What is IEC (Import Export Code)? Definition, Benefits, and How to Apply

The Importer-Exporter Code (IEC) is a basic requirement for anyone wishing to engage in international trade from India. It is a government-issued registration that permits businesses to import and export goods. Without this registration, international trade is impossible and is an important step for companies looking to expand their business.

What is the IEC (Import Export Code)?

An IEC (Import Export Code) is a special 10-digit number given by the Directorate General of Foreign Trade (DGFT), under the Ministry of Commerce and Industry, Government of India. For people or companies wishing to export goods from India or import goods into India, this number is very important.

In fact, without an IEC, no one can legally import or export goods, unless there is some specific exemption. An IEC is not required for a person or company exporting services unless it is using benefits under the Foreign Trade Policy.

The IEC Number has been the same as the PAN Number of an entity or person since the GST came into existence in India. Yet these are still issued by the DGFT separately through the IEC import export Code Application made by the applicant. Proprietorships, partnerships, limited companies, trusts, societies, families (HUFs), etc. can apply for IEC to do smooth international trade.

Benefits of IEC (Import Export Code)

The IEC (Import Export Code) has many benefits for businesses engaged in international trade. Here are the key benefits:

1. It enables businesses to exchange goods and services in world markets.

2. This will allow businesses to take advantage of government benefits like subsidies and duty exemptions.

3. The IEC is lifelong, meaning that there is no expiry and it does not have to be renewed.

4. After the IEC is issued, there is no obligation to file periodic reports.

5. It adds credibility if a business deals with international clients and suppliers.

6. The IEC can be easily obtained in about 10-15 days. It broadens the avenues for businesses to expand and thrive in global markets.

How to apply for IEC (Import Export Code)

Applying for an IEC (Import Export Code) license is simple. Here are simple steps to apply for IEC (Import Export Code) in India:

