How to Link Import Export Code (IEC) with DGFT?

Obtaining the Import Export Code (IEC) is an essential step for all those planning to conduct import-export operations in India. The Import Export Code represents a mandatory 10-digit code that the DGFT issues, which helps businesses to run import-export activities smoothly. The next step for IEC holders is to connect their code with their DGFT portal account for improved administration. In this guide, you will learn about easy steps to link IEC with the DGFT website along with the associated advantages and required documentation.

Steps to Link IEC with DGFT Website

Linking your IEC with the DGFT website is an easy online procedure. Here are the steps to follow:

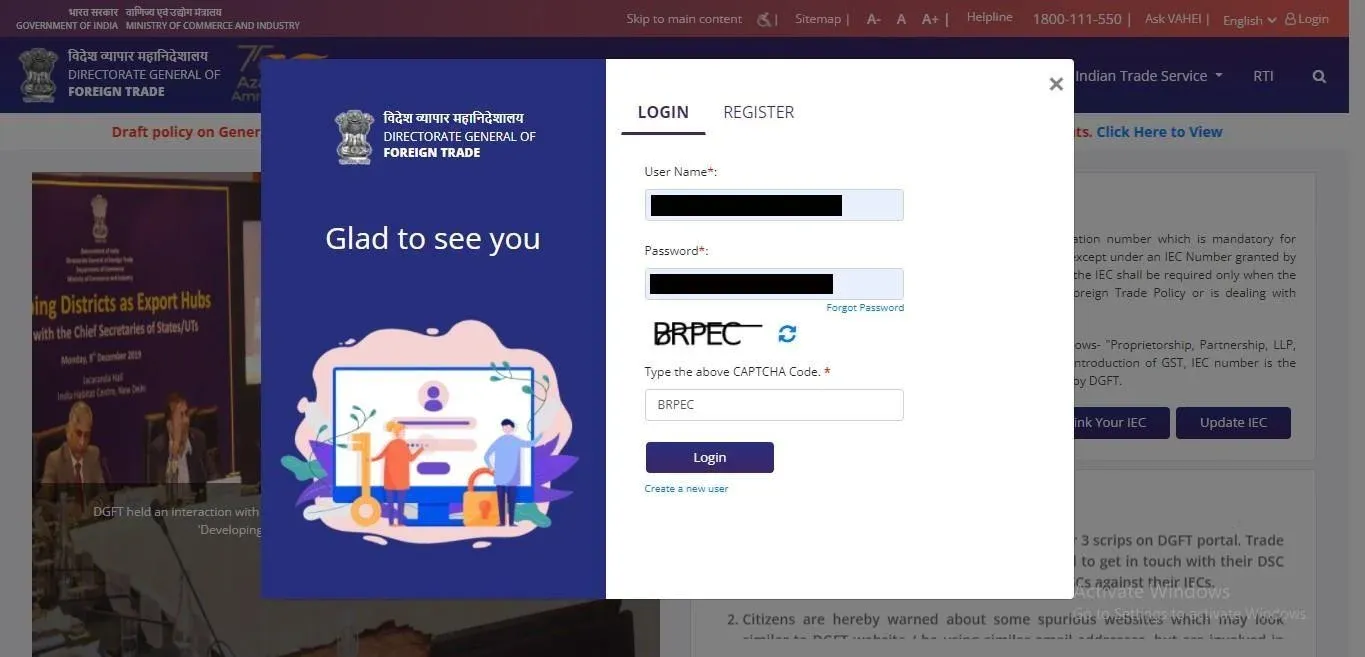

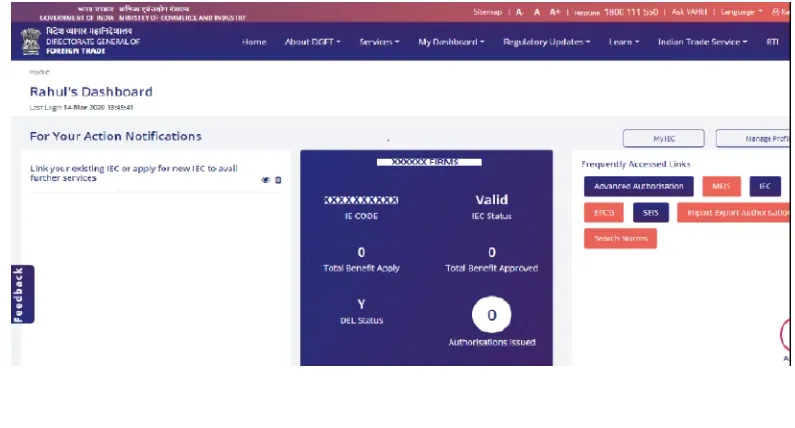

1. Log in to the DGFT Portal

