GSTR-3B Guide: Return Filing, Format, Revision and Due Dates

Published on: Thu Nov 23 2023

What is GSTR-3B?

GSTR-3B is a monthly self-declaration that has to be filed by registered GST taxpayers. Unlike GSTR-1, which is focused on outward supplies, GSTR-3B encompasses a broader range of information. It includes details of both outward supplies (sales) and inward supplies (purchases) liable to reverse charge, as well as the total tax liability, input tax credit claimed, and final tax payment in cash. Essentially, it is a consolidated summary of a taxpayer’s GST liabilities for a particular tax period.

GSTR 3B format

The general GSTR 3B format includes:

GSTIN number

The legally registered name of your business

Details of sales and purchases for which you are accountable for reverse charge.

Details of inter-state sales made to buyers under composition scheme, unregistered buyers, and unique identification number (UIN) holders

Eligible input tax credit

Value of nil-rated, non-GST, and inward supplies

Payment of tax

TCS/TDS credit

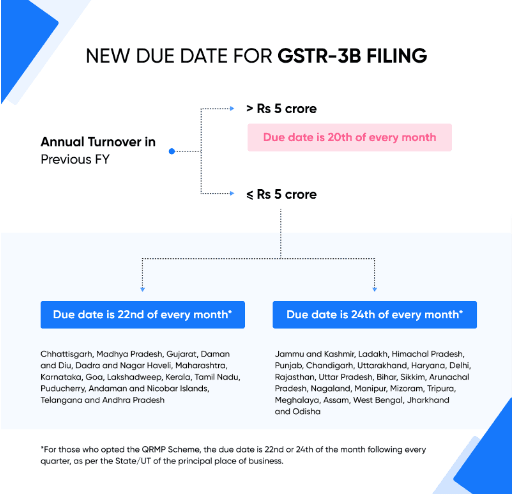

Due Date for GSTR-3B

The due date for filing GSTR-3B varies based on the turnover and the type of taxpayer. Typically, for businesses with a high turnover, the due date is the 20th of the following month. For others, it might be staggered to the 22nd or 24th of the month following the tax period. It's important for businesses to keep track of the specific deadlines applicable to them to ensure timely compliance and avoid penalties.

Also Read : GSTR-1 Guide - Return Filing, Date and Revision

Who Should File GSTR-3B

All regular taxpayers registered under GST are required to file GSTR-3B. This includes businesses, regardless of whether they have any transactions during the tax period. Even if there are no transactions (zero sales and purchases), a Nil GSTR-3B must be filed to comply with GST regulations.

However, there are a few exceptions:

Input Service Distributors & Composition Dealers

Suppliers of OIDAR ( Online Information Database Access and Retrieval Services)

Non-resident taxable person

The above are exempted from filing return in using the 3B form under existing rules.

Also Read : GST Invoices:- A Comprehensive Guide to Rules, Formats, Types and Revisions

Importance of GSTR-3B

GSTR-3B plays a crucial role in the GST framework as it is used for the payment of tax liabilities. The input tax credit available in a taxpayer’s electronic credit ledger can be utilized for payment of the tax due. The information provided in GSTR-3B is also used for reconciling data with GSTR-1 and for the verification of input tax credit claims.

GSTR-3B Revision

Unlike GSTR-1, there is no provision for revising a GSTR-3B once it is filed. If a taxpayer makes a mistake in a GSTR-3B, they must rectify it in the GSTR-3B of the subsequent month(s). This includes adjusting tax liabilities and input tax credit. It is crucial for taxpayers to be careful while filing GSTR-3B, as any errors can complicate their tax filings in subsequent periods.

In summary, GSTR-3B is a critical return under the GST regime, requiring careful attention to detail and accuracy. It serves as a key document for tax authorities to assess a taxpayer’s liability and for taxpayers to maintain compliance with the GST laws.

Related Posts