HSN Codes: A Comprehensive Guide

Published on: Mon Jan 30 2023

What is HSN Codes?

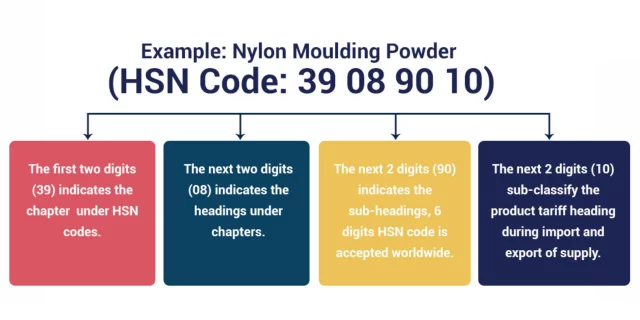

“Harmonized System of Nomenclature” is abbreviated as HSN. The World Customs Organization (WCO) developed the HS Code, also known as the HSN Code in INDIA, as a standardized system for categorizing goods all over the world in a systematic manner. HSN Codes in India have 4, 6, and 8 digits.

How Does HSN Codes Work?

HSN codes are based on 5000 commodity groups, each of which is identified by a six-digit code and is organized in a legal and logical structure.

Why is HSN important?

The systematic classification of commodities is the main function of the HSN code, but it can also be used to collect information and resolve issues that would be challenging to find otherwise. A more effective global trading system is the end result.

HSN Worldwide

HSN is used in over 200 countries around the world. This impressive adoption rate can be attributed to HSN’s benefits, which include: the collection of international trade statistics; the provision of a rational basis for Customs tariffs; and uniform classification.

HSN is used to classify nearly 98% of international trade stock, proving its reputation as the best form of international classification.

Every commodity in every country has an HSN number, and the number is the same for almost all goods. HSN numbers in some countries may differ slightly because they are entirely determined by the nature of the items classified.

HSN in India

Since 1971, India has been a member of the World Customs Organization (WCO). It is used to classify commodities for Customs and Central Excise using 6-digit HSN codes. Customs and Central Excise later added two more digits to the codes to make them more precise, resulting in an 8-digit classification.

Understanding the HSN Code

The HSN code contains:

- 21 section

- 99 chapters

- 1244 headings

- 5224 subheadings

Each section is divided into chapters. Each Chapter is divided into Headings. Each heading is divided into Subheadings.

Section and chapter titles describe broad categories of goods, while heading and subheadings describe products in detail.

Structure of the HSN Code in India

Service Accounting CODE (SAC) in GST

Each service is classified under the GST regime with the aid of service accounting codes. Each service has a distinct SAC that may be used by the providers to invoice customers for the services they supply. They would be able to accurately charge the GST in the invoices if they are aware of the SAC list and the applicable GST rates.

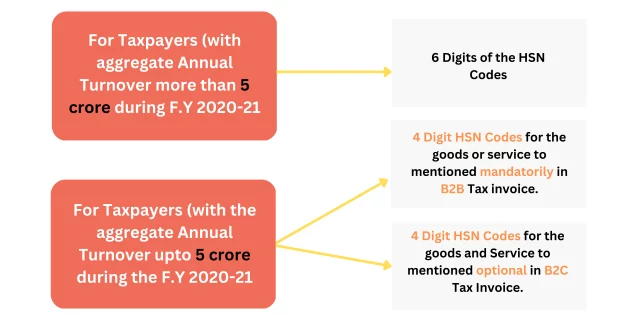

Under the GOODS and SERVICE TAX (GST) regime, the Central Board of Excise and Customs (CBEC) issues codes to categories that are distinct services. These codes are referred to as SACs, or service accounting codes. Each service covered by the GST regime has a different SAC. Service Accounting Code and SAC are the names given to these codes. Every service covered by the GST scheme has a distinct SAC. HSN In GST & Declaration of HSN Code for Good and Service

Why is HSN important under GST

HSN codes are intended to make GST more systematic and globally accepted.

HSN codes will eliminate the need to upload a detailed product description. Because GST returns are automated, it saves time and makes form-filling easier.

How can I find my product in the HSN list and its relevant HSN Code?

