What is Reverse Charge Mechanism?

Reverse charge means the liability to pay taxes is on the recipient of the Supply of Goods or Supply of Services or both instead of the supplier.

Generally, GST is collected by the supplier from the recipient and then deposited to Government (which is simply called a “Forward Charge Mechanism”), however under Reverse Charge Mechanism, GST is paid and deposited by the Recipient to the Government.

For Example, A farmer (Ram), being an unregistered supplier sells raw cotton to any registered person, in such a case, the liability to pay and deposit the GST to the government is on the registered person and not Ram.

Latest updates

23rd July 2024

In the Union Budget for 2024, the Finance Minister suggested an amendment to Section 13 of the CGST Act to establish the time of supply for services when the recipient of the services is obligated to issue the invoice in situations involving reverse charge supplies from unregistered suppliers. *This amendment will become effective once it is announced by the CBIC.

26th June 2024

On June 26, 2024, the CBIC released circular no. 211/5/2024-GST to explain the GST Council's recommendation regarding the eligibility to claim input tax credit under section 16(4) of the CGST Act, applicable when the recipient has received an invoice under the reverse charge mechanism (RCM).

On June 22, 2024, during the 53rd GST Council meeting, it was recommended to clarify that when supplies are received from unregistered suppliers and the recipient needs to pay tax under the reverse charge mechanism (RCM) while issuing the invoice themselves, the applicable financial year for determining the time limit to claim input tax credit under section 16(4) of the CGST Act is the financial year in which the recipient has created the invoice.

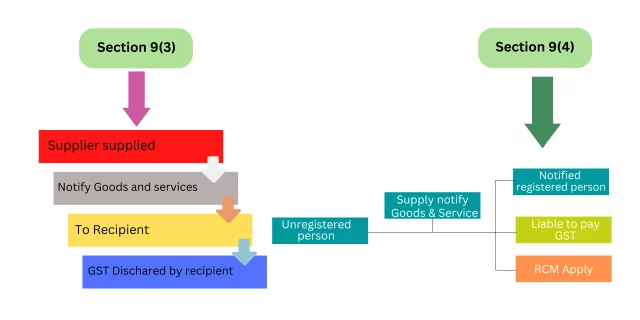

In which cases, Reverse charge is Applicable?

Reverse charge is applicable in two cases:

- First case is dependent on certain notified goods and services where the supply of that specified goods and services is covered under. (This scenario is covered in section 9(3) of the CGST ACT.

- Second case is covered under 9(4) of the CGST ACT, where taxable supply by any unregistered person to a registered person is covered.

List of Notified/ Specified Goods covered under RCM

| S. No. | Supplier of Goods | Supply of Goods | Receiver of Goods |

| 1 | Agriculturist | Cashew nuts not shelled or peeled | Any Registered person |

| 2 | Any person who manufactures silk yarn | Silk yarn | Any Registered person |

| 3 | Agriculturist | Bidi wrapper (Tendu leaves) | Any Registered person |

| 4 | State Gov./Union territory /Local Authority | Supply of lottery | Lottery distributor or selling agent |

| 5 | Agriculturist | Tobacco leaves | Any Registered person |

| 6 | Central/State/Union territory/local Authority | Used vehicles, seized & confiscated goods or old used goods. | Any Registered person |

| 7 | Agriculturist | Raw cotton | Any Registered person |

| 8 | Any registered person | Priority sector lending | Any Registered person |

List of Notified/ Specified Services covered under RCM

| S. No. | Service provider Supplier of service | Name of services | Service receiver |

| 1 | Foreign party | Import of services | Any Registered person |

| 2 | Goods transport agency(if a person opt to pay 5%tax) | Transport of goods | • Any person registered • Any factory • Any society • Any co-operative society in India • Any Body corporate • Any partnership firm (AOP) • Casual taxable person |

| 3 | Advocate/ firm of advocate | Advocate/ legal services | Any business entity |

