GST Helpline Number and Self-Help Portal: The Ultimate Guide

The Goods and Services Tax has altered the entire tax structure in India. To streamline processes and solve complaints regarding GST filings, the GST Network or GSTN, has created helpline services and an online self-help portal. This article will tell you everything about the important features, contact details, and functionalities of the GST Helpline and Self-Help Portal.

GST Helpline Number

The GST Network (GSTN) has a dedicated helpline number for resolving issues related to the GST portal. Taxpayers can contact the following number for assistance:

GST Helpline Number: 1800-103-4786

This number can be used for reporting and resolving any GST-related issues, including difficulties with filing returns, making payments, or technical glitches in the GST portal.

GST Help via Email

Previously, taxpayers could email helpdesk@gst.gov.in for assistance. However, this email address has been discontinued, and taxpayers are now encouraged to use the Self Help Portal for quicker resolution of their issues.

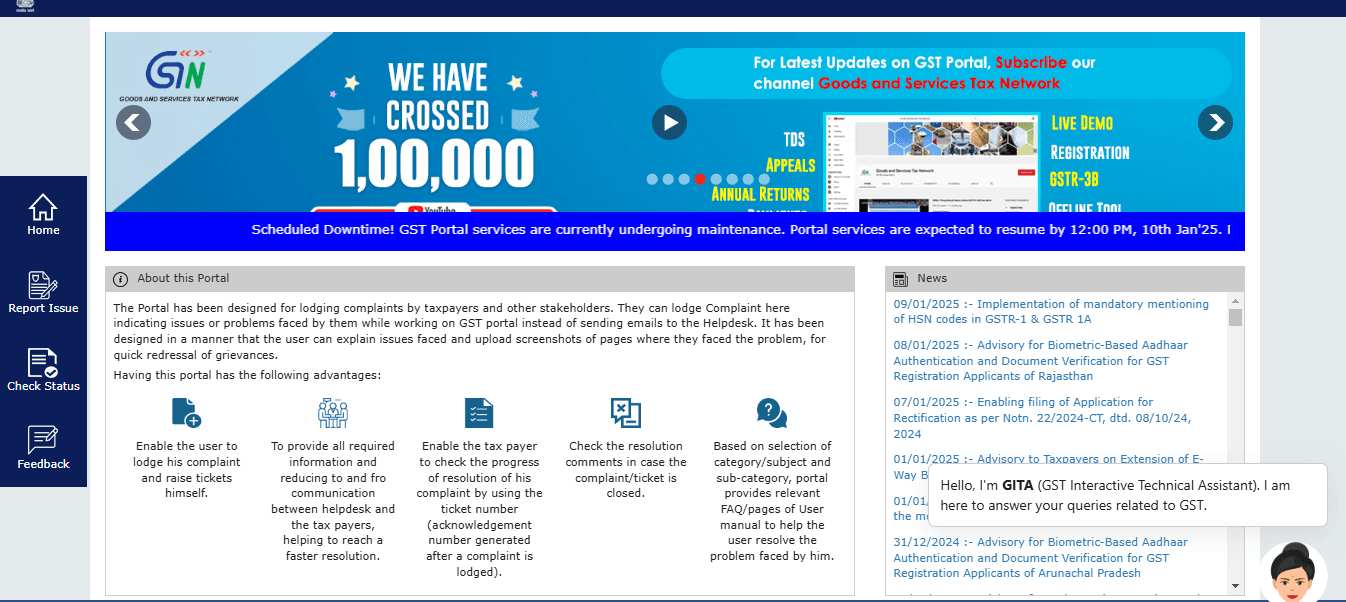

GST Self-Help Portal

The GST self-help portal (also known as the Grievance Redressal Portal), launched on January 22, 2018, is a streamlined way for taxpayers to report issues , track their complaint status, and access useful information related to GST compliance.

Portal URL: GST Self Service Portal

Taxpayers can easily raise complaints by raising tickets, track the status of their complaint, and get real-time solutions through this portal.

Benefits of GST Helpline and Self-Help Portal

- Self-Complaint Filing: Taxpayers can file their complaints and raise tickets independently, which will help in quick resolution.

- Faster Resolution: The portal provides all the information, thus reducing communication delays between taxpayers and the GSTN helpdesk.

- Complaint Tracking: Each complaint is given a unique ticket number (acknowledgement number) so that taxpayers can track the status and resolution progress.

- FAQs and Manuals: The portal provides relevant FAQs and user manuals for instant help based on the category or subject of the issue.

- Resolution Feedback: After the issue is resolved, taxpayers may provide feedback on the resolution process.