You must begin this process by accessing the official website of DGFT. After entering the website, users should use their valid login credentials. You obtained those credentials at the time you signed up for the portal service. The first step requires either finishing the registration process or creating a new account.

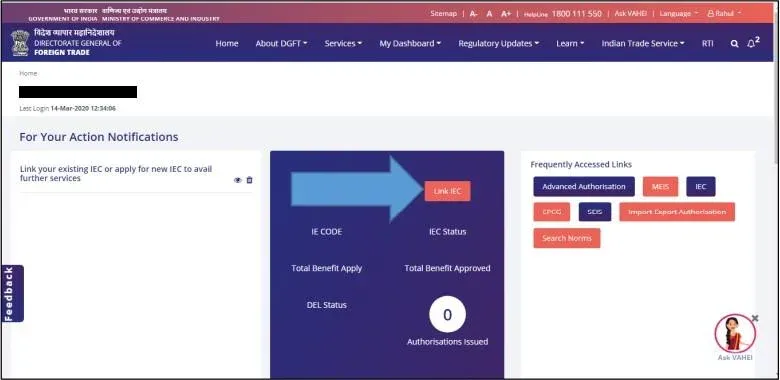

2. Navigate to the Link IEC Section

You can find the "Link IEC" button on your dashboard view after successful login. From My Dashboard click Importer Exporter Code (IEC) then select Link your profile to IEC to continue. The page for link IEC with DGFT integration becomes accessible after following this path through the portal.

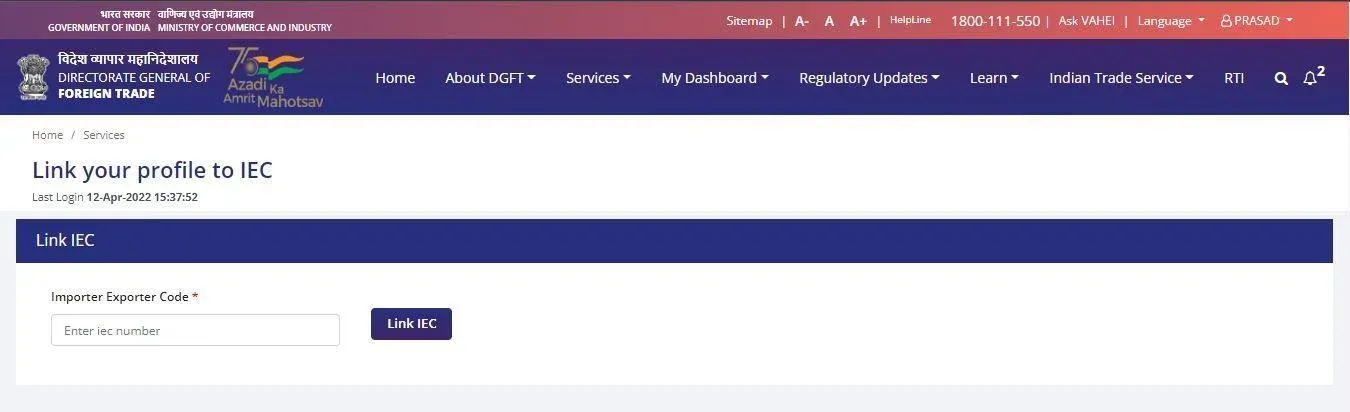

3. Enter Your IEC Number

You will find an IEC number input field when you access the opened page. Type the IEC number that you intend to link. Verify that the entered number matches the correct reference. The next step is to select the Link IEC button to continue with the process.