| 4 | Services provided by an arbitral tribunal | Arbitral tribunal services | Any business entity |

| 5 | Any person | Sponsorship services | Any Body corporate or partnership firms |

| 6 | Director or body corporate | Service of director or body corporate | Company or body corporate located in Taxable territory in Taxable territory Circular issued clarifying applicability of RCM on services of directors to Company/Body corporate – • Services rendered by directors not in capacity of employee to attract GST and also RCM [Entry no.6 of N\N 13/2017-CT (Rate) – CBIC circular no. 140/10/2020- GST (dated 10th June, 2020) |

| 7 | Insurance agent | Insurance agent services | Insurance co. |

| 8 | Recovery agent/ Recovery agent office | Recovery agent services | Bank or financial institution |

| 9 | Foreign party (person located in NTT) | Ocean freight ( transportation of goods by a vessel from a place outside India to custom clearance in India) | Importer |

| 10 | Transfer/Giving permission to copyrighted content (according to section 13(1) of the copyright act 1957) | Artist, musician, or any creative person | Publishing company |

| 11 | Government | All services of government Except; • Services by dept. of post • Services in relation to aircraft/vessel • Services of transportation of goods | Any Business entity |

| 12 | Central/State/Union territory/local authority | Renting of immovable property | Any person registered in taxable territory |

| 13 | Member of overseeing committee | Any services | RBI |

| 14 | Individual direct selling agent (DSA) other that a body corp. PP or LLP | Direct selling agent service(DSA) | Banking co. or NBFC |

| 15 | Business facilitator | Any services | Any registered person located in taxable territory |

| 16 | An agent of business correspondent | Any services | Any registered person located in taxable territory |

| 17 | Any person other than corp. | Security services | Any registered person located in taxable territory |

| 18 | Author | Transfer of copyright | Publisher (located in taxable territory) |

| 19 | Any person, other than a body corporate who supplies the service to a body corporate and does not issue an invoice charging GST@12% (CGST 6% SGST/UTGST 6%) to the service recipient | Services provided by way of renting of any motor vehicle designed to carry passengers where the cost of fuel is included in the consideration charged from the service recipient, provided to a body corporate. | Any Body corporate located in the taxable territory |

| 20 | Lender | Lending of securities | Borrower |

| 21 | Any person | Services supplied by any person by way of transfer of development rights (TDR) or Floor Space Index (FSI) (including additional FSI) for construction of a project by a promotor | Promoter |

| 22 | Any person | Long term lease of land (30 years or more) by any person against consideration in the form of upfront amount (called as premium, salami, cost, prices, development charges or by any other name) and/or periodic rent for construction of a project by a promoter | Promoter |

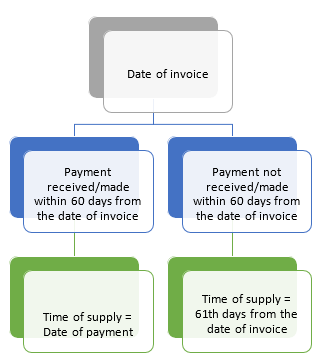

What is the Time of Supply Under RCM?

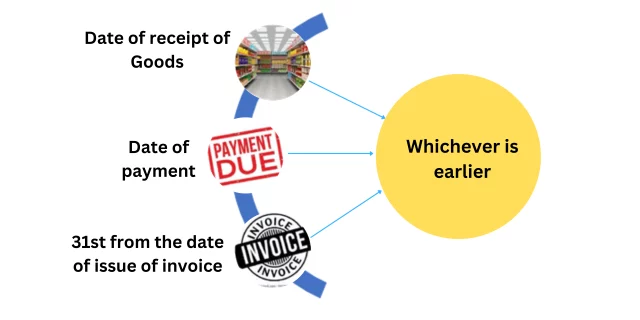

In order to calculate and discharge tax liability, it is important to know the date when the tax liability arises i.e. the date on which the charging event has occurred. In GST law, it is known as the Time of Supply. Section 12(3) & Section 13(3) of CGST Aare, are about the time of supply under RCM.