Key Functionalities of GST Self-Help Portal

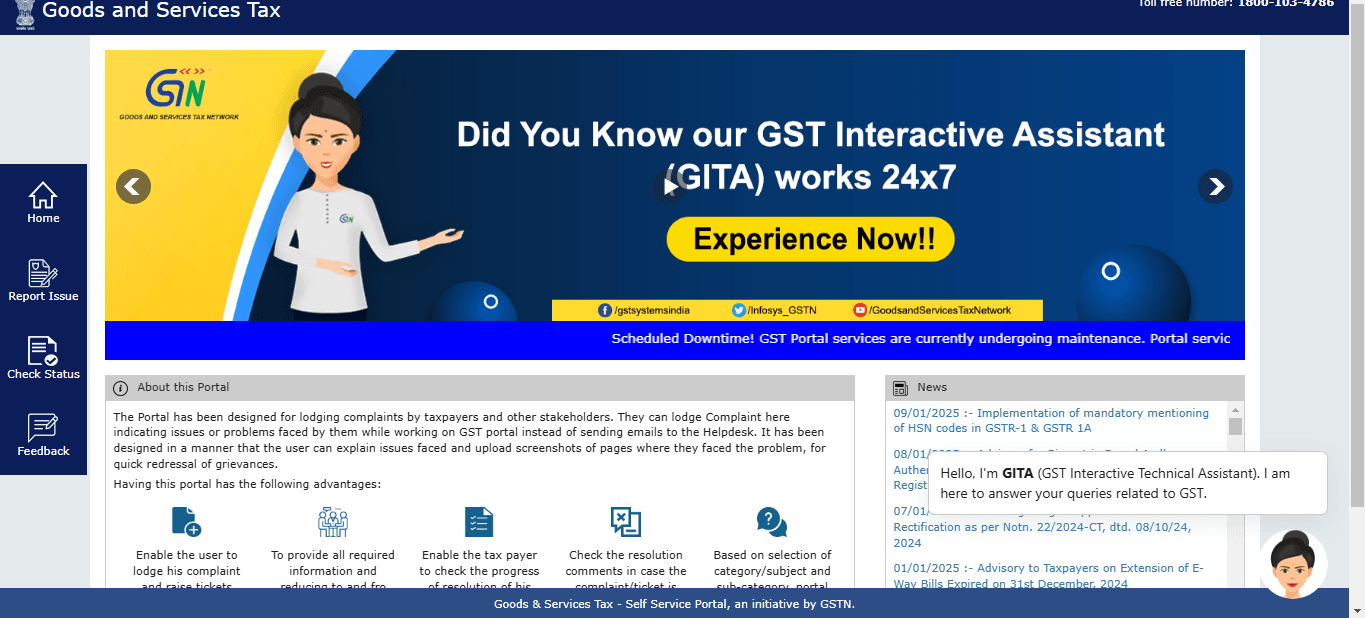

GITA: GST Interactive Technical Assistant

This AI-powered virtual assistant is all about providing solutions to users pertaining to real-time answers and step-by-step guideline support for every GST-related query, filing procedure, and adherence.