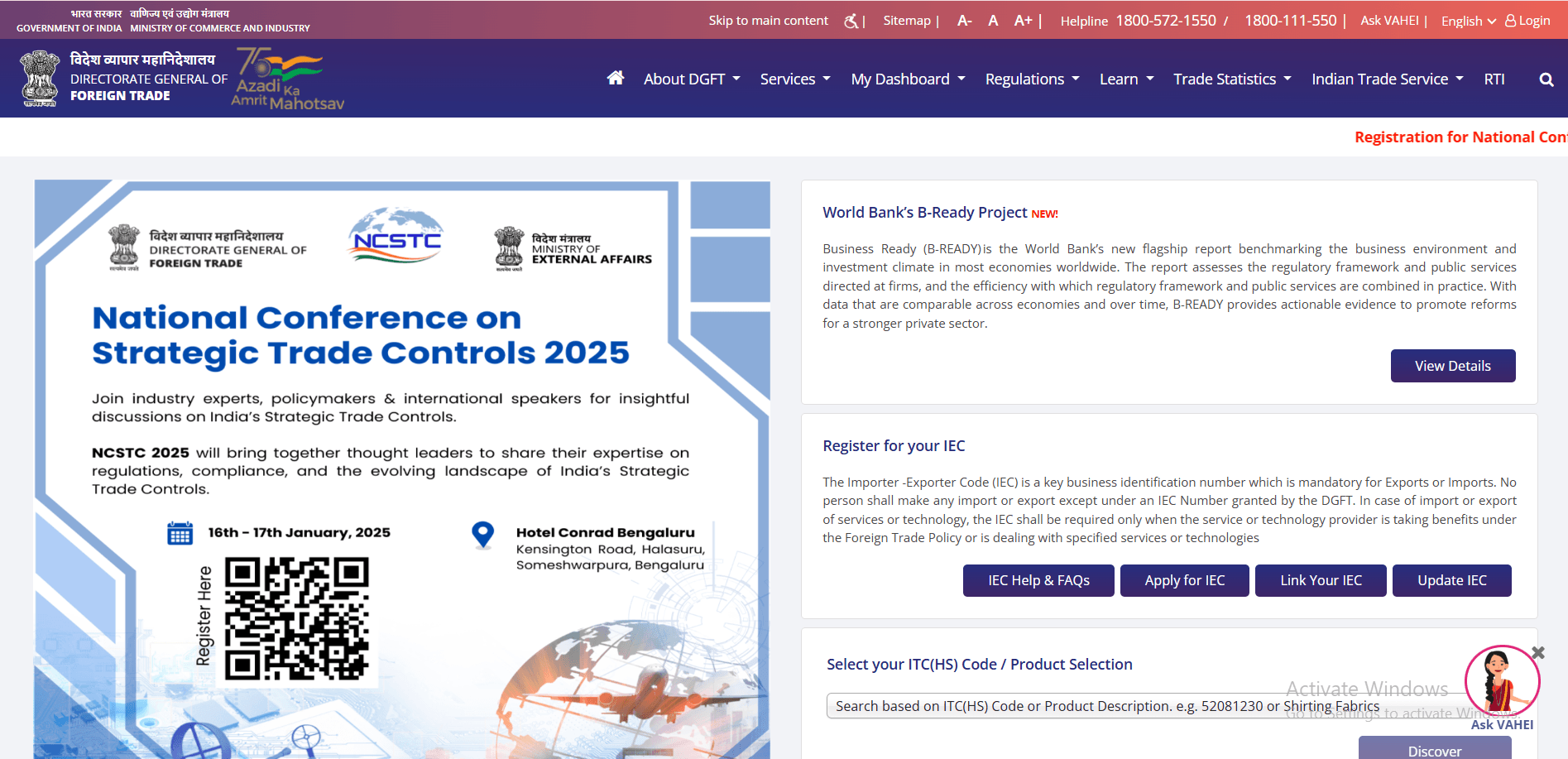

1. Visit the DGFT Website

Visit the official website of the Directorate General of Foreign Trade (DGFT).