As per Section 12(3) of The CGST Act, 20the 17, time of supply of goods under

RCM:-the In the case of RCM time of supply of goods good is the earliest of the following, 1.Date of receipt of goods, 2. Date of payment, 3. 31st day from the date of issuance of invoice.

Section 13(3) of CGST ACT says the out time of supply of Services under RCM:- In case of RCM time of supply of services is earliest of the following, date of payment or days day from the date of issue of invoice by the supplier.

The ere date of payment (DOP) is book entry or credited to the bank account whichever is earlier.

Registration Rules Under RCM?

A person who is required to pay tax under reverse charge has to compulsorily register under GST defined under Section 24 of CGST ACT and the threshold limit of INR 20 lakh (INR 10 lakh for special category states ex except for J &does not apply to them.

However, if a person is engaged in the supply of Goods threshold limit increases up to 40 lakhs INR. (if a person supplies other than notified goods.).

Input Tax Credit (ITC) Under RCM?

The recipient can avoid all ITC up to GST amount if that supply is used in the course or furtherance of business, however, a supplier cannot avoid ailing the benefit of ITC since he is not making any payment of GST under RCM.

What is Self-Invoicing?

Self-invoicing is a situation wherein a registered person is required to issue the invoice on his own on account of purchasing goods/services from an unregistered person and there is by, is liable to pay GST under reverse charge. This is because the use supplier is unregistered and cannot issue a GST invoice.

FAQs:-

What happens if the recipient of goods or services is required to pay tax through reverse charge, but they are not registered as a dealer?

If the recipient of goods or services is obligated to pay tax through the ugh reverse charge mechanism but they are not registered as a dealer, they may face consequences such as fines or legal penalties for non-compliance with tax regulations.

Is ITC allowed unthe der reverse charge mechanism?

Yes, ITC is allowed to the recipient if a person used that goods or services in the course or furtherance of business.

When can a person claim ITC of Tax paid under RCM?

A registered person other than a person covered under section 10 of CGST ACT can take ITC if their purpose was the course or furtherance of business, the and same provision the section 16 is applicable for eligibility and conditions for taking ITC.

How to Show RCM sales in GSTR filing?

An individual can declare their inward or outward supplies under Reverse Charge Mechanism in Form GSTR1 & GSTR3B.

Can we claim Input Tax Credit on RCM in the same month?

Yes, a person can claim ITC in the same month, when said person deposits GST under RCM.

What is the process for claiming reverse charge on the GSTR A reverse?

Reverse charge is a liability to pay taxes to the government, it cannot be claimed. However, a person can declare their supplies liable to RCM in GSTR3B and claim ITC on it.

A person can declare the supplies under RCM in table 3.1(d) of foam GSTR 3B.

How does RCM on unregistered dealer work?

As per Section 9(4) of the o CGST Act, if an unregistered person supplies goods or services to a registered person, the hen liability to pay the taxes shifts to the registered person.

How do you calculate RCM in GST?

RCM is calculated on taxable value of Goods or services. If we take an example

A trader who is registered in GST takes services the of the Goods Transport Agency (GTA) for INR. 10,000. This service is listed under the reverse charge list therefore trader has to pay tax @ 5% on INR. 10,000 on RCM.

What are some important points to keep in mind when handling the RCM?

A few crucial points you can consider while dealing with RCM-

Invoice management & storage- Make sure to store & properly manage the RCM invoices, as these will be useful in GSTR-1 monthly return filing as well as in GSTR-9 annual return filling.

Ensure that payment of ta is must be paid by cash ledger not by credit ledger.

What are the exemptions to RCM?

Goods or services that are exempt from GST would not be subject to the Reverse Charge Mechanism.

Are you Looking for GST Refund Service? Mygstrefund.com offers GST refunds on business, exports, and many more if your GST application is rejected. Get in touch with us today.

Related Posts