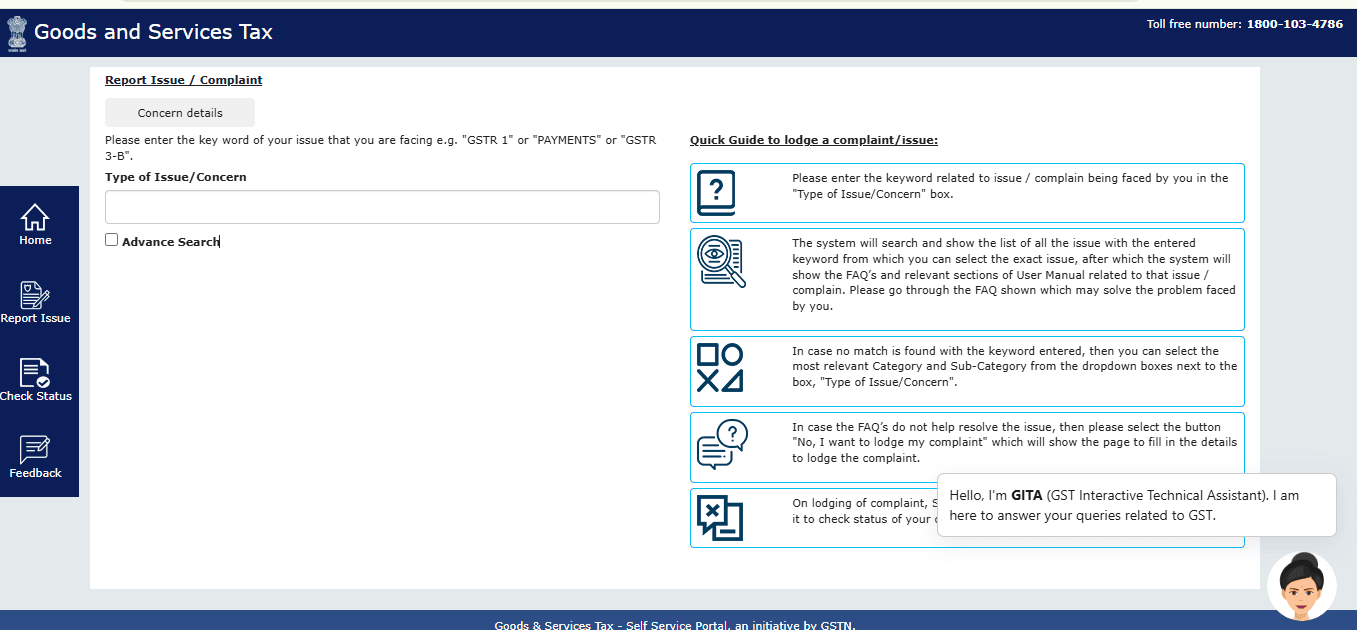

Report An Issue

All the users may report issues by keying them out in the relevant box. Detailed search options for finding answers relating to frequent difficulties are also available.

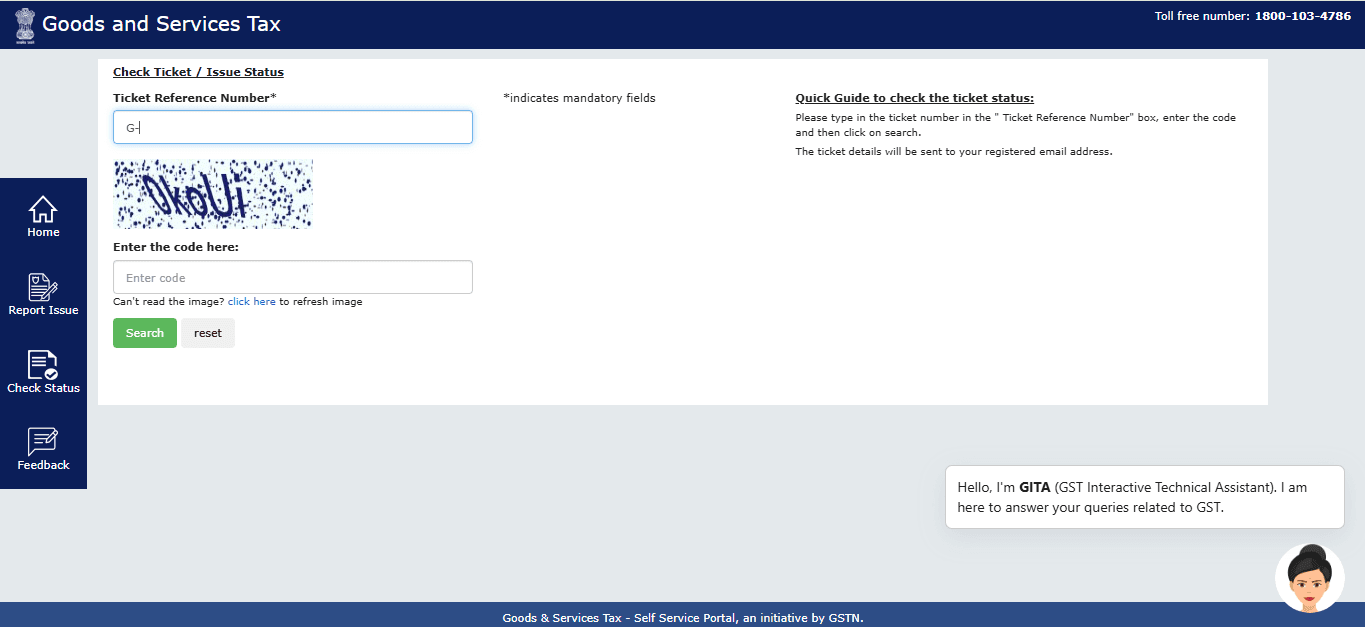

Track Status

Taxpayers can check the status of their grievances using the Check Status feature. They just need to input the acknowledgment number and captcha code to view real-time status on the redressal of their complaint.