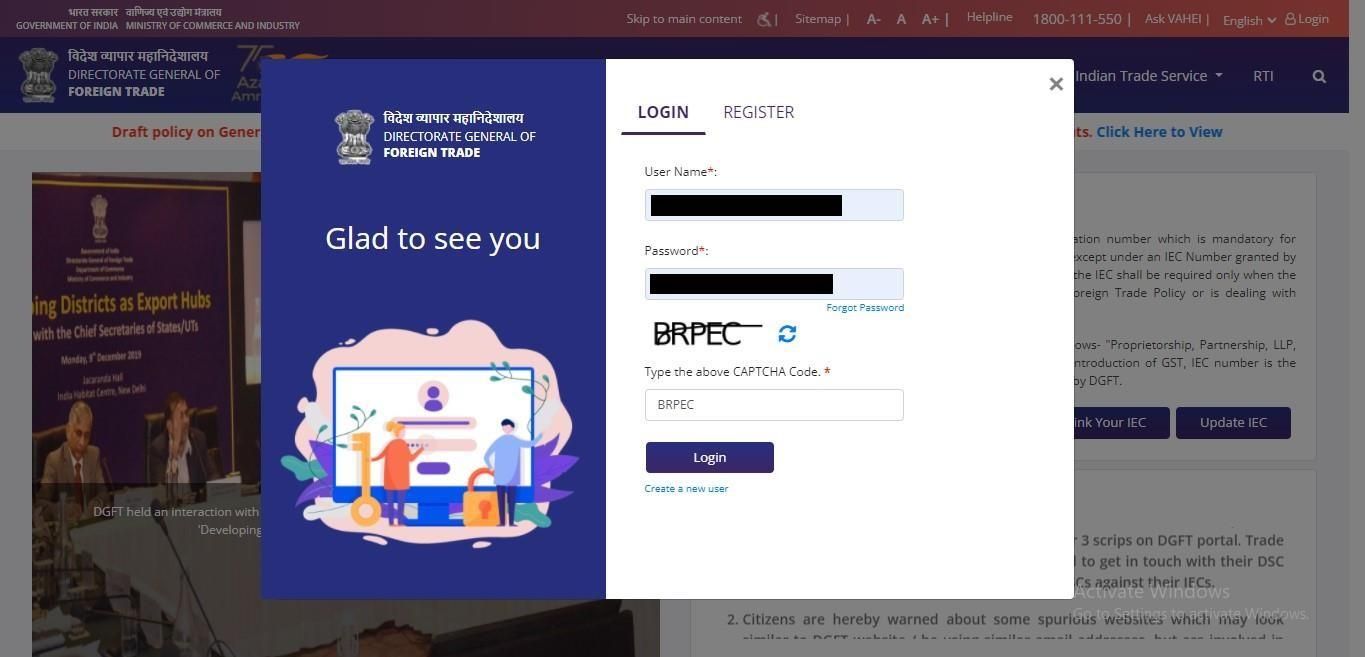

2. Register as a User

You must sign up for an account. Details like PAN number, name, date of birth (or date of incorporation for businesses), email address, and mobile number are required. Then enter the details and you will get OTPs on both email and mobile numbers for IEC verification. After they verify you, you will receive a temporary password, which you should change on your first log-in.