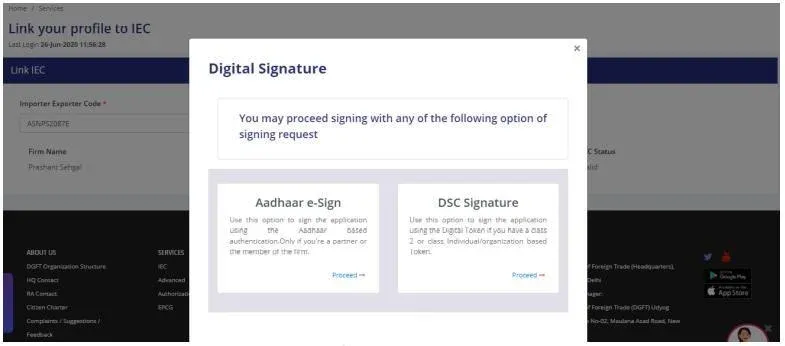

4. Digital Signature or Aadhaar e-Sign

The "Link IEC" button verification process will begin after your click. Upon a successful verification, the system will display a pop-up requesting users to authorize with digital signature (DSC) or Aadhaar e-signature for verification. Use the selected option to continue signing into the system.

Pro Tip: Use our GSTIN Validator to quickly verify GST numbers and ensure accuracy in your business transactions!

5. Successful Linking

During the verification phase, the IEC number will integrate successfully to your existing DGFT profile. A completion confirmation will appear through a message. The updated DGFT portal allows users to view their IEC information, make changes to the data, and print certificates directly from the portal.

Documents Required to Link IEC to DGFT Website

Ensure you prepare these documents before starting the link IEC with DGFT procedure for your IEC.

DGFT Portal Login Credentials

The first step before linking requires registration and login access to the DGFT portal. Revise your credentials for accessing the portal before starting the process.

Digital Signature Certificate (DSC) or Aadhaar

A DSC or an Aadhaar serves as the document needed for business verification based on the industry classification. Sole proprietors must present their Aadhaar to complete the link IEC with the DGFT process. Directors, together with firm partners, require a DSC to authenticate their information.

Benefits of Linking IEC with DGFT

The connection of the IEC to the DGFT portal generates multiple operational benefits. These include:

Simplified Management of IEC Details

You can update and manage your IEC details easily at any time due to the IEC linking service. Users can retrieve their IEC certificate through the portal while having the ability to both download and print this document.

Better Compliance with Government Regulations

The process of linking your IEC represents mandatory compliance with all regulations established by the DGFT. The failure to link your IEC will cause difficulties for your business when you attempt import-export management or document submission.

Access to Additional Services

The linked IEC enables access to more DGFT portal services, which include modifying IEC details together with viewing printing certificates and requesting foreign trade licenses and permissions.

Pro Tip: Use our GST Refund Calculator to easily calculate your refund and simplify the GST process. Whether you want to know your refund amount or check its status, our tool makes it simple to know your GST refund quickly and accurately.

Convenient Online Process

The digital framework enables completely online IEC linking, which provides you with the ability to handle your IEC through any location at any time of day. The lending of IEC does not require physical paperwork, nor does it demand visits to the DGFT office.

Conclusion

Business compliance with foreign trade rules and regulations can be achieved by properly linking your IEC with the DGFT website. The linking process for IEC with the DGFT portal involves basic steps that start with portal entry and IEC number input, followed by digital signature or Aadhaar e-sign verification. IEC management becomes more straightforward after linking to the website where you can unlock government benefits for being in good standing.

Business operations will remain uninterrupted by verifying that your IEC details stay linked to your DGFT profile and stay continually up-to-date.

Frequently Asked Question

How do I link my IEC to DGFT?

Users should access the DGFT portal to start the linking process by entering their IEC number and then authenticate it through digital signature or Aadhaar e-sign.

Is it mandatory to link IEC with GST?

Every business operating under the GST regulations must connect its IEC to achieve proper operation and maintain full compliance with established rules. You need to link IEC for both GST registration purposes and returning to DGFT.

What is the IEC link to the DGFT website?

Users must establish their Import Export Code with the DGFT website through the IEC link procedure. Users can update and modify their IEC information directly through the portal system thanks to this linking capability.

How do I link IEC in the Trade Connect portal?

You must log in to the portal and then navigate to the IEC section before using your credentials to follow the easy steps for IEC linking.

Related Posts