What is UQC?

UQC stands for Unit Quantity code. The intent of using UQC in GST returns is to maintain a standardized terminology for units of measure. Every taxpayer could be using a different name for the same unit of measure and this makes it difficult for the department to track or arrive at analyses.

List of UQC in GST

| UQC | Description | UQC | Description |

| BAG | BAGS | GGR | GREAT GROSS |

| BAL | BALE | GMS | GRAMS |

| BDL | BUNDLES | GRS | GROSS |

| BKL | BUCKLES | GYD | GROSS YARDS |

| BOU | BILLIONS OF UNITS | KGS | KILOGRAMS |

| BOX | BOX | KLR | KILOLITRE |

| BTL | BOTTLE | KME | KILOMETERE |

| BUN | BUNCHES | MLT | MILLILITRE |

| CAN | CANS | MTR | METERS |

| CBM | CUBIC METER | MTS | METRIC TON |

| CCM | CUBIC CENTIMETER | NOS | NUMBERS |

| CMS | CENTIMETER | PAC | PACKS |

| CTN | CARTONS | PCS | PIECES |

| DOZ | DOZEN | PRS | PAIRS |

| DRM | DRUM | QTL | QUINTAL |

| ROL | ROLLS | SET | SETS |

| SQF | SQUARE FEET | SQM | SQUARE METERS |

| SQY | SQUARE YARDS | TBS | TABLETS |

| TGM | TEN GRAMS | THD | THOUSAND |

| TON | TONNES | TUB | TUBES |

| UGS | US GALLONS | UNT | UNITS |

| OTH | OTHERS |

FAQs

- What is the difference between an HSN code and a SAC code?

The main distinction between HSN and SAC codes is that HSN codes are only for goods and services, whereas SAC codes are only for services. Another distinction is the number of digits in their codes and their significance. HSN Code is an 8-digit code, while SAC Code is a 6-digit code.

| Sr. no. | Aggregate turnover in the Preceding Financial Year | Applicability of HSN | Applicability of SAC |

| 1 | Up to Rs. 1.5 Crore | Not mandatory | Not mandatory |

| 2 | Rs. 1.5 Crore to Rs. 5 Crore | 2 Digit HSN Code | Mandatory |

| 3 | Above Rs. 5 Crore | 4 Digit HSN Code | Mandatory |

| 4 | Import & Export Dealer | Mandatory 8 Digit HSN Code | Mandatory |

- What is the full Form of HSN?

Harmonized System of Nomenclature

- Who is eligible for HSN Code in GST?

The taxpayer whose turnover exceeds Rs. 5 Crore is required to report the HSN code in the GSTR-1.

- What is ‘Aggregate turnover’ under GST?

As Per the Notification No. 78/2020. The aggregate turnover is up to Rs. 5 Crore.

- Where are HSN codes required to be mentioned?

In GSTR-1 it is mandatory to mention HSN Code.

- What is SAC Code?

Servicing Accounting Code

- What is HS and HSN code?

In shipping, the HSN code is the same as the Harmonized System Code (HSN). In India, it is commonly referred to as the HSN. The HS code is the same as the HSN code.

- How to add an HSN code in the GST portal?

When submitting the GSTR-1, the taxpayer must enter the HSN Summary into the portal.

- First, depending on whether it is a good or service, the HSN code is feed into the portal.

- Finally, there are the required fields: Taxable Value, UQC, Quantity, GST rate, IGST, CGST, and SGST.

- Is the HSN code mandatory for GST invoices?

Yes, the HSN code is mandatory for GST invoices.

- Is a GST bill valid without an HSN code?

HSN codes must be declared on all invoices (6-digit codes) by taxpayers who had an AATO of more than Rs. 5 crores in the previous fiscal year.

- Are HSN codes the same across all countries?

No, HSN Codes are Varies country to country.

- Should HSN codes be mentioned by taxpayers registered under the composition scheme or taxpayers supplying exempted goods?

No, the HSN code does not differ from scheme to scheme.

Are you Looking for GST Refund Service? Mygstrefund.com offers GST refunds on business, exports, and many more if your GST application is rejected. Get in touch with us today.

Related Posts