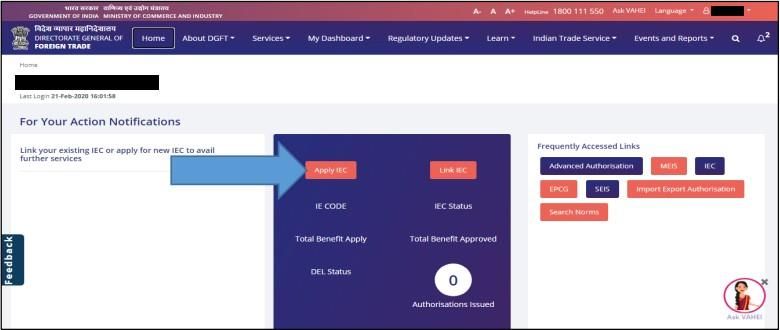

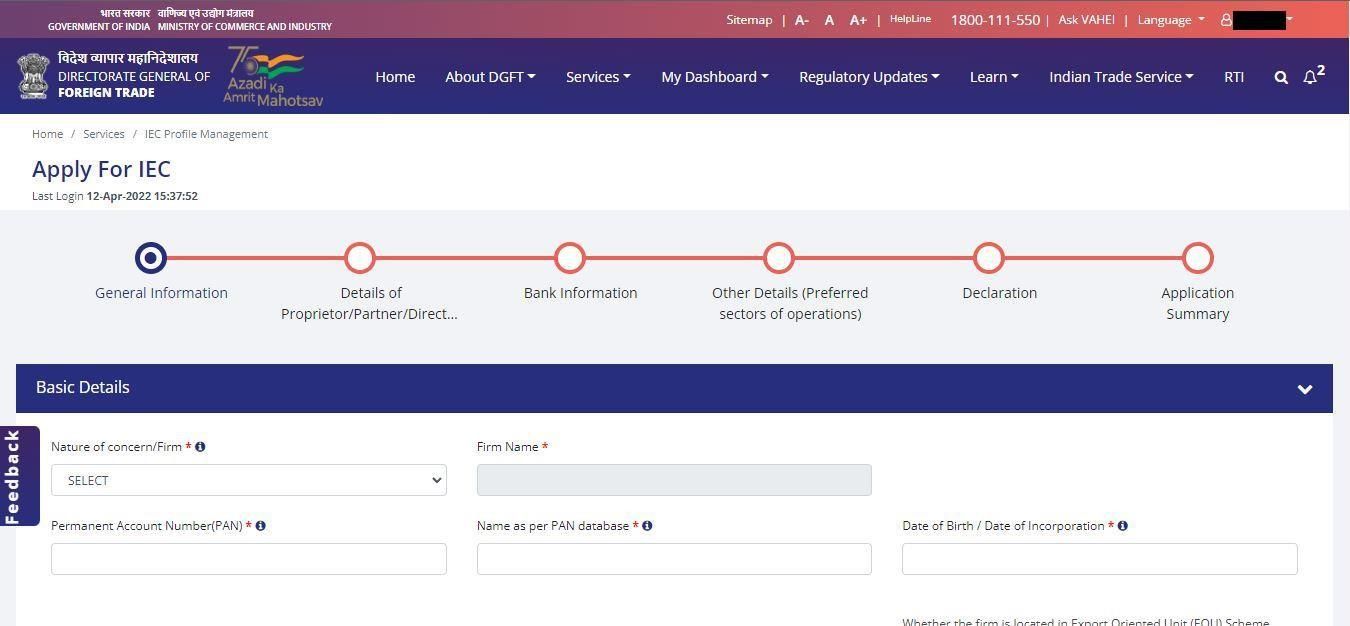

3. Apply for IEC

After logging on to the website, navigate to the 'Services' tab, and click on 'IEC Profile Management.' Click on Apply for IEC and begin a new IEC import export Code Application. Enter the necessary information, for example:

Click on “Start Fresh Application” button or click on “Proceed with Existing

Application”Button in case user already saved a draft application

Type of Business (Proprietorship, Partnership, Company, etc.)

Business address

Bank account details

Director, partner, or owner names and information

4. Upload Required Documents

Please attach clear scanned copies of the following documents:

Business or Individual PAN Card

Identity proof (Aadhaar card, passport, or voter ID) of owner or partners

Business address (rent agreement, utility bill, sale deed, etc.)

Either a bank certificate or a cancelled cheque of business current account

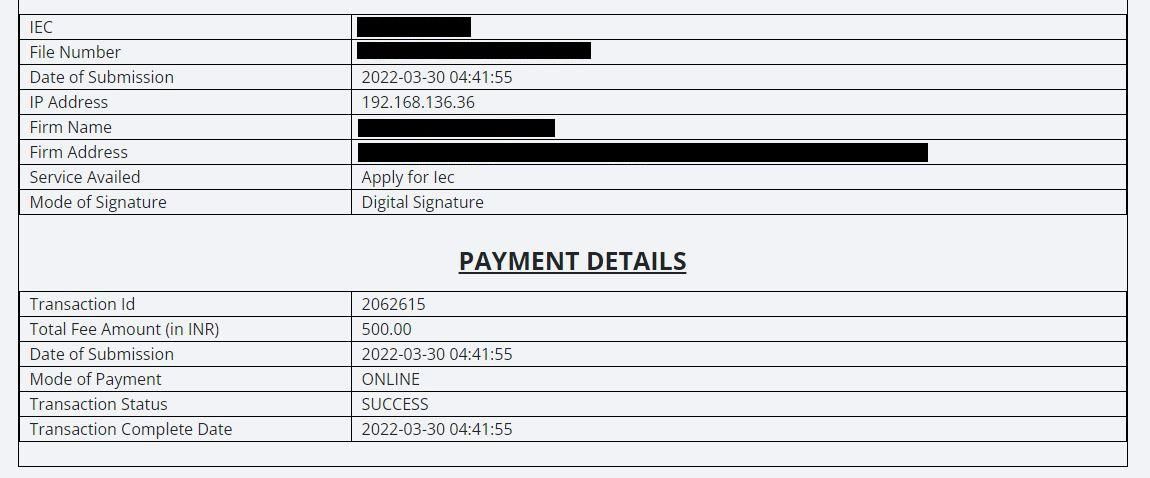

5. Pay the Application Fee

The application fee is ₹500. YOU can pay it online using net banking, a credit card or a debit card.

6. Submit the Application

Double-check all the information and documents that you are providing, before submitting. When you have confirmed that your details are correct, submit the form.