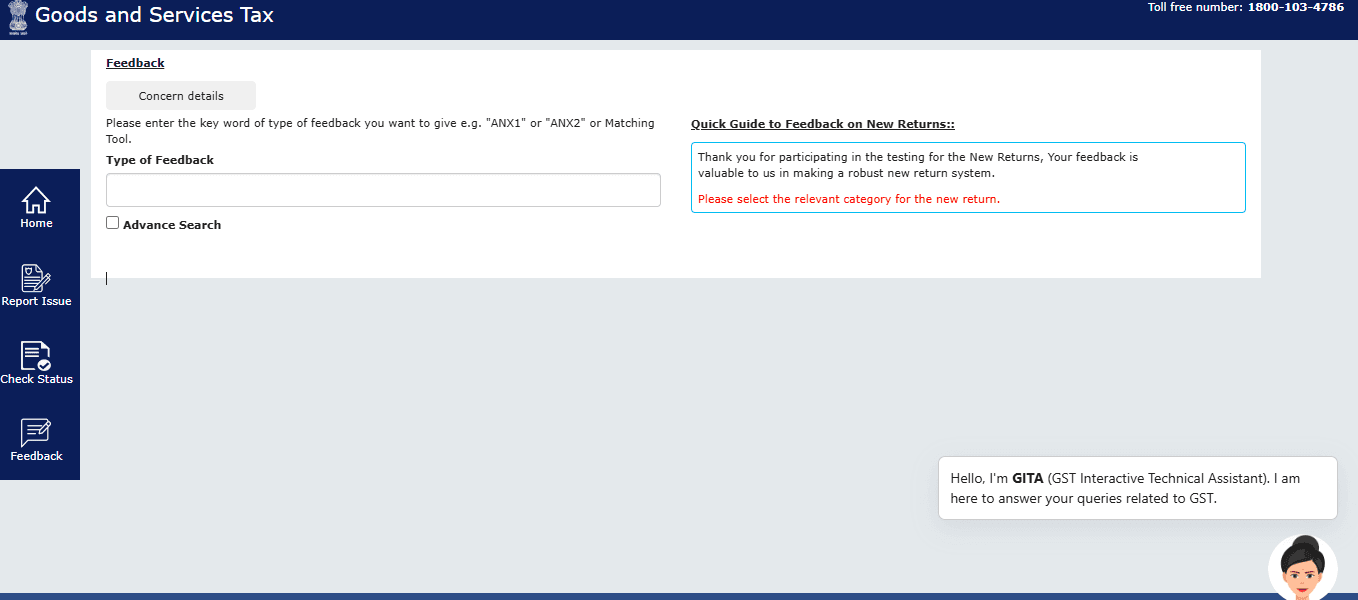

Feedback

This page enables taxpayers to give feedback about the GST portal's functionality. This would further enhance the user experience and effectiveness of the system.

GST Helpline Contacts Across States

For more information, you can also log in to the GST Self Service Portal: All-State GST Helpline Contacts

Additional Features of the GST Helpline Portal:

- Ticket Number & Acknowledgement: Once a complaint is raised, an acknowledgment number is generated. The taxpayer can track the ticket status and follow up on the resolution. This process ensures greater transparency in issue resolution.

- 24/7 Availability: The portal is available at all times, allowing taxpayers to report issues and track the resolution at their convenience. This reduces dependence on office hours for complaints.

- Mobile-Friendly: The GST Self Help Portal is mobile-friendly, so taxpayers can access it easily even on the move.

- Multi-Language Support: The portal offers options in various languages to cater to taxpayers across India and make it more accessible to a wider user base.

Conclusion

The GST Self-Help Portal has been a game-changer for businesses as well as taxpayers, providing an efficient means to get on with issues arising out of GST filings. Hereby, by using the portal, taxpayers can save time and get their queries resolved sooner. With the GST helpline number and the self-service portal, managing issues to do with GST-related problems has never been easier.

FAQs.

Q. What is the GST Helpline number?

The GST Help Desk number is 1800-103-4786.

Q. Are there other ways to contact GST Customer Care?

Yes, taxpayers can raise grievances through the GST Self-Help Portal at

https://selfservice.gstsystem.in/.

Q. How do I raise a complaint about GST services?

Visit the Self Help Portal, sign up, and raise your concern as a complaint ticket.

Q. If the helpline is unable to resolve my issue, what should I do?

You can check the status of your complaint by logging into the Self Help Portal or escalate it if required.

Q. Are there self-help resources for GST-related questions?

Yes, the GST Self Help Portal includes FAQs, user manuals, and an AI-powered assistant for real-time answers.

Q. What information should I have on hand when calling the GST Helpline?

Have your GSTIN, details of the issue, and any relevant screenshots or error messages ready.

Related Posts