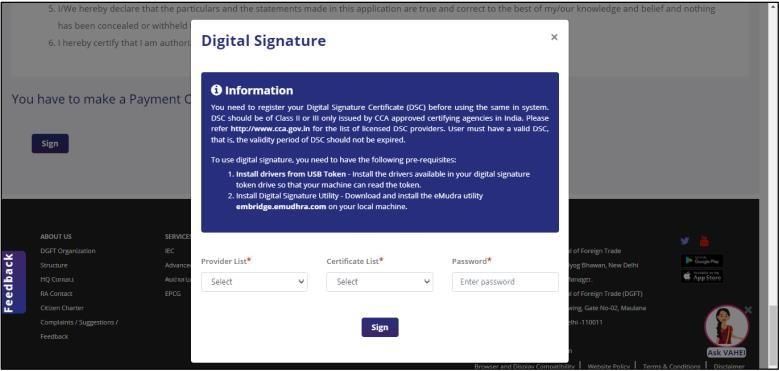

2. Click Sign to sign the application using:

A Digital Token (Digital Signature Certificate).

Aadhaar-based authentication.

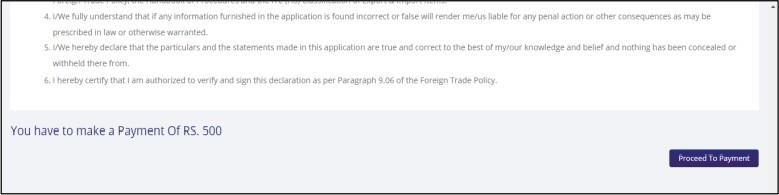

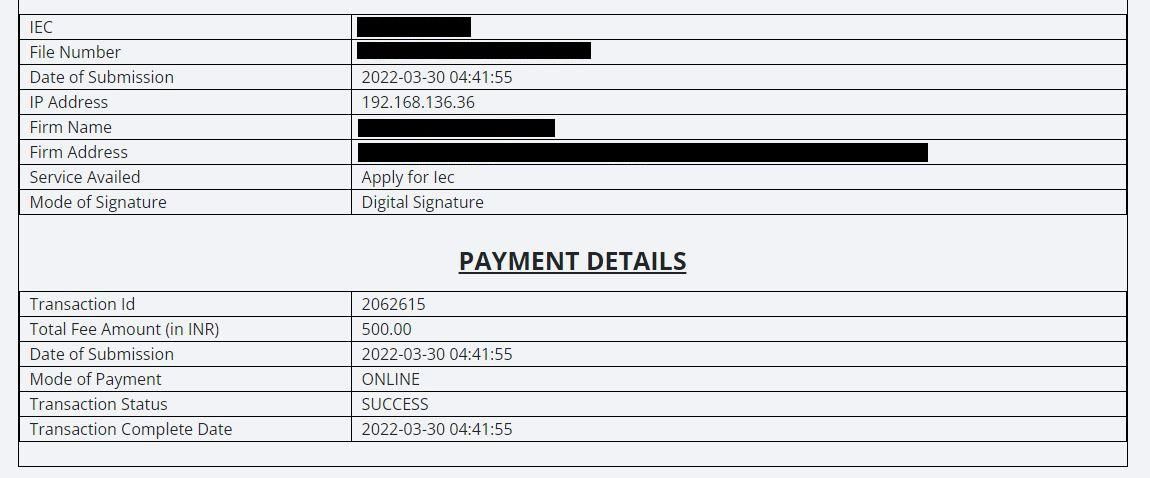

Step 9: Payment

1. Proceed to payment via the Bharatkosh Payment Gateway.

The IEC fee is ₹500.

2. After successful payment, you will receive a receipt.

3. In case of payment failure, wait for an hour for the payment status to reflect.

Step 10: IEC Certificate

1. After approval:

The IEC Certificate will be sent to your registered email.

You can also download it via the “Print Certificate” option on the DGFT portal under the “Manage IEC” section.

2. The IEC will be transmitted to CBIC.

Check the transmission status by navigating to “My IEC” and viewing the CBIC Transmission Status.

This step-by-step guide ensures you don’t miss any critical details and simplifies the IEC registration process.

Conclusion

Ultimately, getting an Importer Exporter Code (IEC) is an essential process, and must be done by anybody who wishes to trade internationally. It’s a simple process that needs just a few documents. However, an IEC is required because it enables you to legally export and import goods and services. It also eases customs clearance and helps you access global markets.

To get your IEC and be able to start trading internationally follow the eligibility requirements and application steps. With the increasing world market, an IEC can give your business the impetus to grow and succeed internationally.

FAQs

How to register an IEC code?

If you want to register for an IEC, log on to the DGFT website, create an account, fill up the application upload the required documents, pay ₹500, and submit. Once the verification is done successfully, you will receive your IEC code in your email.

What documents do I need for IEC?

Your PAN card, Aadhaar card, a recent photograph (for sole proprietors) and a cancelled cheque or bank certificate, address proof such as a utility bill or rental agreement, are some of the documents you’ll need, to keep your details up to date and accurate.

What is the cost of IEC registration?

To register for IEC, the cost is ₹500. The amount of this fee is fixed and can be paid through online payment methods of Net Banking, Credit/Debit Cards, or UPI on the DGFT portal at the time of submitting the application.

How many days to get the IEC code?

The IEC code is usually given within 2 to 7 business days after submitting the application. Depending on documents completeness and information correctness, this time might take a few days or a week. After approval, you will get an email.

Related Posts