7. Receive Your IEC

Once you submit, your application will be reviewed by the DGFT. If everything checks out, an IEC (Import Export Code) Certificate will be mailed to your registered email ID. The IEC certificate can also be downloaded from the DGFT website by logging into your account and going to the IEC Profile Management section.

The entire process is made user-friendly and the IEC is issued between 10 to 15 days of submission of application. The IEC is a lifetime Import Export code registration and does not require renewal once obtained.

For detailed guidance, you can refer to the DGFT's official FAQs on IEC application:

These steps will help you get your IEC and start doing import-export business as per the law of Indian trade.

IEC (Import Export Code) Registration Documentation

You need to ensure that you have the proper documents available so that you can avoid getting stuck in the application process when applying for Import Export Code registration. Here is a complete list of the documents required:

Read More: Guide to Online IEC Registration in India

Identity Proof

The PAN Card copy of the individual, firm, or company.

Address Proof

Proof of address of proprietor, firm, or company: Any one of the following to be submitted as proof.

Voter ID

Aadhaar Card

Passport

Business Premise Proof

You may need to provide evidence the business is located at a particular address, such as:

Rent Agreement (in case the premise is rented).

Lease Deed or Sale Deed (if the property is owned).

Utility bills (electricity telephone or mobile bills) (recent)

Bank Account Details

Cancelled Cheque of the existing bank account in the name of the person, firm, or company.

Documentation of Establishment or Incorporation

For entities, if applicable, documents confirming the formation or registration of the entity. Examples include:

Partnership Firms / Societies / Companies Registration Certificate

As of this writing, sole proprietorships must declare proprietorship.

Delivery Details

A self-addressed envelope to obtain an IEC (Import Export Code) Certificate by registered post.

IEC (Import Export Code) Renewal

To maintain an active IEC (Import Export Code) license, it is essential to update the details online every year between April and June, even if there are no changes. This annual update allows the records maintained by DGFT to accommodate various changes and keep up to date. You must validate this status online within the specified period even if there are no changes to your IEC details.

Read More: IEC Modification and Updation

Implications of Non-Compliance

Non-compliance with the timeline shall result in the deactivation of your IEC, banning you from the import-export business. Deactivation of an IEC may be removed on successful filing of the update, however, failure to update the IEC will result in increased scrutiny or action as per the provisions of the Foreign Trade Policy.

The renewal or update of your IEC (Import Export Code) is a simple online process:

1. Go to DGFT official website and go to 'IEC Profile Management.

2. Please enter your credentials to view your IEC profile.

3. Change your IEC details if necessary and update them. If nothing needs to change, confirm the information that is there.

4. Submit the updated information and complete the process.

Through this process, the IEC remains active thus you can continue on with your international trade activities uninterrupted.

Validity of IEC (Import Export Code)

An IEC is valid for a lifetime, but an IEC holder has to update his IEC details electronically on a yearly basis (between April-June period) as per DGFT Notification No. 58/2015-2020 dated 12th February 2021. Need confirmation for existing details even if nothing changed

Read More: Surrender IEC (Import Export Code) Online

Conclusion

To summarize, the Import Export Code (IEC) is mandatory for anyone running an international trading company. It benefits the business, provides government benefits, and helps to build trust with customers. Businesses can continue to be compliant with IEC and update it at regular time intervals to achieve more opportunities in the global market.

Frequently Asked Questions

1. What is IEC full form?

IEC full form is Importer Exporter Code, a unique 10-digit identification number issued by the Directorate General of Foreign Trade (DGFT) for businesses involved in import and export activities in India.

2. How to check the IEC (Import Export Code) code?

Visit the DGFT website, log in, navigate to 'IEC Profile Management,' and view or verify your IEC details online.

3. How long is the IEC (Import Export Code) valid?

IEC is valid for a lifetime but must be updated annually between April and June to remain active.

4. How to get an IEC certificate?

Apply online on the DGFT website, fill out the ANF 2A form, upload documents, pay ₹500, and digitally sign the application.

Related Posts