GST E-Way Bill Update: New HSN Code requirements effective from October 1, 2023

Published on: Wed Sep 06 2023

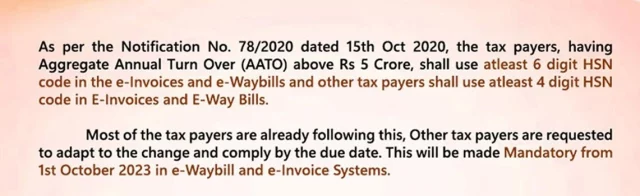

The Goods and Services Tax (GST) E-way bill system has recently issued an update, reminding GST taxpayers to follow the requirement of using either 6-digit or 4-digit HSN Codes, which will soon become mandatory.

According to Notification No. 78/2020 dated October 15, 2020, taxpayers with an Aggregate Annual Turnover (AATO) exceeding Rs 5 Crore must incorporate a 6-digit HSN code in their e-Invoices and e-Waybills, while other taxpayers should use a minimum of 4 digits in their E-invoices and E-Way Bills. Many taxpayers are already compliant with this rule, and those who aren’t are urged to make the necessary adjustments and comply by the specified due date. This requirement will become mandatory starting from October 1, 2023, in both the e-Waybill and e-Invoice Systems.

Read Also: E Way Bill: Understand the importance and implication of e way bill

It is crucial to emphasize that this mandatory change will take effect on October 1, 2023, affecting both the e-Waybill and e-Invoice Systems. Taxpayers should ensure their invoicing and way billing processes align with these updated regulations within this timeframe to maintain seamless compliance.

Are you Looking for GST Refund Service? Mygstrefund.com offers GST refunds on business, exports, and many more if your GST application is rejected. Get in touch with us today.

Related Posts